Dollar suffered a brief knee-jerk selloff after Fed raised interest rate as widely expected but stopped calling monetary policy as accommodative. But the greenback recovered as the overall announcement wasn’t dovish at all. There were indeed more hawkish elements in the details of the new economic projections. For now, the greenback is the second strongest one for the week after Sterling. For today, the overall markets are rather mixed, except that Canadian Dollar is clearly suffering due to deadlock in NAFTA negotiations. Sterling also turned softer. Euro and Yen are trading as the strongest ones in Asia.

In other markets, DOW closed down -0.40% after last hour selling. S&P 500 lost -0.33% and NASDAQ dropped -0.21%. Treasury yields dropped quite notably with 10 year yield down -0.041 at 3.061. 30 year yield was down -0.042 at 3.191. Both were rejected quite heavily by 3.115 and 3.255 key resistance levels respectively. In Asian, Nikkei is trading down -0.65%, Hong Kong HSI down -0.45% and China Shanghai SSE down -0.39%. Singapore Strait Times bucks the trend and is up 0.49%. Gold continues to gyrate in range of 1187.58/1214.30.

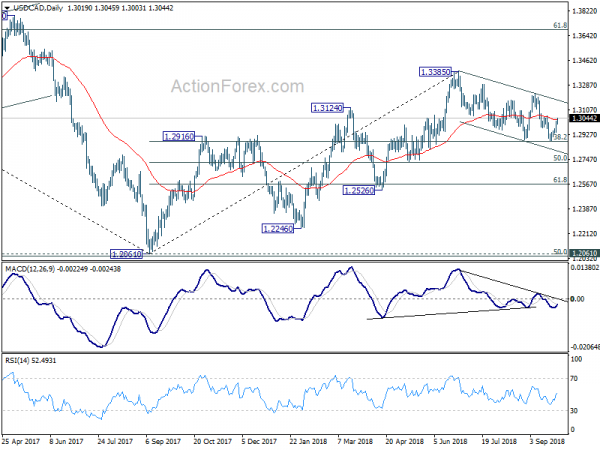

Technically, the most notable development is USD/CAD’s strong break of 1.2975 resistance yesterday. Key fibonacci level at 1.2879 was defended. Immediate focus in on 1.3063 and break will pave the way to 1.3225 resistance next. Yen is a currency to watch today as USD/JPY lost much momentum after failing to hit 113.17 key near term resistance. Break of 112.39 minor support will bring deeper pull back in USD/JPY and could drag down other Yen crosses. Meanwhile, Dollar is staying in range against Euro, Sterling and Australian Dollar. 1.1723 minor support in EUR/USD, 1.3042 in GBP/USD and 0.7228 in AUD/USD need to be broken to prove Dollar’s bullish momentum.

More hawkish elements in Fed’s projections than not

Fed raised federal funds rate by 25bps to 2.00-2.25% overnight as widely expected, by unanimous vote. The accompanying statement was largely dubbed from the previous meeting. But Fed no longer mentioned policy as “accommodative” and that’s a factor triggering knee jerk selloff in Dollar. Adding to that, based on the new economic projections, the median federate fund rates projection in 2021 is at 3.4%, unchanged from 2020. That is, Fed could stop the rate hike cycle after 2020. This could be a result of forecast of slowdown in GDP growth from 2.0% in 2020 to 1.8% in 2021. Plus, unemployment rate is also projected to rise from 3.5% in 2020 to 3.7% in 2021.

However, the overall new projects do contain more hawkish elements than not. Firstly, the longer run federal funds rate was raised from 2.9 to 3.0. That is, the neutral rate was somewhat lifted. Secondly, for 2019, range of projections changed from 1.9 – 3.6 to 2.1- 3.6. That means, doves are in some ways conceding ground but hawks stayed the same. Fed should be more “firm” on its path for another three hikes next year. Thirdly, range changed from 1.9-4.1 to 2.1 – 3.9. That means doves become less dovish and hawks become less hawkish too. But 3.9 is still way higher (2 more hikes) then median projection of 3.4. Fourthly, long run range was changed from 2.3 – 3.5 to 2.5 – 3.5. That suggests doves also agree to a rise in neutral rate estimate. Another sign that they’re less dovish.

So all in all, Fed’s announcement overnight should be Dollar supportive. And that’s why after initial spike, the greenback quickly recovered. Though, Fed’s message is not strong enough to trigger a sustainable rebound in Dollar yet.

Suggested readings on FOMC:

- Another look at Fed funds rate projections, doves become less dovish

- Fed’s projects to end rate hike after 2020, but long run…

- FOMC Hiked Rate and Removed “Accommodative” Policy Reference

- Is the Fed Funds Rate Now in “Neutral” Territory?

- Fed Raises Rates as Expected; More to Come this Year and Next

- FOMC Review: Gradual Fed Hikes Are Set To Continue

- Fed Recap: Accommodative No More

- Another Exercise In FOMC Verbal Gymnastics

- Fed Raises Rates and No Longer Considers its Policy “Accommodative”

Trump rejected non-existent meeting request of Trudeau, launched fresh personal attacks

Trump “claimed” he rejected one-on-one meeting with Canadian Prime Minister Justin Trudeau on trade. Additionally, Trump launched fresh personal attacks on both Trudeau and the Canadian team. In response, Trudeau shouldered it and pledged to continue work for a good deal for Canada, but be prepared to walk away.

Trump said he turned out the meeting request because “his tariffs are too high, and he doesn’t seem to want to move”, referring to Trudeau apparently. Trump repeated his threat and said “forget about it and frankly we’re just thinking about just taxing cars coming in from Canada”. He stepped up further and said “that’s the motherlode, that’s the big one.”

Additionally, Trump added that “We’re very unhappy with the negotiations and the negotiating style of Canada. We don’t like their representative very much. That’s another personal attack on apparently on Canadian Foreign Minister Chrystia Freeland.

Trudeau spokeswoman Chantal Gagnon said: “No meeting was requested. We don’t have any comment beyond that.” Trudeau himself reiterated “we will keep working as long as it takes to get to the right deal for Canada.” He also emphasized Canada would need to feel confident “about the path forward as we move forward – if we do – on a NAFTA 2.0.”

It’s now clearly more likely then not the Canada-US NAFTA negotiation will slip the US imposed deadline of October 1. It’s reported that the US could publish the text of the agreement with Mexico on Thursday or Friday and move on with the process, without Canada.

Japan PM Abe agreed bilateral talks with US only on goods

Japan and the US agreed to start bilateral trade talks after meeting of Prime Minister Shinzo Abe and Trump. But after the meeting, Abe emphasized that the new framework would only be a Trade Agreement on Goods. It’s not a full Free Trade Agreement that includes investments and services. Both countries pledged in a joint statement to ” respect positions of the other government.”

However, US Trade Representative Robert Lighthizer ignored the position of Japan. He told reporters he’s aiming for a full free trade deal requiring approval by Congress under the “fast track” trade negotiating authority law. Lighthizer added the talks will be handled in two “tranches” targeting an “early harvest” on reducing tariffs and non-tariffs barriers in goods.

In the joint statement, it’s noted that:

- For the United States, market access outcomes in the motor vehicle sector will be designed to increase production and jobs in the United States in the motor vehicle industries; and

- For Japan, with regard to agricultural, forestry, and fishery products, outcomes related to market access as reflected in Japan’s previous economic partnership agreements constitute the maximum level.

NZD/USD range bound after non-eventful RBNZ rate decision

NZD/USD trades steadily in range after RBNZ kept OCR unchanged at 1.75% as widely expected and delivered no surprise to the markets. Governor Adrian Orr reiterated in the statement that “we expect to keep the OCR at this level through 2019 and into 2020.” He also kept the options open and indicated the next move could be “up or down”. Economic projections are “little changed” from the August MPS. Even though Q2 GDP was stronger than anticipated, Orr noted “downside risks to the growth outlook remain”. He concluded the statement by repeating “we will keep the OCR at an expansionary level for a considerable period to contribute to maximising sustainable employment, and maintaining low and stable inflation.”

Looking ahead

The economic calendar is rather busy today. German Gfk consumer sentiment and CPI will be featured in European session. Eurozone will release confidence indicators and M3. ECB will release economic bulletin. Later in the day, US will release trade balance, wholesale inventories, durable goods, jobless claims, pending home sales and Q12 GDP final.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2969; (P) 1.2997; (R1) 1.3050; More…

USD/CAD’s strong rebound and break of 1.2975 support turned resistance suggests that fall from 1.3225 has completed at 1.2883 already. Also, 1.2879 key fibonacci level remains intact and thus, we’re staying bullish in the pair. That is, larger rise from 1.2061 is expected to resume after consolidation from 1.3385 completes. Intraday bias is back on the upside for 1.3063 resistance first. Break will target 1.3225 key near term resistance. On the downside, however, break of 1.2971 minor support will turn focus back on 1.2879 fibonacci level.

In the bigger picture, focus is back on 38.2% retracement of 1.2061 to 1.3385 at 1.2879 key fibonacci level. As long as it holds, rise from 2017 low at 1.2061 is still in progress. Break of 1.3384 should target 61.8% retracement of 1.4689 (2015 high) to 1.2061 (2017 low) at 1.3685. However, sustained break of 1.2879 will dampen his bullish view and turn focus back to 61.8% retracement at 1.2567, which is close to 1.2526 support.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | RBNZ Official Cash Rate | 1.75% | 1.75% | 1.75% | |

| 06:00 | EUR | German GfK Consumer Confidence Oct | 10.6 | 10.5 | ||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Aug | 3.80% | 4.00% | ||

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 09:00 | EUR | Eurozone Business Climate Indicator Sep | 1.39 | 1.22 | ||

| 09:00 | EUR | Eurozone Economic Confidence Sep | 111.5 | 111.6 | ||

| 09:00 | EUR | Eurozone Industrial Confidence Sep | 5.2 | 5.5 | ||

| 09:00 | EUR | Eurozone Services Confidence Sep | 15.3 | 14.7 | ||

| 09:00 | EUR | Eurozone Consumer Confidence Sep F | -2.5 | -2.9 | ||

| 12:00 | EUR | German CPI M/M Sep P | 0.20% | 0.10% | ||

| 12:00 | EUR | German CPI Y/Y Sep P | 2.00% | 2.00% | ||

| 12:30 | USD | Advance Goods Trade Balance (USD) Aug | -70.6B | -72.0B | ||

| 12:30 | USD | Wholesale Inventories M/M Aug P | 0.30% | 0.60% | ||

| 12:30 | USD | GDP Annualized Q2 T | 4.20% | 4.20% | ||

| 12:30 | USD | GDP Price Index Q2 T | 3.00% | 3.00% | ||

| 12:30 | USD | Durable Goods Orders Aug P | 1.50% | -1.70% | ||

| 12:30 | USD | Durables Ex Transportation Aug P | 0.30% | 0.10% | ||

| 12:30 | USD | Initial Jobless Claims (SEP 22) | 208K | 201K | ||

| 14:00 | USD | Pending Home Sales M/M Aug | -0.20% | -0.70% | ||

| 14:30 | USD | Natural Gas Storage | 64B | 86B |