Key Highlights

- The Euro started a downside move after forming a short-term top at 133.10 against the Japanese Yen.

- There was a break below a key bullish trend line with support at 132.40 on the 4-hours chart of EUR/JPY.

- The US ADP Employment in Sep 2018 increased 230K, more than the 185K forecast.

- Today, the US Factory Orders report for August 2018 will be released, which is forecasted to rise 2.1% (MoM).

EURJPY Technical Analysis

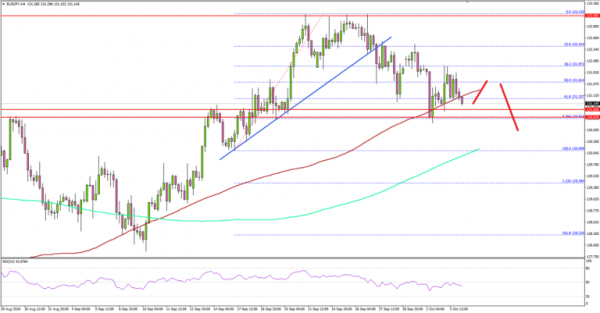

The Euro made a couple of attempts to break the 133.10 resistance against the Japanese Yen, but it failed. As a result, the EUR/JPY pair declined below 132.00 and moved into a negative zone.

Looking at the 4-hours chart, the pair clearly formed a short-term top at 133.10 and declined towards the 131.00 support area. During the decline, the pair broke the 50% Fib retracement level of the last wave from the 130.09 low to 131.13 high.

More importantly, there was a break below a key bullish trend line with support at 132.40 on the same chart. However, the pair found support near 130.80 and it is currently consolidating losses.

On the upside, the broken support at 132.00 could act as a resistance. If the Euro buyers push the pair above the 132.00 hurdle, it could revisit the 133.00 resistance.

On the other hand, if the pair decline below the recent low, then it may well drop towards the 130.00 support. Below 130.00, the pair is likely to test the 1.236 Fib extension level of the last wave from the 130.09 low to 131.13 high at 129.38.

Fundamentally, the US ADP Employment Change figure for Sep 2018 was released recently. The market was looking for an increase of 185K, more than the last 163K.

However, the result was above the market forecast as the Private Sector Employment increased by 230K jobs from August to September 2018.

The outcome increased bearish pressures on EUR/USD, GBP/USD and other major pairs. There could be short-term recoveries, but the greenback is likely to accelerate gains in the near term.

Economic Releases to Watch Today

- US Initial Jobless Claims – Forecast 213K, versus 214K previous.

- US Factory Orders August 2018 (MoM) – Forecast +2.1%, versus -0.8% previous.