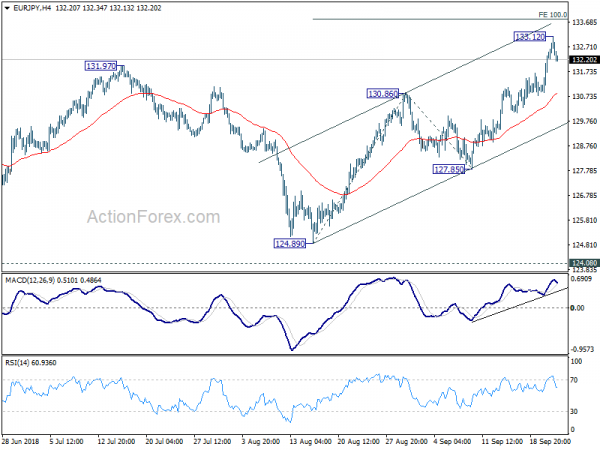

EUR/JPY surged to as high as 133.12 last week before forming a temporary top there and retreated. Initial bias is neutral this week first. Current development suggests that whole corrective fall from 137.49 has completed, ahead of 124.08 key support. Further rise is expected as long as 130.86 resistance turned support holds. On the upside, above 133.12 will target 100% projection of 124.89 to 130.86 from 127.85 at 133.82 first. Break will target 137.49 high. However, firm break of 130.86 will dampen this bullish view and turn focus back to 127.85 support.

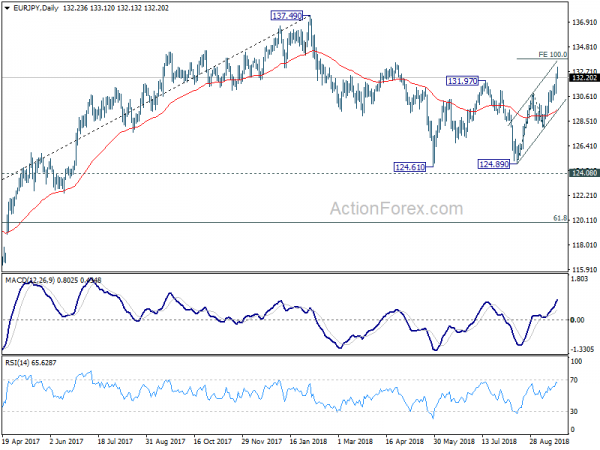

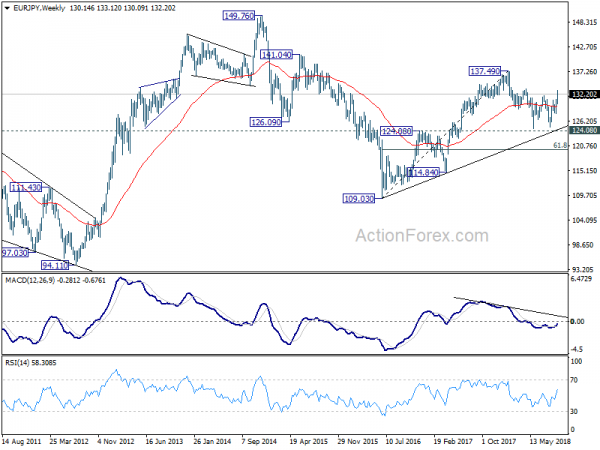

In the bigger picture, current development suggests that EUR/JPY has defended key support level of 124.08 key resistance turned support. And, the larger up trend from 109.03 (2016 low) is still in progress. Firm break of 137.49 will target 141.04/149.76 resistance zone next. This will now be the preferred case as long as 127.85 near term support holds.

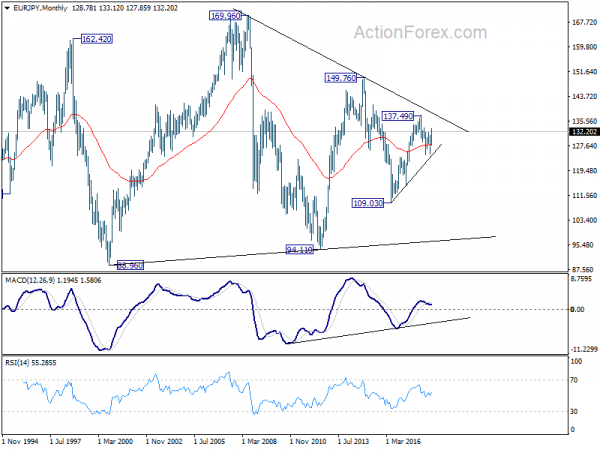

In the long term picture, at this point, EUR/JPY is staying in long term sideway pattern, established since 2000. Rise from 109.03 is seen as a leg inside the pattern. As long as 124.08 support holds, further rally is in favor in medium to long term through 149.76 high. However, break of 124.08 could extend the fall through 109.03 low instead.