The GBP/USD currency pair has dropped from the recent highs, but it has still been bought on dips. In the lack of Brexit news lately, we have seen a bullish market that has been supported by the latest UK CPI numbers. Today, the manufacturing PMI (Purchasing manager Index) is on the table, scheduled for 8:30 AM GMT. The PMI is a leading indicator of economic health as businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company’s view of the economy. Don’t forget to follow our Forex calendar for all regular updates on the news,economic announcements, forecasts and much more.

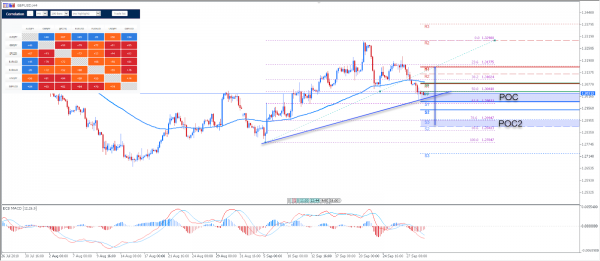

Technically, the GBP/USD currency pair has formed an ascending trend line. At this point the price is struggling to bounce from the POC zone 1.2980-1.3015. A sustained bounce and positive bullish momentum should lead the price to pivot point resistance levels – 1.3077 and 1.3102. Only a strong close above 1.3102 could get the price towards 1.3177. Rejections from the POC 2 zone 1.2845-95 are also possible, as long as the 88.6 fib lies exactly at S3 and S2 support. After the Manufacturing PMI numbers today we should see slightly higher than usual volatility so be prepared to react to price action as usual.

Pivot Lines – Weekly Support and Resistance

POC – POC – Point Of Confluence (The zone where we expect the price to react – aka the entry zone)