Euro surged broadly last week and led European majors higher on expectation that pro-EU centrist Emmanuel Macron will have an easy win in French presidential election this Sunday. Traders seemed to have ignored the news about hacking attack on Macron’s campaign. With 20 pt lead over EU-sceptic far-right Marine Le Pen, there should be enough safety margin for Macron. The focus is now on the reactions in that markets on the results during the initial part of next week. As Macron’s win should be well priced into the markets, there is prospect of a setback in Euro after the facts. However, judging from the strength in European indices, it’s believed that there is solid underlying optimism in the European economy. And, strategy could indeed be "buy-pull-back" rather that "sell-on-news".

CAC acclerated to 9 year high

French CAC 40 surged strongly to close at 5432.40 last week, up 203.85 pts for the week, or 3.9%, at the highest level in more than 9 years. The strength is even more impressive comparing e to the close at 5059.20 two Fridays ago, just before the first round of election. CAC is clearly staying in medium term up trend holding well above rising 55 day EMA. Momentum was also strong as seen in the upside acceleration in daily MACD. Overbought condition in daily RSI could limit upside potential in near term. But as long as 5261.73 support holds, the up trend is still in health state to extend higher.

DAX hits record too

German DAX also jumped to record high at 12716.89, up 281.1 pts, or 2.2%. Similar to CAC, it’s in healthy medium term up trend, staying solidly above rising 55 day EMA. Overbought condition in daily RSI could limit upside in near term. But overall, the in dice is expected to extend the record run ahead.

Euro solid against Swiss, Yen, Aussie and Loonie

Against other major currencies, Euro’s strength is admittedly uncertain against Sterling as seen in EUR/GBP. EUR/USD‘s rise from 1.0339 are still viewed as a corrective move. However, the common currency has been solid against others and showed sign of further strength in crosses.

EUR/CHF‘s recent rise indicates medium term bottoming at 1.0629 after defending 38.2% retracement of 0.9771 to 1.1198 at 1.0653 again. And the long term correction from 1.1198 should have finished too. We’d looking at a firm break of 1.0897 resistance in near term to finally establish medium term momentum.

The picture in EUR/JPY is even clearer with the correction from 124.08 completed with three waves down to 114.84. Impulsive nature of the rise from 114.84 affirmed the view that it’s resuming whole rise from 109.03. 124.08 level might provide some resistance initial. But we’d expect a break there to 126.09 key resistance at least. There is prospect of extending the rally to 100% projection of 109.03 to 124.08 from 114.84 at 129.89.

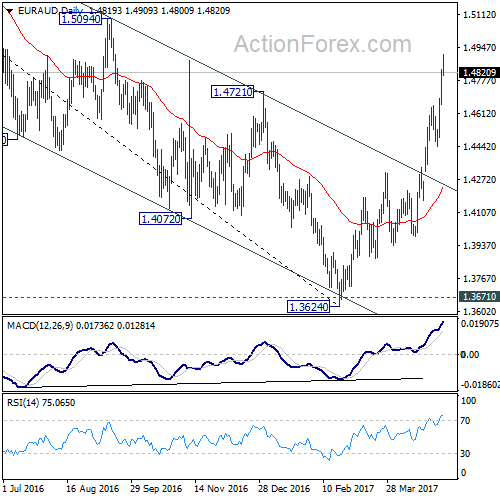

EUR/AUD‘s strong rally and firm break of 1.4721 resistance also confirms trend reversal. That is, the correction from 1.6587 has completed at 1.3624 after defending 1.3671 key support level. Further rally should be seen to 61.8% retracement of 1.6587 to 1.3624 at 1.5455.

EUR/CAD’s strong rise last week should also confirm completion of the correction from 1.6103, with three waves down to 1.3782. Further rally should be seen through 1.5279 resistance to retest 1.6103 in medium term.

EUR/GBP to look into BoE Super Thursday

EUR/GBP stayed in right range last week and it’s uncertain whether the corrective move from 0.9304 is still heading lower. But the direction should be determined in the coming weeks. BoE will have another Super Thursday this. The pound was first lifted this year as one MPC member Kristin Forbes voted for a rate hike in BoE policy meeting. Sterling was then given another boost after Prime Minister called for a snap election on June 8, ahead of formal Brexit negotiation with EU. Market’s eyes will be on the updated economic projections to be published in the quarterly inflation report. In particular, any updated inflation forecasts would give the Pound a boost.

Dollar to shy from spotlight

Dollar is not having a very clear direction for now. Weakness in the dollar index was mainly due to Euro’s strength and that was some what countered by weakness in yen. Fed’s policy path for the year is clear. Markets are pricing in more than 70% chance of a rate hike in June. Fed is expected to raise interest rates a total of three times this year and then start shrinking the balance sheet. Last week’s FOMC statement and non-farm payroll provided little change to such expectation. The greenback would likely shy away from spotlight in near term.

Buy EUR/JPY and EUR/AUD on dips

Regarding trading strategy, we were somewhat correct in calling for buying GBP/JPY and USD/CAD last week. But our strategies were too conservative and with the orders not filled. We’d cancel the strategies first. Instead, we’ll look for opportunity to buy Euro on dip this week is there is a "sell-on-news" pull back. We’d firstly buy EUR/JPY at 121.60, close to 4 hour 55 EMA, with a stop at 120.50, below 120.60 support. Secondly, we’ll also buy EUR/AUD at 1.4660, above 1.4649 support, with stop at 1.4430, below 1.4442 support.

USD/CAD Weekly Outlook

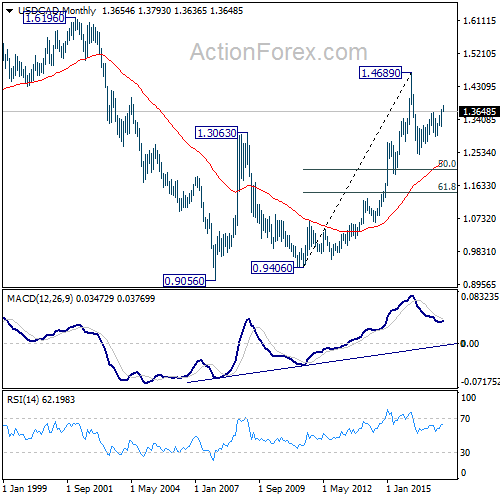

USD/CAD surged to as high as 1.3793 last week but lost momentum ahead of 1.3838 fibonacci level. Choppy rise from 1.2460 is seen as a corrective move. We’d stay cautious on topping at around 1.3838. Focus will also be on 1.3534 resistance turned support. Break there will indicate reversal.

Initial bias in USD/CAD is neutral this week for consolidation first. In case of another rise, we’ll be cautious on topping at around 1.3838 fibonacci level. Meanwhile, consider bearish divergence condition in 4 hour MACD, break of 1.3534 support will argue that rise from 1.2968 is already completed. In such case, intraday bias will be turned back to the downside for 1.3222 support.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. Rise from 1.2460 is seen as the second leg and would end at around 61.8% retracement of 1.4689 to 1.2460 at 1.3838. Break of 1.3222 should indicate the start of the third leg while further break of 1.2968 should confirm. Nonetheless, sustained trading above 1.3838 would pave the way to retest 1.4689 high.

In the longer term picture, rise from 0.9056 (2007 low) is viewed as a long term up trend. It’s taking a breath after hitting 1.4689. But such rise expected to resume later to test 1.6196 down the road.