Here are the latest developments in global markets:

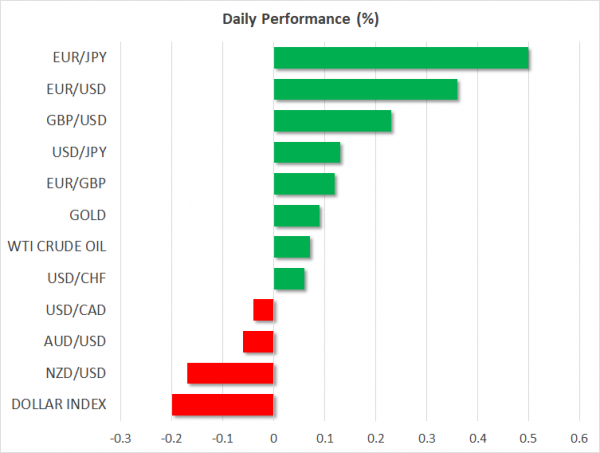

FOREX: The dollar index – which tracks the greenback’s performance against a basket of six major currencies – is lower by 0.20% on Wednesday. This is owed mainly to a recovery in the currency with the heaviest weight in this index, the euro, which bounced overnight following news that Italy is willing to compromise on its budget deficits from 2020 onwards. Elsewhere, the pound grinded lower during the Conservative Party Conference, with all eyes now turning to PM May, who will deliver remarks later today.

STOCKS: The Dow Jones (+0.46%) closed at a fresh record high on Tuesday, propelled higher by strong gains in chipmaker Intel (+3.55%). The benchmark S&P 500 (-0.04%) and the tech-heavy Nasdaq Composite (-0.47%) were not as fortunate though, with losses in giants like Facebook (-1.91%) and Amazon (-1.65%) dragging the broader market down. Futures tracking the Dow, S&P, and Nasdaq 100 are pointing to a higher open today. Asia was mostly in the red on Wednesday, with Japan’s Nikkei 225 (-0.66%) and Topix (-1.17%) edging lower, alongside the Hang Seng in Hong Kong (-0.22%). In Europe, all the major indices are set for a much higher open today according to futures, with news that Italy is willing to compromise on its budget deficit for 2020 and 2021 supporting sentiment.

COMMODITIES: Oil had a rather uninspiring session, with neither WTI nor Brent moving much, both benchmarks holding on to the spectacular gains they posted on Monday. Additionally, both continue to hover just below their respective four-year highs, with WTI at $75.38 per barrel and Brent at $84.97/barrel. In precious metals, gold showed some signs of life again on Tuesday, spiking higher to trade around the $1,204 zone on the back of Italian budget worries, even as the dollar was also rising. Since gold is denominated in dollars, an appreciating greenback typically weighs on demand for the yellow metal.

Major movers: Euro bounces on reports Italy is willing to compromise on future budgets

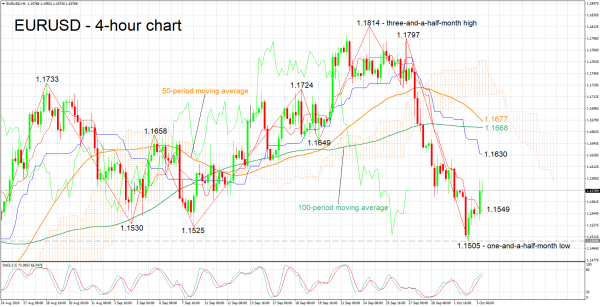

The euro experienced another bout of weakness during the early European session on Tuesday, after a senior lawmaker in one of Italy’s ruling parties said that having its own national currency would solve most of Italy’s problems, resurrecting specters of “Italexit”. He later clarified though, multiple times, that the idea of leaving the euro is “out of the window”. Euro/dollar initially grinded lower towards the 1.1500 support handle, found fresh buy orders and bounced from that level. It later spiked even higher back towards 1.1580 during the Asian session Wednesday, after media reports suggested the Italian government plans to lower its budget deficit in 2020 and 2021. This provided a glimmer of hope, indicating both that Italy wants to avoid a real clash with the EU, and that lowering the nation’s high debt level remains a priority.

From a technical standpoint, the fact that 1.1500 held as the proverbial “line in the sand” is encouraging for the bulls. Although the euro may remain “heavy” for a while unable to stage a sustained rally, as long as the 1.1500 hurdle holds, there is cause for optimism that the pair won’t revisit the 1.1300 neighborhood again but may instead hover near current levels until the Italian fog clears. The real question for the single currency may be how much of the “bad news” is priced in by now, and to what extent the European Commission – who is set to deliver its verdict on this budget by October 15 – will seek to confront Italy at the risk of fueling another crisis resembling the one in Greece.

The dollar, meanwhile, ended the day higher overall on Tuesday on the back of euro weakness, but has given back all those gains and is trading even lower on Wednesday. The world’s reserve currency barely responded to some remarks from Fed chief Powell yesterday, not least due to the absence of any fresh policy signals. All eyes remain on the employment data due on Friday.

Elsewhere, the pound was hammered lower as the Conservative Party Conference failed to impress investors looking for reassuring signs around the Brexit process. Boris Johnson spoke yesterday and generally attacked PM May’s Chequers plan, though he later called on Tories to continue backing her. Theresa May will speak today at 0900 GMT, and any Brexit remarks will be closely scrutinized.

Day ahead: UK services PMI, eurozone retail sales, US ADP jobs report & ISM services PMI on the agenda; PM May’s speech in focus with Italian budget updates to be monitored

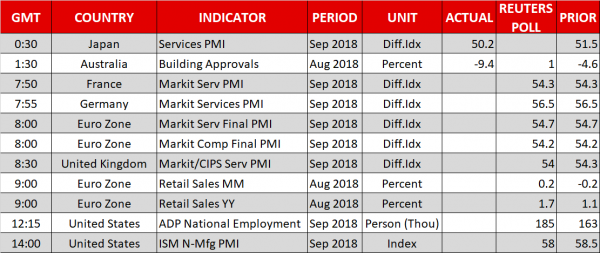

Of note on Wednesday’s agenda are the UK services PMI, the ADP jobs report and the ISM’s non-manufacturing PMI out of the US, as well as retail sales out of the eurozone. Beyond releases, of great interest will be PM Theresa May’s speech at the Conservative Party Conference, as well as any updates having to do with Italy’s budget plans.

At 0800 GMT, the eurozone will be on the receiving end of September’s final PMI prints for the services sector, as well as the composite PMI that blends manufacturing and services and which is considered a good overall growth indicator for euro area economies. Not much of a reaction is anticipated as the numbers are made public as the flash releases tend to be fairly reliable; market positioning usually takes place in the aftermath of the preliminary estimates. In fact, the two measures are anticipated to be confirmed at 54.7 and 54.2 respectively. Meanwhile, Germany and France, the eurozone’s two largest economies, will see the release of their respective PMI prints earlier in the day; at 0755 GMT and 0750 GMT correspondingly.

Also out of the euro area, retail sales figures for August are due at 0900 GMT. Month-on-month, sales are forecast to grow by 0.2%, after contracting by the same proportion in July. This would allow the annual pace of growth in sales to stand at 1.7%, above July’s 1.1%.

But of more importance for the euro are likely to prove developments revolving around Italy’s budget plans and the prospect for a clash with the European Commission over those; the higher the odds for such an outcome, the greater the drag on the euro is likely to be and vice versa.

Turning to the UK, the nation’s services PMI for September will be made public at 0830 GMT. The gauge is expected at 54.0, slightly below August’s 54.3. The fact that the services sector accounts for roughly 80% of the UK economy renders the release important; also, unlike the eurozone, the UK sees one and only release. Despite this, of more significance for sterling pairs will be PM May’s speech at her party’s annual conference, set to take place at 0900 GMT. Will she be able to unite her party under her Brexit vision? Will she be seen as coming closer to a breakthrough from the current backstop in negotiations? If the answer is “Yes” to both these questions, then sterling can be reasonably expected to post gains.

Out of the US, September’s ADP national employment report on the number of positions added to the economy by the private sector is due at 1215 GMT. The number of jobs added is forecast to stand at 185k, up from 163k in August. Some analysts use the ADP data to speculate on how the nonfarm payrolls report will come out, though it should be kept in mind that the two are not as correlated as they may have been on occasion in the past. Elsewhere, the ISM’s non-manufacturing PMI for September will be hitting the markets at 1400 GMT. It is predicted at 58.0, below August’s 58.5, though still comfortably in expansion territory above 50.

Fed chief Powell will be delivering remarks at 2000 GMT. Numerous other Fed policymakers will be making public appearances today: Evans (non-voting FOMC member in 2018 – 1030 GMT and 1800 GMT), Barkin (voter – 1205 GMT), Harker (non-voter – 1715 GMT), Bullard (non-voter – 1800 GMT), Brainard (permanent voter – 1800 GMT) and Mester (voter – 1815 GMT).

In energy markets, EIA data on US crude stocks are due at 1430 GMT. An inventory buildup of around 2.0 million barrels is projected for the week ending September 28, following a rise by around 1.9m during the previously tracked week

Technical Analysis: EURUSD bearish bias in place, though stochastics bullish in very short-term

EURUSD is trading roughly 70 pips above yesterday’s one-and-a-half-month low of 1.1505. The negatively-aligned Tenkan- and Kijun-sen lines continue to project a bearish short-term bias. The stochastics, though, are pointing to a bullish picture in the very short-term: the %K line is above the slow %D one and both are heading higher. Should the pair’s recovery extend further, then the negative near-term bias will increasingly come under question.

Easing worries over Italy are likely to push EURUSD higher. Resistance to gains may take place around the Kijun-sen at 1.1630, with an upside violation turning the attention to the current levels of the 100- and 50-period moving average lines at 1.1668 and 1.1677 respectively.

Conversely, rising Italian budget angst is expected to push the pair lower. Immediate support to losses could occur around the Tenkan-sen at 1.1549, with yesterday’s low of 1.1505 coming into view next. Steeper losses would increasingly bring within scope mid-August’s nadir of 1.1300, a level previously experienced in late June 2017.

Eurozone and US releases later in the day can also move the pair.