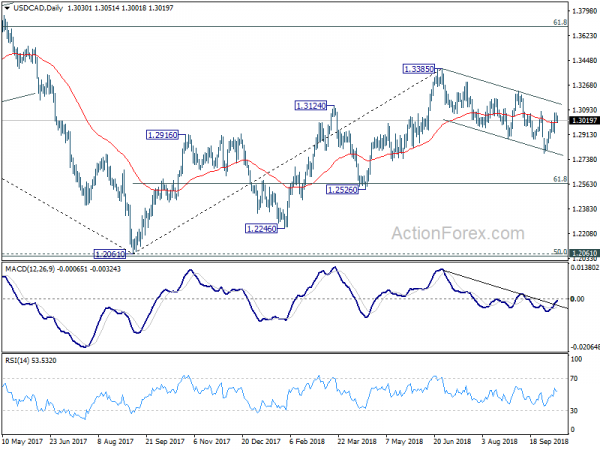

Despite rebounding further last week, USD/CAD is held below 1.3081 resistance. With 4 hour MACD crossed below signal line again, initial bias is neutral this week first. On the upside, decisive break of 1.3081 will be the first sign of completion of whole choppy fall from 1.3385. In that case, near term outlook will be turned bullish for 1.3225 resistance for confirmation. On the downside, below 1.2886 minor support will turn bias to the downside for 1.2781 instead. That would also argue that fall from 1.3385 is still in progress for another low.

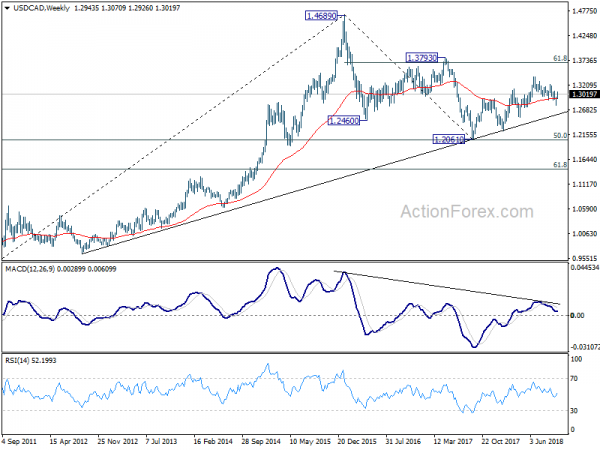

In the bigger picture, corrective rebound from 1.2061 could have completed at 1.3385 already. Deeper fall is mildly in favor to 61.8% retracement of 1.2061 to 1.3385 at 1.2567, which is close to 1.2526 support. For now, we’re not seeing fall from 1.3385 as resuming larger down trend from 1.4689 (2015 high) yet. Thus, we’ll look for bottoming signal again below 1.2567 . On the upside, though, break of 1.3081 resistance will argue that the pull back from 1.3385 is completed and rise from 1.2061 is resuming for another high above 1.3385.

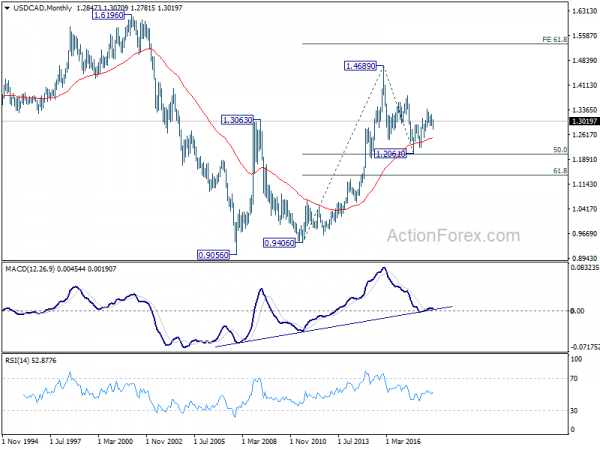

In the longer term picture, corrective fall from 1.4689 (2015 high) should have completed with three waves down to 1.2061, just ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. The development keeps long term up trend from 0.9406 and that from 0.9056 (2007 low) intact. For now, there is prospect of extending the long term up trend to 61.8% projection of 0.9406 to 1.4689 from 1.2061 at 1.5326 in medium to long term.