Key Highlights

- The British Pound failed to break the 1.3250 resistance and declined sharply against the US Dollar.

- There is a connecting bearish trend line formed with resistance at 1.3050 on the 4-hours chart of GBP/USD.

- The Chicago Fed National Activity Index (CFNAI) declined from the last revised reading of 0.27 to 0.17 in Sep 2018.

- Today, the UK CBI Industrial Trends Orders Survey Index for Oct 2018 will be released, which is forecasted to remain at -1.

GBPUSD Technical Analysis

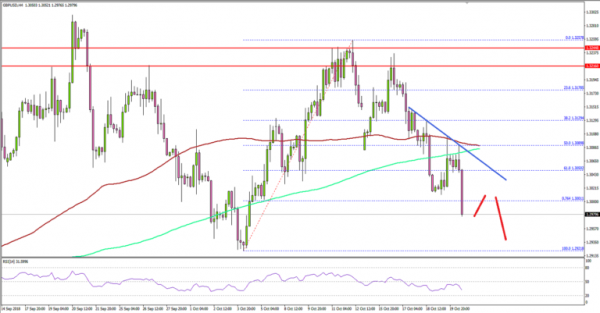

This past week, the British Pound climbed above the 1.3120 and 1.3150 resistances against the US Dollar. However, the GBP/USD pair failed to break the 1.3250 resistance area and started a downside move.

Looking at the 4-hours chart, the pair failed to hold key supports near the 1.3150 and 1.3100 levels and declined heavily. During the decline, the pair even settled below the 1.3100 support and the 100 simple moving average (red, 4-hours).

More importantly, there was a break below the 61.8% Fib retracement level of the last upside wave from the 1.2921 low to 1.3257 high. It opened the doors for more losses and the pair declined below 1.3000.

If the pair continues to move down, it could soon test the 1.2921 low, below which it could target a new monthly low. The next support could be near the 1.2850 level and the 1.236 Fib extension level of the last upside wave from the 1.2921 low to 1.3257 high.

On the upside, there is a strong resistance near the 1.3040 level. There is also a connecting bearish trend line formed with resistance at 1.3050 on the same chart.

A proper break above the trend line and the 100 SMA is needed for buyers to take back control. If not, there is a risk of more losses towards or below 1.2920 in the near term.

Economic Releases to Watch Today

- UK’s CBI Industrial Trends Survey Orders Oct 2018 (MoM) – Forecast -1, versus -1 previous.

- German Producer Price Index for Sep 2018 (MoM) – Forecast +0.3%, versus +0.3% previous