Here are the latest developments in global markets:

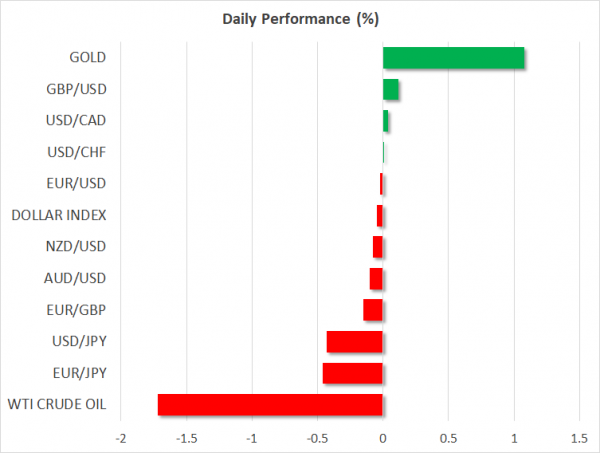

- FOREX: The dollar index was trading weaker by 0.10% while dollar/yen failed to pierce the 113 round level and instead dived to 112.30 (-0.43%), as the yield on 10-year Treasuries dropped by 5 basis points to 3.14%. Meanwhile the US President promised to give the middle class a 10% tax cut yesterday, intensifying his campaign ahead of US midterm elections on November 6. Euro/dollar was flat at 1.1468 as investors awaited the EU to give an answer on the Italian draft budget later today. Pound/dollar was up by 0.20% at 1.2985 despite worries over British Prime Minister Theresa May’s political future, and a continued deadlock in the Brexit talks. However, with demand for safe-havens rising, pound/yen fell to negative territory, losing 0.25%. Taking a look at the antipodean currencies, aussie/dollar and kiwi/dollar moved marginally lower by 0.07%. Dollar/loonie remained flat for another day, hovering near the 1.3100 handle. The Turkish lira plummeted by almost 2.0% after the Turkish president said that his ruling AK party will not unite with the nationalist party for the 2019 local elections, though he added that both parties will keep close ties. Note that the parties had formed an alliance before June elections but were in disagreements about legal issues.

- STOCKS: European shares were a sea of red on Tuesday at 1100 GMT, creating multi-month lows after disappointing third-quarter earnings results, especially in the tech sector. Moreover, a cocktail of negative factors including Brexit uncertainties, Italy’s budget, Saudi isolation, Chinese growth and US trade protectionism were keeping investors away from riskier assets. The pan-European STOXX 600 and the blue-chip Euro STOXX 50 declined by 1.17% and 0.83% respectively, to their lowest levels since December with almost all sectors flashing red. The German DAX 30 was the worst performing index, diving by 1.78%, the French CAC 40 tumbled by 1.26%, while the Italian FTSE MIB declined by 0.46%. UK’s FTSE 100 saw a loss of 0.66%. In the US, futures tracking the major stock indices were pointing to a significantly negative open.

- COMMODITIES: Oil prices plummeted as well today, as Iran’s oil minister said that the US cannot stop Iranian oil exports by imposing sanctions on Tehran. WTI crude oil plunged by 1.77% to $68.13/barrel and London-based Brent dived by 2.17% to $78.10/barrel. In precious metals, gold prices returned to gains (+1.08%), recording a new 3-month high of $1236 per ounce, as stock markets suffered amid political and economic uncertainties.

Day Ahead: Italy to receive budget feedback from the EU; May could face leadership challenge

The future of the Italian spending outline, the ongoing US-Sino trade war, and questions of whether the UK and the EU will ever agree on divorce terms before Brexit are likely to continue to feed risk-off sentiment in the markets later in the day.

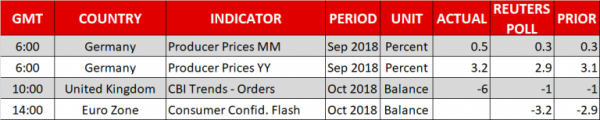

In Italy, the coalition government will be expecting official budget feedback from the European Commission until next Monday which is highly likely to be a negative one after the aforementioned legislative institution said in a letter that Italy’s fiscal demands are unprecedented given the country’s overloaded public debt (130% of GDP). In case the EU rejects the 2019 budget draft which aims for a deficit target of 2.4% compared to 1.8% in 2018, Rome will have to re-submit new spending plans in three weeks. While the Italian Finance Minister, Giovanni Tria, revealed on Monday that Italy is open for dialogue with the EU and has no intention to overcome the 2.4% target in 2020 and 2021, he did not show any commitment to change the 2019 budget outline, suggesting Italy might not leave this battle so early. Especially after he warned that the government is ready to intervene so that these targets are respected. Traders will be closely watching the Italian 10-year government bond yield as risk aversion could help the yield to catch the 4-year high of 3.78% marked on Friday. Yet given that a rejection is highly priced in the markets, the impact on yields as well as on the euro might be minimal. The latter however, could see some volatility after the release of the October flash Consumer Confidence index at 1400 GMT. Analysts believe that consumers turned more pessimistic this month, leading the index to a fresh 1 ½ -year low of -3.2 compared to -2.9 before.

In the UK, the British Prime Minister, Theresa May is under pressure over her Brexit plans as members within her Conservative party as well as rivals from the rival Labour party turned more frustrated after reports her administration is willing to accept an open-ended timeframe for the Irish border and prolong the transition period. Should ministers issue a no-confidence vote against May’s leadership in coming sessions, the pound could extend even lower. Recall that although May said that 95% of the Brexit deal is done, she needs to pass the withdrawal bill through Parliament before implementation.

In Sweden, the Riksbank will meet to decide on monetary policy at 0830 GMT on Wednesday. In September, policymakers signaled that interest rates will remain steady in October but hinted that in December or February a rate hike could be on the cards. As inflation readings appeared stronger than expected in September, the central bank may well use a more hawkish tone on the path of interest rates, potentially helping the krona to head up.

Meanwhile in Turkey, the murder of the Saudi Washington Post journalist which has raised political tensions between US and Saudi Arabia remains a puzzle. The Turkish President called statements from Saudi Arabia, which is blamed for killing the columnist, inconsistent earlier today and argued that the death was a planned murder, adding further pressure on Saudi Arabia.

In oil markets, the American Petroleum Institute will publish its weekly report on US crude inventories at 2030 GMT, with traders looking forward to seeing whether US stocks continued to build up in the week ending October 20. In case this comes true, oil prices will probably lose further ground.

Equities will be also under the spotlight following the recent sell-off and ahead of important earnings releases from Google’s parent Alphabet, Amazon, Microsoft and Twitter later in the week.

Any potential updates on the trade front would be valuable during the day as China tries to mitigate negative risks from US import tariffs after GDP growth figures in the third quarter slowed surprisingly to levels never seen since 2009.

As for today’s public appearances, at 1730 GMT Atlanta Fed President Raphael Bostic will be commenting on the economic outlook and monetary policy before the Committee of 100, while at 1815 GMT Dallas Fed President Robert Kaplan will be participating in a Q&A session before the Galveston Economic Development Partnership 7th Annual Economic Development Summit, in Galveston, Texas. Later at 2215 GMT,Chicago Fed President will be talking at the Northwestern University.