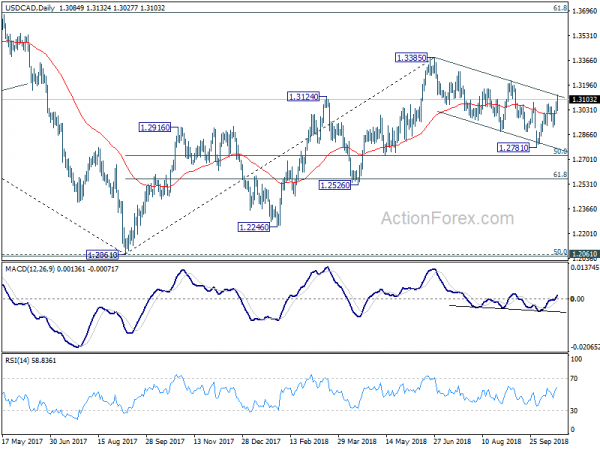

USD/CAD’s rebound from 1.2781 extended to as high as 1.3132 last week. The break of 1.3081 minor resistance argues that whole choppy fall from 1.3385 has completed at 1.2781. Initial bias stays on the upside this week for 1.3225 first. Break will confirm this bullish case and target 1.3385 high next. On the downside, below 1.3027 minor support will turn intraday bias neutral first. But as long as 1.2916 support holds, further rally will remain mildly in favor in case of retreat.

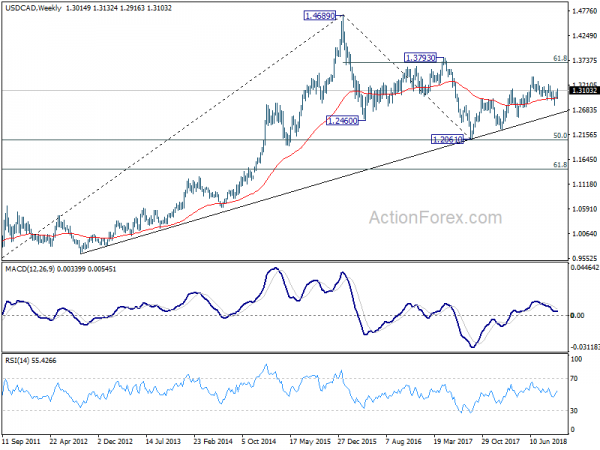

In the bigger picture, current development argues that choppy corrective fall from 1.3385 has completed at 1.2781 already. And that in turns suggests that the up trend from 1.2061 is still in progress. Decisive break of 1.3385 will pave the way to 61.8% retracement of 1.4689 to 1.2061 at 1.3685. On the downside, though, break of 1.2916 support will likely extend the fall from 1.3385 to 61.8% retracement of 1.2061 to 1.3385 at 1.2567 before completion.

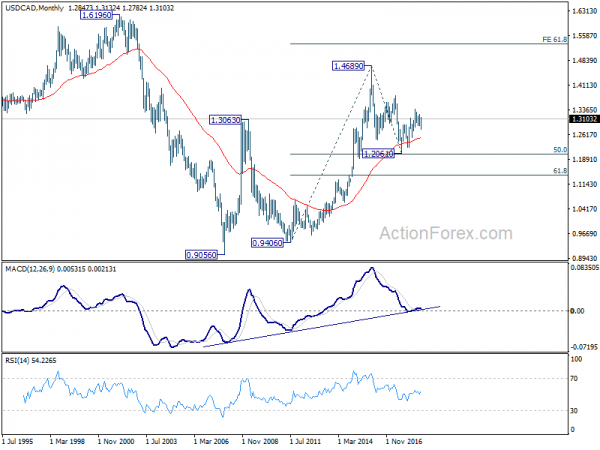

In the longer term picture, corrective fall from 1.4689 (2015 high) should have completed with three waves down to 1.2061, just ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. The development keeps long term up trend from 0.9406 and that from 0.9056 (2007 low) intact. For now, there is prospect of extending the long term up trend to 61.8% projection of 0.9406 to 1.4689 from 1.2061 at 1.5326 in medium to long term.