Here are the latest developments in global markets:

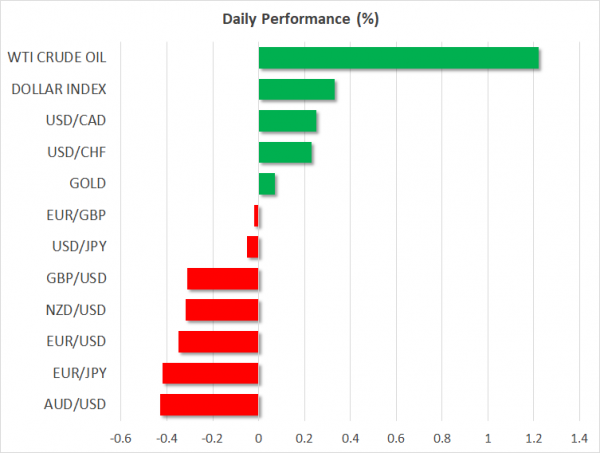

FOREX: The dollar index – which tracks the greenback’s performance against a basket of six major currencies– is higher by 0.35% on Thursday. This is owed mainly to weakness in the currency that has the biggest weight in this index by far, the euro, which is under pressure amid fresh worries around the Italian budget situation. The kiwi, meanwhile, responded little to the RBNZ rate decision overnight, though it is trading lower overall today.

STOCKS: An early rally in Wall Street came to a screeching halt on Wednesday, with all the major indices closing the day lower after a widely-telegraphed Fed rate hike sapped risk appetite. The Dow Jones led the way lower (-0.40%), while the S&P 500 (-0.33%) and Nasdaq Composite (-0.21%) followed not far behind. Asia took its cue from the US, with most benchmarks trading in the red on Thursday. In Japan, the Nikkei 225 (-0.99%) and the Topix (-1.18%) gave back some of their recent gains, while in Hong Kong, the Hang Seng fell by a modest 0.33%. In Europe, all benchmarks were set to open lower today according to futures, most likely due to renewed concerns around the Italian budget situation (see below).

COMMODITIES: Oil edged higher despite a larger-than-expected build in the crude inventories yesterday. The gains came after US Energy Secretary Rick Perry said his nation will not tap its Strategic Petroleum Reserves to combat higher oil prices – something that had been speculated following Trump’s recent address at the UN. WTI is up by 1.21% at $72.43 per barrel, while Brent gained 1.02% to reach the $82.16/barrel mark. In precious metals, gold is fractionally higher on Thursday (+0.06%) at $1,196 per ounce, recovering some of the losses it posted in the previous session.

Major movers: Dollar little changed after Fed; euro drops on Italian budget woes

As was universally expected, the Fed raised interest rates by 25bps yesterday, delivering few fresh signals on policy. The dollar tumbled immediately on the decision, as policymakers removed from the statement a sentence that previously read “policy remains accommodative”, generating worries that the pace of hikes may slow moving forward. However, the US currency quickly recovered to trade almost unchanged after Chair Powell downplayed the change as merely cosmetic. He also didn’t appear too worried about the escalation in trade tensions, indicating that it’s a risk, but that the Fed doesn’t see adverse effects in the numbers yet.

In terms of the rate projections, while the “median” dots remained unchanged to signal another hike in 2018 and three more in 2019, there was greater confidence on these forecasts among officials. As for economic forecasts, GDP growth for 2018 and 2019 were revised higher, while inflation for 2019 was marked slightly lower. Overall, there was nothing shocking out of this meeting, a fact reflected by the subdued reaction in the dollar and the nearly-unchanged market pricing for a December rate hike (still roughly 80%). The Fed remains committed to raising rates in a gradual manner amid a fiscally-turbocharged US economy, and trade risks are not dire enough yet to derail – or even delay – the central bank’s normalization efforts.

Euro/dollar spiked up on the decision, almost touching the 1.1800 zone, but then fell back to 1.1740 once the press conference commenced. Several hours later, during the early European session on Thursday, the pair fell even further towards the 1.1700 handle – this time on euro weakness. Italian-budget worries came back to haunt the single currency, which took a hit on news that the much-anticipated budget may be delayed amid “complications” on reaching a consensus on the deficit. Concerns around a potential Italy-EU standoff over budget deficit limits will likely keep a risk-premium on the euro, and perhaps risk-sensitive assets in general, until there is some greater clarity on the situation.

Overnight, the RBNZ kept its policy unchanged, reiterating that the next move in interest rates could be both up or down, implicitly keeping a rate cut on the table. The Bank maintained a cautious-to-neutral tone overall, indicating that there are signs of “core inflation rising”, but “downside risks” to growth linger. Given the lack of fresh signals, there was little reaction in the kiwi.

Day ahead: German inflation, US durable goods & final Q2 GDP figures due; Italian budget plans eyed

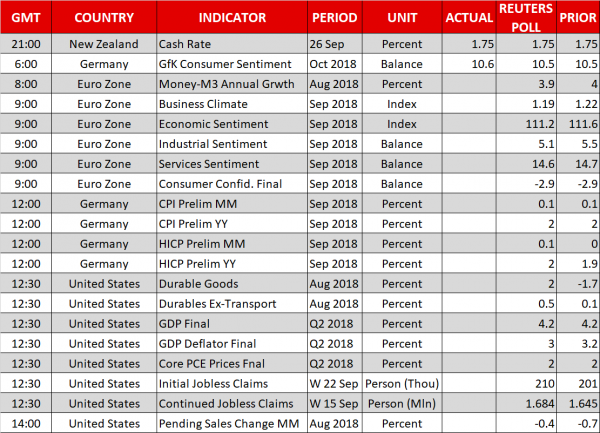

Eurozone business surveys, German inflation numbers, US durable goods & final Q2 GDP figures will be on tap on Thursday.

Numerous surveys gauging business sentiment in the eurozone during September are due out at 0900 GMT, all of which are expected to show a slight deterioration in morale relative to August; rising trade tensions have weighed on survey results in the past. Meanwhile, eurozone consumer confidence data due at the same time are projected to confirm the preliminary release which saw the relevant index coming in at -2.9 in September, its lowest since May 2017. For comparison, the US Conference Board’s consumer confidence index for September released on Tuesday jumped to a fresh near two-decade high.

Having greater potential to drive euro pairs will be September flash inflation readings out of Germany at 1200 GMT. Month-on-month, CPI growth is expected to remain at 0.1%, which would leave the year-on-year pace of expansion unchanged at 2.0%. The harmonised figures (HICP), that use a common methodology across EU countries, will also be watched. It bears mention that the numbers come one day ahead of the eurozone’s preliminary prints on September inflation and traders may thus use today’s figures to speculate on tomorrow’s euro-wide release, positioning themselves accordingly.

Also euro-important will be deliberations for Italy’s budget, with reports suggesting that a meeting on the country’s 2019 budget plan will be postponed.

Out of the US, data are anticipated to show durable goods orders rebounding to grow by 2.0% m/m in August, after contracting by 1.7% in July. Growth in the core measure of durable goods that excludes transportation items is forecast to stand at 0.5% m/m, faster than July’s 0.1%. The prints are due at 1230 GMT, the same time as final Q2 GDP figures which are expected to confirm the annualized pace of growth at 4.2%. Also out at 1230 GMT will be Q2’s final GDP deflator and core PCE prices. Weekly jobless claims data will be hitting the markets at the same time as well, while August’s pending home sales will be released at 1400 GMT.

Numerous policymakers, including Fed chief Powell (2030 GMT), ECB President Draghi (1330 GMT), Bank of England Governor Carney (1400 GMT), and Bank of Canada head Poloz (2200 GMT) will be making public appearances. Also on the agenda are BoE policymaker Haldane (1145 GMT), ECB chief economist Praet (1700 GMT), and Dallas Fed President Kaplan (non-voting FOMC member – 1800 GMT).

Elsewhere, Turkish President Erdogan will be visiting Germany, where he will also meet Chancellor Merkel in an effort to restore ties and improve relations between the two nations; the two will be speaking to reporters tomorrow.

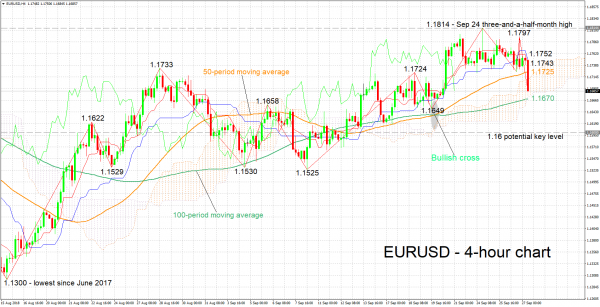

Technical Analysis: EURUSD bearish momentum as pair hits one-week low

EURUSD touched a one-week low of 1.1684 earlier on Thursday, while trading activity continues to take place near this trough. The Tenkan-sen moved below the Kijun-sen, signaling bearish momentum.

Stronger-than-expected German inflation numbers may boost the pair. The region from 1.1714 to 1.1752 includes the Ichimoku cloud top, the current level of the 50-period moving average line, and the Tenkan- and Kijun-sen lines, and may thus prove of significance, acting as resistance to gains. Further above, the area around the three-and-a-half-month high of 1.1814 would increasingly come into view.

On the downside and in case of a data miss, immediate support could occur around the 100-period MA at 1.1670; this is where the Ichimoku cloud bottom lies too. Steeper losses would bring into focus the zone around the 1.16 round figure which was congested between late August to mid-September.

Italian budget developments can well move the pair as well, while it should be kept in mind that US data are due later in the day.