The global financial markets react little to the highly expected win of pro-EU centrist Emmanuel Macron’s in the French presidential election. Euro trades generally lower with Swiss franc as the expectation became news. Dollar on the other hand, trades mildly higher. Strength in the greenback is mildly overwhelmed by New Zealand dollar. The Kiwi is lifted on expectation that RBNZ would sound more upbeat in this week’s policy statement. Canadian Dollar follows as oil price stabilized after last week’s steep selloff. Meanwhile, Aussie is weighed down by weaker than expected import growth in China.

Macron to work on EU and modernizing French economy

Centrist independent Emmanuel Macron has won the French presidential election in a decisive victory. With virtually all votes counted, Macron has taken 66% of votes in the second round runoff, compared with far-right populist Marine Le Pen’s 34%. Macron is pro-EU but believes some changes are needed to make the institution strong. As he suggested in an interview prior to the election, ‘I propose to restore the credibility of France in the eyes of Germany, to convince Berlin in the next six months to adopt an active investment policy and move towards greater solidarity in Europe’.

On the economy and the labor market, Macron’s plan in modernization of the economy includes an investment program focusing on the digital economy and environmental protection. Transformations of the health care system and housing policies are also in his agenda. The next event in France is the Parliamentary election scheduled in June. Only with a parliamentary majority would the new President be able to fully implement his political agenda and designate his own PM and cabinet members.

More in Macron Becomes French President In Landslide Victory

China exports and imports grew less than expected

China trade surplus widened to USD 38.1b in April, up from USD 23.9b and beat expectation of USD 35.3b. However, exports rose merely 8.0% yoy while imports rose 11.9% yoy. Both fell short of expectation of 10.4% yoy and 18.0% yoy respectively. In Yuan terms, trade surplus widened to CNY 262b, up from CNY 164b and beat expectation of CNY 197b. The data showed softening domestic demand that weighed down imports. There would likely be more downward pressure with the government’s tightening policies.

Looking ahead for today, Germany will release factory orders while Eurozone will release Sentix investor confidence. Canada will release housing starts. US will release labor market conditions index.

RBNZ and BoE to highlight the week

For the week ahead, RBNZ and BoE meetings on Thursday are the major focuses. RBNZ is widely expected to keep the OCR unchanged at 1.75%. While headline inflation in New Zealand has reached the 2% target sooner than expected, RBNZ is still expected to stand pat throughout the year. The timing of rate hike, based on current development, though, could be pulled ahead to mid to late 2018. We’d look for sign that RBNZ is sounding more neutral and relieved in the accompany statement.

In BoE’s "Super Thursday", rate decision, minutes and the quarterly Inflation Report will be released. BoE is widely expected to keep interest rate unchanged at 0.25% and the asset purchase size at GBP 435b. The are two particular things to note in the announcements. Firstly, Kristin Forbes will likely continue to vote for rate hike this month. Her view represents the camp in the MPC that is getting more impatient with inflation. The voting and minutes could show who else would be joining her. Secondly, adjustments in growth and inflation forecast would provide hints on timing of a hike by BoE .

Here are some highlights for the week ahead:

- Tuesday: Australia retail sales; Swiss unemployment rate; German industrial production, trade balance; Canada building permits

- Wednesday: BoJ summary of opinions; China CPI and PPI; Japan leading indicators; US import price

- Thursday: RBNZ rate decision; Japan current account, Eco Watcher sentiment; Swiss CPI; ECB bulletin; BoE rate decision; UK productions, trade balance; US PPI, jobless claims

- Friday: New Zealand manufacturing index; Germany GDP, Eurozone industrial production; US CPI, retail sales, U of Michigan sentiment

EUR/JPY Daily Outlook

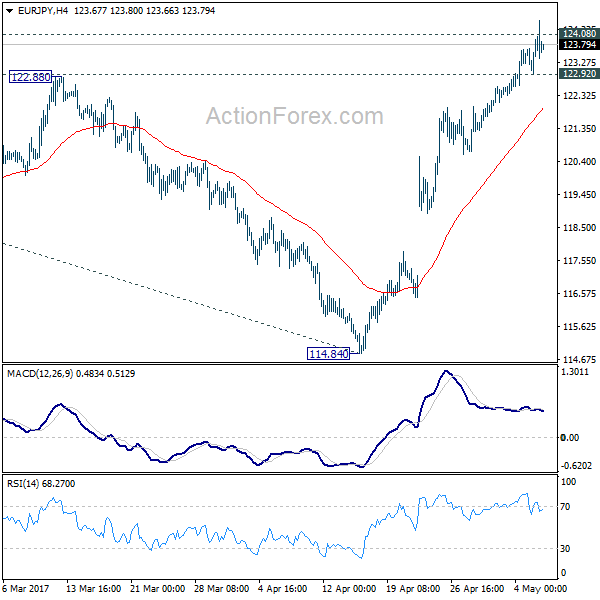

Daily Pivots: (S1) 122.85; (P) 123.25; (R1) 123.91; More…

EUR/JPY edges higher to 124.48 earlier today but quickly retreats. With 122.92 minor support intact, intraday bias stays on the upside for the moment. Firm break of 124.08 key resistance will confirm resumption of whole rise from 109.20. In that case, EUR/JPY would target 126.09 resistance first. Break there will pave the way to 100% projection of 109.03 to 124.08 from 114.84 at 129.89. On the downside, below 122.92 minor support will turn bias neutral and bring retreat first.

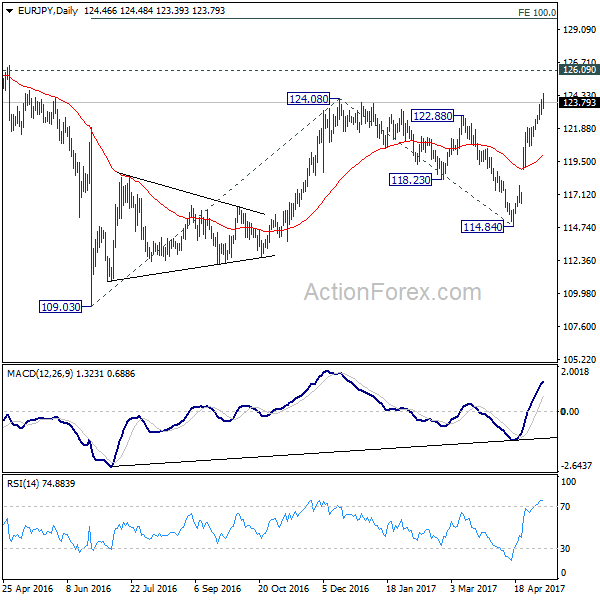

In the bigger picture, focus is back on 126.09 support turned resistance. Decisive break there will confirm completion of the down trend from 149.76. And in such case, rise from 109.20 is at the same degree and should target 141.04 resistance and above. Meanwhile, rejection from 126.09 and break of 114.84 will extend the fall from 149.76 through 109.20 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| EUR | Second and Final Round of French Presidential Election | |||||

| 1:30 | AUD | Building Approvals M/M Mar | -13.40% | -4.00% | 8.30% | 8.90% |

| 1:30 | AUD | NAB Business Confidence Apr | 13 | 6 | ||

| 3:25 | CNY | Trade Balance USD Apr | 38.05B | 35.3B | 23.9B | |

| 3:25 | CNY | Trade Balance CNY Apr | 262B | 197B | 164B | |

| 5:00 | JPY | Consumer Confidence Index Apr | 43.2 | 44.3 | 43.9 | |

| 6:00 | EUR | German Factory Orders M/M Mar | 0.70% | 3.40% | ||

| 8:30 | EUR | Eurozone Sentix Investor Confidence May | 25.2 | 23.9 | ||

| 12:15 | CAD | Housing Starts Apr | 220.0k | 253.7k | ||

| 14:00 | USD | Labor Market Conditions Index Change Apr | 0.4 |