US stocks ended the day lower after conflicting reports about Deputy Attorney General Rod Rosenstein’s future at the Department of Justice. Various reports suggested he had been fired while others suggested he had resigned following last week’s bombshell report about him secretly recording US President, Donald Trump. Investors were worried that his exit would leave the country in a constitutional crisis, which would affect the current growth. The Dow ended the day lower by 190 points.

The yen continued sliding against the US dollar after the BOJ released its minutes for the previous meeting. The minutes showed that a few officials are concerned about the dangers of the ongoing ultra-easy policies. The bank has retained negative interest rates for years in a bid to increase activity in the country. In all this, the biggest casualty has been the banks, which have been forced to offer loans at ultra-low interest rates. Others in the committee were worried that the bank could trigger a rise in long-term interest rates because of last month’s decision to allow the rates to move above 0.2%. Officials expect the inflation rate to rise slowly to the 2% target. With this talk, there is a likelihood that the BOJ will start tightening or talking about tightening in 2019.

The dollar index rose slightly during the Asian session as traders waited for the decision by the Federal Reserve. The bank will release its interest rate decision tomorrow. Many expect this to be a major event because it will send signals about a December rate hike. Previously, the probability of a rate hike in December was higher than 90%. This dropped after the previous meeting and after a series of underperforming data. Today, consumer confidence numbers from the Conference Board will be released. Traders expect the confidence to fall slightly to 132.2. In August, the confidence number was 133.4.

EUR/USD

The EUR/USD pair is trading at 1.1736, which is slightly lower than the yesterday’s close of 1.1814. Nonetheless, the pair has continued the rally that started mid last month. The current price is along the 14 and 28-day EMA while the momentum indicator has crossed the 100 mark. This is an indication that the upward momentum is easing as traders wait for the Fed’s decision tomorrow. Today, it will likely trade between 1.1724 and 1.1815.

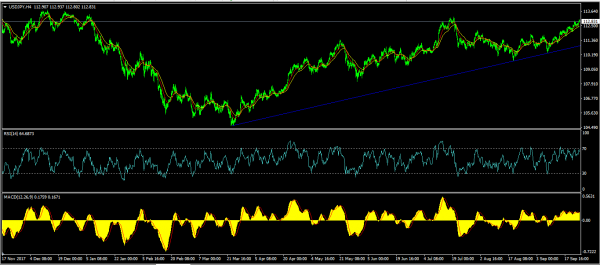

USD/JPY

The USD/JPY pair moved higher during the Asian session after the BOJ minutes. In recent days, the pair has attempted to move above the multi-monthly high of 113.19. The current price of 112.81 is higher than yesterday’s close and above the important support shown below. The RSI has been above 65 in the past week and the price is slightly above the 28 and 14-day EMA, with the MACD moving sideways above the neutral line. This is an indication that traders will continue to wait and see what the Fed decision will be.

USD/CHF

Last week, the USD/CHF pair fell to a multi-month low of 0.9540. After the decision by the Swiss National Bank, the pair started moving up and today, it reached an intraday high of 0.9664 during the Asian session. The upward movement is gaining momentum as shown by the momentum indicator below. This is an indication that the pair will likely continue the upward momentum until it tests the important resistance level of 0.9700.