Asian markets are in crisis mode as dragged down by the stock market crash in the US over night. At the time of writing, Nikkei is down -970 pts or -4.13%. Singapore Strait Times is down -89.59 pts or -2.86%. Hong Kong HSI is down -1010 pts or -3.86%. And, China Shanghai SSE is down -4.61% at 2600. Key support level at 2638 (2016 low) is taken out and 2600 handle looks vulnerable.

Overnight, DOW dropped -831.83 pts or 3.15% to 25598.74. S&P 500 lost -3.29% and NASDAQ fell -4.08%. Treasury yields were strong with 10 year yield up 0.017 at 3.225. The biggest test today is US consumer inflation. Both headline and core CPI are expected to accelerate in September. Any upside surprise would further affirm Fed’s rate path and could prompt deeper selloff in stocks.

In the currency markets, Dollar is trading as the weakest one in Asian session and gets not support from surging yield. Trump’s unjustified scapegoating attack on Fed could be a reason for the weakness. But it should be reminded that Fed is doing a good job in achieving its dual mandate in both employment and inflation. If Fed’s rate path is being seen as too fast, it’s because of the pro-cyclical fiscal stimulus, the tax cuts, that was launched earlier this year. The fiscal stimulus also set up the a trap on investors by giving unnecessary boost to the stock markets for this year’s upleg. So who’s to blame?

For today, Yen also pared back some gains and is trading as the second weakest. On the other hand, New Zealand Dollar is the strongest one, followed by Swiss Franc and then Euro.

The weekly picture is actually more representative on what’s happened. Yen is the strongest one for the week, followed by Sterling. Canadian Dollar is the weakest one, followed by Dollar and then Australian Dollar.

DOW already in medium term reversal? 24531 is next test

DOW’s strong break of 55 day EMA, coupled with bearish divergence condition in daily MACD, is significantly raising the chance that it’s now in medium term reversal. From price structure point of view, there was also a beautiful wave four triangle from 26616.71 to 23997.21, followed by a short impulse wave five from 23997.21 to 26951.81. Unless DOW could get back above 55 day EMA quickly, otherwise, risk is now heavily on the downside.

So how far could DOW fall to? If we take a less bearish view, it’s just correcting the uptrend from 2016 low at 15450.56 to 26951.81. Then, first support is 55 week EMA (now at 24531.54). Defending this support will keep the medium term intact and invalidate the above mentioned medium term reversal case. However, firm break there should at least send DOW back to 38.2% retracement of 15450.56 to 26951.81 at 22558.33 before bottoming.

Trump scapegoats Fed as going crazy, wild and loco

Trump launched another scapegoating attack on Fed and said, referring to the over 800 pts fall in DOW, “I think the Fed is making a mistake. They are so tight. I think the Fed has gone crazy.” He added “actually, it’s a correction that we’ve been waiting for for a long time, but I really disagree with what the Fed is doing.”

Later he doubled down and said in a telephone interview that “the problem I have is with the Fed. The Fed is going wild. I mean, I don’t know what their problem is that they are raising interest rates and it’s ridiculous.” “The problem [causing the market drop] in my opinion is Treasury and the Fed. The Fed is going loco and there’s no reason for them to do it. I’m not happy about it.”

IMF Lagarde urged to de-escalate trade wars for the innocent bystanders

In a conference in Indonesia, IMF Managing Director Christine Lagarde urged countries to “de-escalate” trade wars was they could hurt “innocent bystanders”. She said, “We certainly hope we don’t move in either direction of a trade war or a currency war. It will be detrimental on both accounts for all participants… and there would also be lots of innocent bystanders.”

Regarding recent depreciation of the Chinese Yuan, Lagarde said it’s mainly driven by the strengthen of Dollar. And she noted that Yuan has not depreciated as much against a basket of currencies. She acknowledged that “we’re seeing more and more countries, China included, let their currencies fluctuate.” At the same time she also supported “the move of China toward (currency) flexibility” and urged China to go down that path.”

On the data front

UKK RICS house price balance dropped to -2 in September. Japan domestic corporate goods price index rose 3.0% yoy in September. Australia consumer inflation expectation was unchanged at 4.0% in October.

ECB monetary policy meeting accounts will be the main focus in European session. US CPI will catch all attention later in the day. Headline CPI is expected to rise to 2.8% yoy in September and core CPI to rise to 2.3% yoy. That would reaffirm Fed’s rate path and any upside surprise could prompt even deeper selloff in stocks. US will also release jobless claims. Canada will release new housing price index.

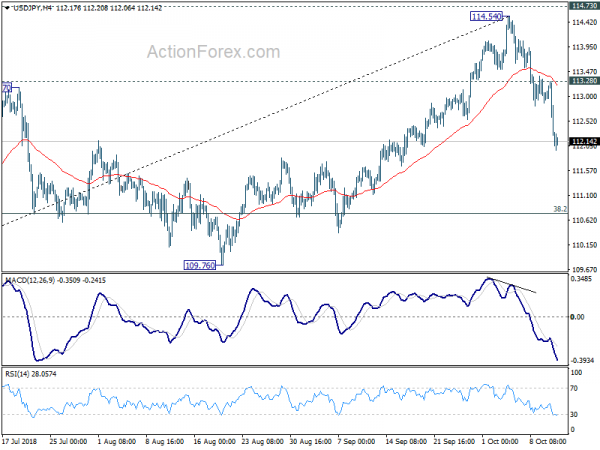

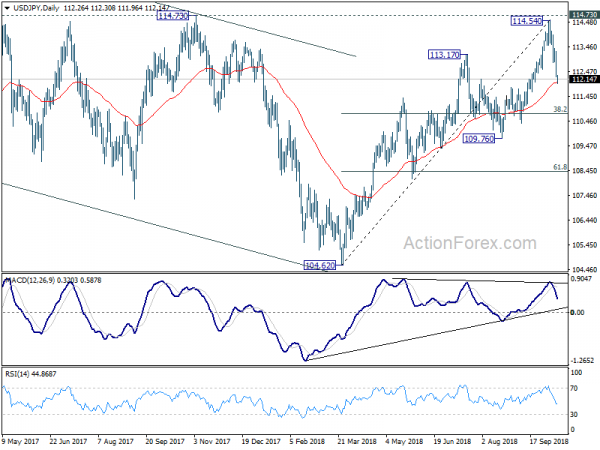

USD/JPY Daily Outlook

Daily Pivots: (S1) 111.92; (P) 112.60; (R1) 112.95; More…

USD/JPY’s fall from 114.54 extends to as low as 111.96 so far today. There is no sign of bottoming yet and intraday bias remains on the downside. Current downside acceleration argues that USD/JPY is correcting whole up trend from 104.62, after rejection by 114.73 resistance. Further fall could be seen to 38.2% retracement of 104.62 to 114.54 at 110.75. We’ll look for bottoming signal above 109.76 key support. On the upside, break of 113.28 minor resistance is needed to indicate completion of the decline. Otherwise, near term outlook stays mildly bearish even in case of recovery.

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.76 support holds. However, decisive break of 109.76 will dampen this bullish view and turns outlook mixed again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS House Price Balance Sep | -2.00% | 2.00% | 2.00% | 1.00% |

| 23:50 | JPY | Domestic Corporate Goods Price Index Y/Y Sep | 3.00% | 2.90% | 3.00% | |

| 0:00 | AUD | Consumer Inflation Expectation Oct | 4.00% | 4.00% | ||

| 11:30 | EUR | ECB Monetary Policy Meeting Accounts | 2.45 | |||

| 12:30 | CAD | New Housing Price Index M/M Aug | 0.20% | 0.10% | ||

| 12:30 | USD | CPI M/M Sep | 0.20% | 0.20% | ||

| 12:30 | USD | CPI Y/Y Sep | 2.80% | 2.70% | ||

| 12:30 | USD | CPI Core M/M Sep | 0.20% | 0.10% | ||

| 12:30 | USD | CPI Core Y/Y Sep | 2.30% | 2.20% | ||

| 12:30 | USD | Initial Jobless Claims (OCT 6) | 205K | 207K | ||

| 14:30 | USD | Natural Gas Storage | 98B | |||

| 15:00 | USD | Crude Oil Inventories | 8.0M |