Euro geo-political risks have abated somewhat, at leas until next month’s French Parliamentary elections, now that Emmanuel Macron handily won the French Presidential election over the weekend. Long euro asset profit taking has been the order of the day over the past 36-hours.

For the time being, for investors and dealers, they now have to revert back to basic fundamentals and focus again on the possibility of rate differentials widening, similar to ‘old’ school FX.

Overnight, global equity markets were mixed, with Asian shares slipping after a rally to a two-year high while European stocks were bolstered by corporate earnings. The ‘mighty’ U.S dollar has found some traction, while crude oil reversed some of its losses, but remains in trouble.

1. Global equities mixed results

Asian stocks were largely quiet in the overnight session after strong gains yesterday.

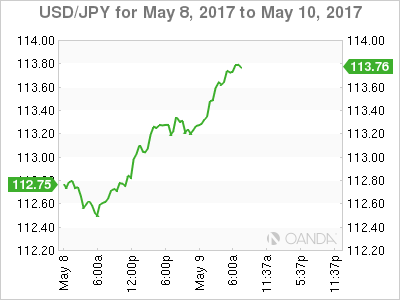

In Japan, the Nikkei eased -0.1% after Monday’s +2.3% jump to a 17-month high. If signs of a Fed June rate hike increase many dollar ‘bulls’ now see Yen under performing towards ¥115.00 region, which could see the Nikkei get to 20,500. The broader Topix fell -0.3% after closing at the highest since December 2015 in the previous session.

In Hong Kong, the Hang Seng index rose +0.2%, as China fell further after yesterday’s slide. The Shanghai Composite pared early losses to recently to close -0.3% lower on the session.

In China, stocks fluctuated after erasing more than -$500B from equity values amid a crackdown on financial leverage.

Markets in Korea are closed as voters there elect a new president. The Kospi hit a record high Monday while jumping +2.3%, the biggest daily gain in 20-months.

Down-under, the Aussie S&P/ASX 200 Index dropped -0.5%, hurt mostly by financials on rumours that the Government set to impose a +A$6B levy on lenders in today’s budget.

In Europe, equities trade higher across the board, with financials leading the way on the Eurostoxx. Energy shares on the FTSE 100 are under pressure on news that the Conservative Party has pledged to cap energy tariffs.

U.S equities are set to open a tad higher (+0.1%).

Note: The VIX (volatility index) has tumbled to its lowest level in 24-years. it fell -8% to +9.77% Monday

Indices: Stoxx50 +0.5% at 3661, FTSE +0.4% at 7331, DAX +0.5% at 12757, CAC-40 0.4% at 5407, IBEX-35 0.2% at 1124, FTSE MIB +0.9% at 21616, SMI +0.4% at 9074, S&P 500 Futures +0.1%.

2. Oil gives up earlier gains as rising U.S. output, gold lower

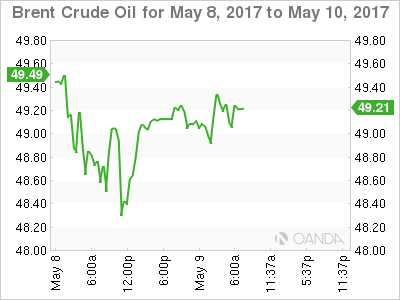

Crude oil prices have given up earlier gains overnight, as concerns over slowing demand and a relentless rise in U.S crude output continues to undermine the impact of hopes that OPEC-led production cuts could be extended.

Brent crude futures are at +$49.33 per barrel, down from a high of +$49.60 earlier in the session and near their last close. U.S. West Texas Intermediate (WTI) crude oil futures are trading at +$46.40 per barrel, down from an intra-day high of +$46.66.

In the U.S, increase in production is coming from shale producers. Since the middle of 2016, U.S. crude production has risen by over +10% to +9.3m bpd, which is close to the output of top producers Russia and Saudi Arabia.

Note: The energy market is also eyeing the concerns of China’s growth as both imports and exports have slowed.

A decision on whether to continue OPEC and non-OPEC member production cuts is expected at the next official meeting on May 25 in Vienna.

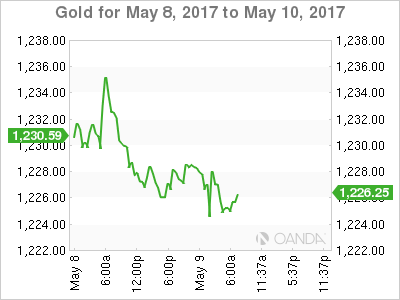

Ahead of the U.S open, gold prices have hit their lowest price in nearly two-months as safe-haven demand diminished on easing political worries after the weekend’s France’s Presidential election. Spot gold is steady at +$1,226.13 per ounce, after touching +$1,223.34, its lowest since mid-March.

3. Fixed income yields slow march higher

Global yields have trended upward in recent weeks, as alarming geopolitical headlines fade into the background and investors increasingly focus on the potential for the Fed to raise interest rates at their meeting next month. The odds of that happening are currently trading at +80%.

The yields on 10-year Treasury notes are little changed at +2.39%, after climbing +4 bps in yesterday’s session. Down-under, yields on Aussie debt with a similar maturity have pushed back +1 bps to +2.68%, while in France, 10-year OAT’s yields increased +2 bps to +0.87%.

It seems that the days of these ultra lows yields are numbered, in Germany, 10-year Bunds currently yield +0.44%. It was only 18-months ago that Bunds reached minus -0.19%.

There are a couple of central banks in the frame this week, on Wednesday May 10, the Reserve Bank of New Zealand (RBNZ) and on Thursday, the Bank of England (BoE) – neither are expected change monetary policy soon.

4. Dollar shines brightly

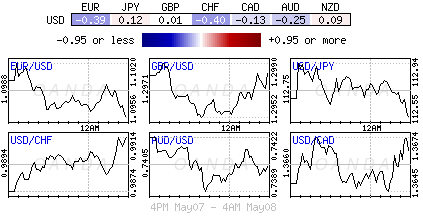

The dollar has gained broadly in the overnight session, rising to an eight-week high against the low-yielding yen of ¥113.69, while the EUR and the pound stay below key resistance levels of €1.1000 and $1.3000, respectively.

The “mighty’ dollar continues to derive some support from higher U.S. yields, both nominal and real. Falling commodity prices are also providing support to the greenback, especially against commodity-linked and emerging market currencies.

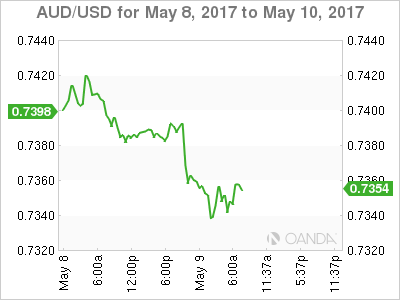

The EUR/USD trades down -0.1% at €1.0919, while the AUD/USD drops to a four-month low A$0.7347 pressured by a dismal retail sales print overnight (see below).

The pound as been given some support by a strong BRC retail sales survey (British Retail Consortium) overnight, but trades only slightly higher outright, up +0.1% at £1.2952.

5. Blame the weather: Aussie retail sales disappoints

Data overnight showed that Australian retail sales unexpectedly fell -0.1% in March. The market had anticipated a +0.3% rise. The disappointing data may suggest that the Aussie economy is facing headwinds from a weak job market and slack wage growth.

Digging deeper, the demand for food retail and household goods contributed to the monthly fall. The March data contribute to Q1 retail sales rising just +0.1%, below the +0.5% growth expected.

Blame it on the weather – a number of analysts are blaming Cyclone Debbie for the disappointing retail sales headline. Cyclone Debbie damped spending significantly. Sales in Queensland, which bore the brunt of the cyclone, fell by -1.3%. In contrast, sales across the rest of Australia rose by +0.2%.