While the US markets tumbled for another day overnight, Asian markets showed their own resilience and turned positive after initial pressure. Nikkei closed up 0.46% at 22694.66. Japanese 10 year JGB yield is also above 0.15 at 0.151, up 0.0059. Singapore Strait Times is rising 0.72%. Hong Kong HSI is trading up 1.82%. China Shanghai SSE is up 0.86% at 2605.93 but cannot reclaims 2638 key support yet. Overnight, DOW lost -2.13% or 545.91 pts to 25052.83, barely held 25000 handle. S&P 500 lost -2.85% and NASDAQ dropped -1.25%. Treasury yields also tumbled with 10 year yield closed down -0.092 at 3.133.

In the currency markets, Canadian Dollar is the strongest one so far today, followed by Sterling and then Dollar. Yen is the weakest one again for today. But it’s now followed by New Zealand and then Australian Dollar. For the week, however, Canadian Dollar is the weakest one followed by Dollar. New Zealand Dollar, yen and Australian Dollar are the stronger ones.

Technically, there is no clear sign that Dollar is bottoming, except possibly versus Yen. The greenback might need to seek help from stabilization in US stocks, if that happens today, to find its footing.

IMF downgrades 2019 Asia growth forecasts, including Australia, Hong Kong, Korea, Singapore, China, India

In the regional outlook report released today, IMF downgraded Asia growth forecasts in 2019 due to financial market stress and trade tensions. But it maintained that “near-term outlook for Asia remains positive, supported by steady global momentum and broadly accommodative policies”. Also, “Asia continues to be the main growth engine of the world”.

Overall Asian growth is projected to be at 5.6% in 2018 and 5.4% (downgraded by -0.2%) in 2019. For 2019, four of the seven advanced economies got growth projections downgraded, including Australia at 2.8% (-0.3%), Hong Kong 2.9% (-0.3%), Korea 2.6% (-0.3%), Singapore 2.5% (-0.2%). Taiwan got an upgrade to 2.4% (+0.4%), so did New Zealand at 3.0% (+0.1%). Japan’s forecast was unchanged at 0.9%. Overall emerging Asian economies was downgraded to 6.3% (-0.3%) in 2019. China’s growth was downgraded to 6.2% (-0.2%), India to 7.4% (-0.4%).

Additionally, IMF cited the following near-term downside risks to the forecasts:

- Escalating trade tensions

- Tighter global financial conditions

- Homegrown risks

And it urged the following policy actions:

- strengthen macro building blocks

- liberalize trade and investment

- strengthen productivity prospects

- seize the opportunities of, while addressing the spillovers from, the digital economy

US Treasury not to name China a currency manipulator, just keep it in monitoring list

There are media reports came out yesterday saying that US Treasury is not going to name China a currency manipulator in the upcoming report to be released later in the month. Though China will remain on a monitoring list due to the huge trade surplus with the US.

That could put Treasury Secretary Steven Mnuchin under even bigger pressure from Trump and the trade hawks in his administration. Mnuchin is clearly the one who preferred to and tried to line up restart of negotiation with China. But he has been receiving cold shoulders from his colleagues.

And Trump seemed to have gotten impatient with Mnuchin. If should be reminded that Trump didn’t just complained Fed for rate hikes. In his words, he said earlier “The problem [causing the market drop] in my opinion is Treasury and the Fed. The Fed is going loco and there’s no reason for them to do it. I’m not happy about it.”

In a Bloomberg interview yesterday, Mnuchin declined to comment and only said “We are concerned about the depreciation” of the yuan, he said, “and want to make sure that it’s not being used as a competitive devaluation.

China exports to US grew despite trade war, imports shrank for another month

China’s trade surplus surprisingly widened in September, as trade surplus with US jumped to record high at USD 34.1B. As trade war started and escalated to another phase, exports to US continued to grow while imports from the US contracted for another month. For the year as a whole, China continued to have faster import growth with EU, than exports.

In USD terms, China’s trade surplus widened to USD 31.7B in September, well above expectation of USD 19.4B. Exports rose 14.5% yoy to USD 226.7B. Import rose 14.3% yoy to 195.0B.

For the month of September

- Exports to EU rose 1.2% mom, 11.4% yoy to USD 37.4B. Imports from EU dropped -0.6% mom, rose 9.1% yoy to USD 24.7B. Trade surplus rose 9.9%, 37.7% yoy to USD 12.7B.

- Exports to US rose 5.2% mom, 14.0% yoy to USD 46.7B. Imports from US dropped -5.8% mom, -2.3% yoy to USD 12.6B. Trade surplus rose 9.9% mom, 21.5% yoy to USD 34.1B.

From January to September

- Exports to EU rose 11.4% yoy to USD 301.5B. Imports from EU rose 14.1% to USD 205.2B. Trade surplus rose 6.1% yoy to USD 96.3B.

- Exports to US rose 12.9% yoy to 348.8B. Imports from US rose 8.3% to USD 123.0B. Trade surplus rose 15.5% to USD 225.8B.

Elsewhere

New Zealand BusinessNZ manufacturing PMI dropped 0.3 to 51.7 in September. Australia home loans dropped -2.1% mom in August. Japan M3 rose 2.8% yoy in September. Tertiary industry index rose 0.5% mom in August. Eurozone industrial production, US import price and U of Michigan sentiment will be featured today.

USD/CAD Daily Outlook

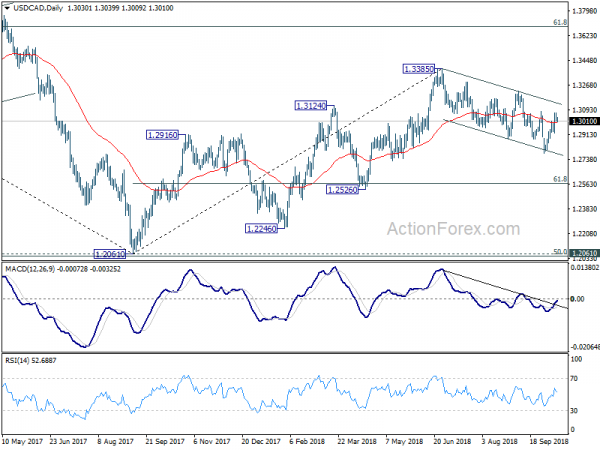

Daily Pivots: (S1) 1.3010; (P) 1.3041; (R1) 1.3068; More…

USD/CAD failed to break through 1.3081 resistance and retreats with 4 hour MACD crossed below signal line. Intraday bias is turned neutral again. On the upside, decisive break of 1.3081 will be the first sign of completion of whole choppy fall from 1.3385. In that case, near term outlook will be turned bullish for 1.3225 resistance for confirmation. On the downside, below 1.2886 minor support will turn bias to the downside for 1.2781 first.

In the bigger picture, corrective rebound from 1.2061 could have completed at 1.3385 already. Deeper fall is mildly in favor to 61.8% retracement of 1.2061 to 1.3385 at 1.2567, which is close to 1.2526 support. For now, we’re not seeing fall from 1.3385 as resuming larger down trend from 1.4689 (2015 high) yet. Thus, we’ll look for bottoming signal again below 1.2567 . On the upside, though, break of 1.3081 resistance will argue that the pull back from 1.3385 is completed and rise from 1.2061 is resuming for another high above 1.3385.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | BusinessNZ Manufacturing PMI Sep | 51.7 | 52 | ||

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Sep | 2.80% | 2.90% | 2.90% | |

| 0:30 | AUD | Home Loans M/M Aug | -2.10% | -0.90% | 0.40% | 0.00% |

| 2:54 | CNY | Trade Balance (USD) Sep | 31.7B | 19.4B | 27.9B | |

| 2:54 | CNY | Trade Balance (CNY) Sep | 213B | 192.3B | 179.8B | |

| 4:30 | JPY | Tertiary Industry Index M/M Aug | 0.50% | 0.30% | 0.10% | -0.10% |

| 6:00 | EUR | German CPI M/M Sep F | 0.40% | 0.40% | 0.40% | |

| 6:00 | EUR | German CPI Y/Y Sep F | 2.30% | 2.30% | 2.30% | |

| 9:00 | EUR | Eurozone Industrial Production M/M Aug | 0.40% | -0.80% | ||

| 12:30 | USD | Import Price Index M/M Sep | 0.30% | -0.60% | ||

| 14:00 | USD | U. of Mich. Sentiment Oct P | 100.9 | 100.1 |