Here are the latest developments in global markets:

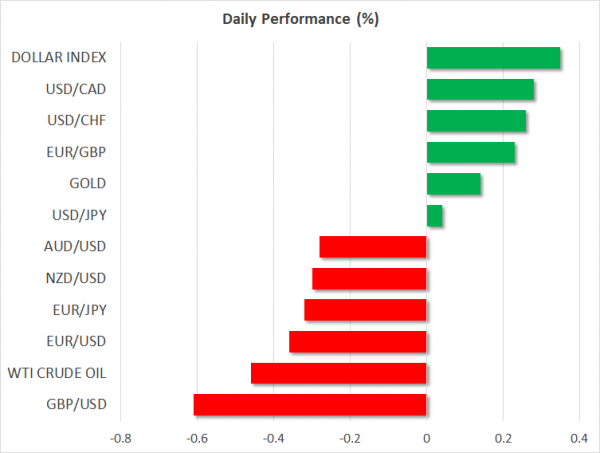

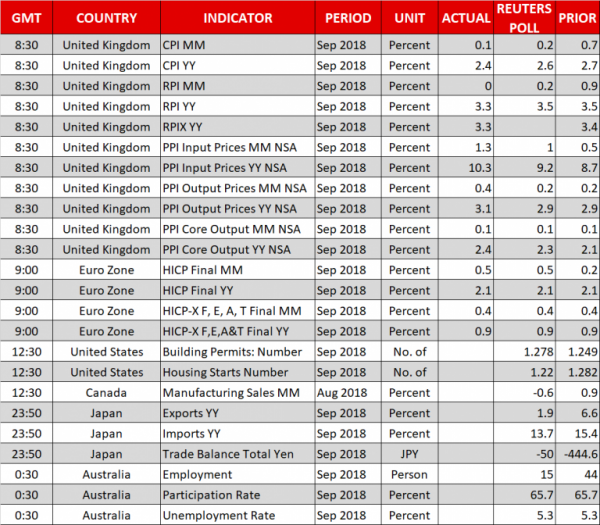

- FOREX: Worse-than-expected CPI readings out of the UK drove sterling lower early in the European session after September’s data showed an annual inflation rate of 2.4%, below the consensus of 2.6% and under the previous mark of 2.7%. This is the lowest annual price growth in three months. Pound/dollar dropped by 0.61% to 1.3100, paring the gains it posted on Tuesday, while pound/yen declined by 0.55% and euro/pound edged higher by 0.21%. Rising concerns over the EU summit not providing a breakthrough on Brexit were weighing on the sentiment as well. In the eurozone, the annual inflation rate was confirmed steady at 2.1% in September, while on a monthly basis the gauge increased to 0.5% versus 0.2% before. Euro/dollar fell by 0.36% to 1.1530 barrier. Worries over Italy’s draft fiscal plans, whether those would be accepted by the EU, and a potential credit downgrade by rating agencies next week were weighing on the single currency. Meanwhile, the US dollar index moved higher by 0.36% on Wednesday before the release of FOMC minutes later in the day, however, dollar/yen steadied at 112.28. The antipodean currencies were on the back foot, with aussie/dollar losing 0.29% and kiwi/dollar down by 0.36%. Dollar/loonie was last seen at 1.2970 (+0.30%).

- STOCKS: European stocks were mixed on Wednesday at 1000 GMT. The UK’s FTSE 100 traded higher by 0.21% amid a modest downfall in sterling. Since the index is constituted mainly by large multinational companies that earn most of their revenues abroad, a weaker pound benefits the FTSE, and vice versa. The Spanish IBEX 35 was underperforming, falling by 0.41%, while the German DAX 30 was retreating by 0.39%. Italy’s FTSE MIB fell by 0.32%, while the French CAC 40 moved marginally higher by 0.05%. The STOXX 50 and the STOXX 600 edged down by 0.04% and 0.10% respectively. In the US, job openings hit another record high in August and industrial production picked up steam, data showed yesterday, sending S&P 500, Dow Jones, and Nasdaq 100 sharply higher. However, futures tracking these indices are pointing to a lower open today.

- COMMODITIES: Oil prices posted some losses during the European session despite an unexpected drop in API weekly US crude oil inventories. WTI crude oil ticked lower by 0.50% to $71.56/barrel and the London-based Brent crude declined by 0.31% to $81.16/barrel. Note that the US prepares a second round of sanctions against Iran on November 4, a threat to oil exports. Gold rebounded towards an intra-day high of $1228/ounce before it slipped to $1,225/ounce (+0.08%).

Day ahead: FOMC delivers meeting minutes; Australia reports on employment

The Federal Open Market Committee (FOMC) is due to publish minutes of its September 25-26 policy meeting at 1800 GMT, probably to remind investors that another rate hike is in on the way as soon as December, while three more increases should be expected in 2019 but in a gradual pace.

Any reference to neutral rates and particularly where these are estimated according to policymakers would be a valuable information to determine the path of rate rises after the Fed chief said that “interest rates are still accommodative, but we’re gradually moving to a place where they will be neutral”. He also added that the central bank might go past neutral in the future. Views on trade are likely to attract attention as the bitter US-Sino trade war continues, though given the solution in NAFTA a few weeks ago, statements might be outdated and thus the dollar might not show much reaction. Stock and bond markets will be closely watched as well.

Prior to the FOMC meeting minutes, US building permits and housing starts for the month of September will become public at 1230 GMT, with the former forecasted to improve, whilst the latter is projected to slow down.

Canadian manufacturing sales for August will be available at the same time.

Elsewhere, Japan will release trade numbers for September at 2350 GMT, but the safe-haven yen might respond little as per usual. Still, the data could provide evidence on how pressured producers in the export-oriented country are under steel and aluminum tariffs from the US. Analysts believe that export growth softened significantly on a yearly basis, falling to 1.9% from 6.6% in August. Imports are said to have eased too, from 15.3% to 13.7%, probably causing a much narrower trade deficit of JPY 50 billion compared to JPY 438.4bn previously.

In other data of interest, Australian employment figures are likely to move the aussie overnight. At 0030 GMT on Thursday, the Australian Bureau of Statistics is expected to say that the number of employees increased by 15k in September, much less the 44k rise in August. The unemployment and the participation rates, however, are said to have remained steady at 5.3% and 65.7% respectively, potentially hinting that the slowdown in job creation might not be that important for now. Should the figures appear more encouraging than projected, the aussie could head north.

Following the API weekly report which indicated a decline in US crude inventories in the week ending October 13, the EIA is the next in line to provide clues on weekly US oil stocks today at 1430 GMT. If these are confirmed negative as well, oil prices will likely face upside pressures.

As for public appearances scheduled for today, Bank of England Deputy Governor Jon Cunliffe reappointment hearing before the Parliament’s Treasury Committee is at 1315 GMT. Permanent FOMC voting member Brainard will be also talking about “Fintech and Financial Inclusion” at 1410 GMT.

In equities, Alcoa is among corporations releasing earnings results after the closing bell on Wall Street.

Brexit could make headlines as the EU summit in Brussels starts today with investors looking eagerly to see whether the eurozone and the UK can deliver progress on the divorce terms. If the sides fail to break the deadlock especially on the Irish border front, November’s summit might not even take place. In fact, sources stated today that the EU is looking to arrange a meeting next month in order to step up preparation for a no deal exit instead.