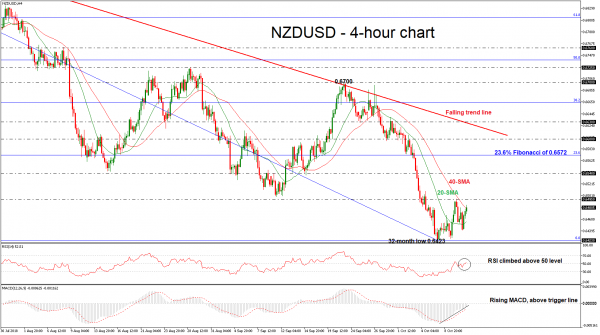

NZDUSD has been neutral over the past week, developing within the 0.6495 high and the 0.6423 low. Meanwhile, the 20-simple moving average (SMA) is sloping to the upside and may record a bullich crossover with the 40-SMA in the 4-hour chart, suggesting some gains. The RSI indicator climbed above the 50 level with strong momentum, while the MACD oscillator remains below the zero line, strengthening its positive movement.

Upside moves are likely to find resistance at the latest high of 0.6495. A run above this level would challenge the 0.6540 hurdle, taken from the low on September 17, while a steeper advance above this level would hit the 23.6% Fibonacci retracement level of the downleg from 0.7060 to 0.6423, around 0.6572.

If the price slip below the 20- and 40-simple moving averages (SMAs), it is expected to lose more ground and meet the 32-month low of 0.6423. More downside extension could post a fresh lower low until the next support coming from 0.6345, where it bottomed on January 2016.

Regarding to the longer-timeframe, NZDUSD has been trading bearish in the past six months after the pullback on the 0.7390 hurdle, but if the price jumps above the falling trend line, this could shift the outlook to a more neutral to bullish one.