In an interview on Thursday, US Treasury Secretary Mnuchin stated that the US wants to make sure that Yuan’s recent depreciation isn’t a competitive devaluation. According to media, info leaked that US treasury department staff will not be categorizing China’s Yuan, as a manipulated currency. IMF states that the Chinese currency is fairly valued, however worries among investors exist, that the US-Sino trade tensions may expand into the FX sector of the supply chain. Should Mnuchin revise the final report of the Treasury department before its release, due to pressure from President Trump or any other reason, we could see volatility rising for the USD.

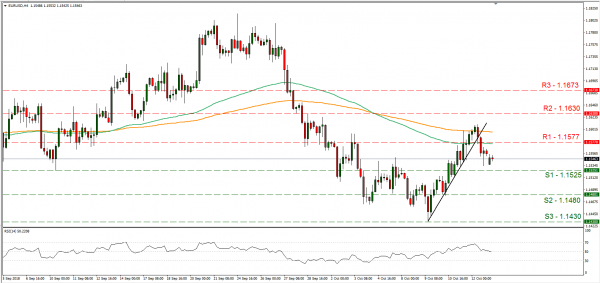

EUR/USD dropped on Friday, breaking the upward trend-line incepted since the 9th of October and the 1.1577 (R1) support line, now turned to resistance. As the pair has broken the prementioned upward trend-line we change our bullish view in favour of a sideways movement, however we suspect that bearish tendencies could occur, as the financial releases today could favour the USD side. Should the bears take over, we could see the pair breaking the 1.1525 (S1) support line and aim for the 1.1480 (S2) support barrier. Should on the other hand, the bulls dictate the pair’s direction, we could see the pair breaking the 1.1577 (R1) resistance line and aim for the 1.1630 (R2) resistance hurdle.

Brexit negotiations fail to have breakthrough over the weekend

As per media, intensive Brexit negotiations failed to produce a deal over the weekend. The two sides may not be able to meet the deadline, at the EU summit on the 18th of October, as no further talks are expected until then. Officials on both sides, seem increasingly concerned that time is running out to get an agreement before the UK’s exit in March. Analysts, point out that primary focus for the pound is Brexit and data is only a distraction, adding that investors may start ignoring conflicting headlines and wait for final confirmation. Further volatility could be expected for the pound, as the EU summit draws near.

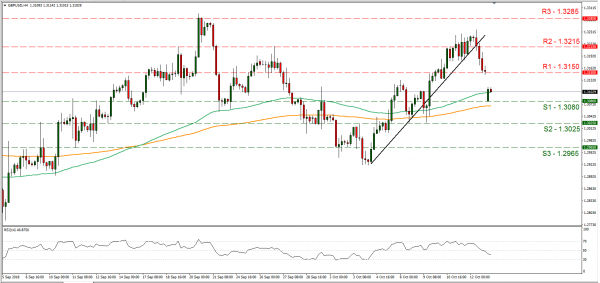

Cable tumbled on the news and broke the upward trend-line incepted since the 4th of October and the 1.3215 (R2) along with the 1.3150 (R1) support lines (now turned to resistance), before testing the 1.3080 (S1) support level. As the pair has broken the prementioned upward trend-line, we lift our bullish bias in favour for a sideways movement, albeit the pair may show some bearish tendencies, as it may prove sensitive to any further Brexit news and today’s US financial releases. Should the market favour the pair’s short positions, we could see the pair breaking the 1.3080 (S1) support line and aim for the 1.3025 (S2) support zone. On the other hand should the market favour the pair’s long positions, we could see it breaking the 1.3150 (R1) resistance line and aim for the 1.3215 (R2) resistance level.

In today’s other economic highlights:

During the American session, the US retail sales growth rates (headline and core) for September, are to be released and should their respective forecasts be realised we could see the USD getting some support.

As for the week ahead

On Tuesday, we get New Zealand’s CPI rate for Q3, China’s CPI rate for September, UK’s employment data for August and Germany’s ZEW economic indicator for October. On Wednesday, we get UK’s CPI rates for September, Eurozone’s final CPI rate for September and from the US the FOMC meeting minutes. On Thursday, we get Japan’s trade balance figure for September, Australia’s employment data for September and from the US the Philly Fed Business Index for October. On Friday, we get Japan’s and Canada’s CPI rates, both for September and China’s GDP growth rate for Q3.

EUR/USD 4H

Support: 1.1525 (S1), 1.1480 (S2), 1.1430 (S3)

Resistance: 1.1577 (R1), 1.1630 (R2), 1.1673 (R3)

GBP/USD 4H

Support: 1.3080 (S1), 1.3025 (S2), 1.2965 (S3)

Resistance: 1.3150 (R1), 1.3215 (R2), 1.3285 (R3)