The new round of tariffs on China’s imports to the US was finally formalized. Dollar got a brief lift but there was no further buying. The impacts on the markets quick faded and what’s next will depend on China’s counter-measures, which were already spelled out long ago. In the currency markets, major pairs and crosses are bounded yesterday’s range at the time of writing. Yen is notably the weaker one while Australian Dollar and New Zealand Dollar are the strongest ones.

Asian stocks are pretty calm in reaction to the trade war escalation. Indeed, at the time of writing, Nikkei is trading up over 1.5%, with solid buying throughout the day. Hong Kong HSI is down -0.74% while Singapore Strait Times is down -0.58%. China Shanghai SSE is down just -0.12% at 2648.5. Key support level at 2638 (2016 low) is still safe, even though it’s vulnerable. Gold lost 1200 again but is holding firm in range of 1187.58/1214.30 and maintains near term bullishness. USD/CNH (offshore Yuan) edged higher to 6.8930 earlier today but there is no follow through buying to push it through 6.8959 minor resistance yet.

Technically, GBP/USD and GBP/JPY are extending recent rally while USD/CHF is also extending recent fall. Euro is still in range in EUR/USD and EUR/JPY. Respective levels at 1.1733 and 131.00 need to be taken out to indicate rise resumption. AUD/USD, USD/CAD and USD/JPY are stuck in familiar range.

USTR announced 10% tariffs on Chinese imports, to increase to 25% on Jan 1 2019

US Trade Representative finally announced the tariffs on USD 200B of Chinese imports, effective September 24, 2018. The initial tariff rate is 10%. Staring January 1, 2019, the tariff rate will be increased to 25%. The list of products covers 5745 lines of the original 6031 lines proposed back in July 10. 297 lines were fully or partially removed from the list. Products include consumer electronics, certain chemical inputs for manufactured goods, textiles and agriculture; certain health and safety products such as bicycle helmets, and child safety furniture such as car seats and playpens.

The tariffs were part of the follow-up actions on Section 301 investigations. China’s unfair trade practices were repeated in the statement. These include, forced technology transfer, depriving UA companies to set market based terms in negotiations, unfairly facilitating systematic investment in acquisition of US technology companies, and cyber intrusions to US commercial computer networks for valuable business information.

Trump warned in a statement that new round of tariffs on around USD 267B of additional imports will be pursued if China retaliates. He added that “we have been very clear about the type of changes that need to be made, and we have given China every opportunity to treat us more fairly.” “But, so far, China has been unwilling to change its practices.”

Responses on tariffs: Trump did not heed American warnings

Here are some responses from the industry on Trump’s tariffs on China:

The U.S. Chamber of Commerce president and CEO Thomas Donohue said in a statement, “today’s decision makes clear that the administration did not heed the numerous warnings from American consumers and businesses about rising costs and lost jobs on Main Street, in factories, and on farms and ranches across the country. ”

Dean Garfield, president of the Information Technology Industry Council said in a statement, “President Trump’s decision to impose an additional $200 billion is reckless and will create lasting harm to communities across the country.”

Hun Quach, the Retail Industry Leaders Association’s s vice president for international trade said in a statement, “we are extremely discouraged by the Administration’s announcement to levy tariffs on millions of products American consumers buy every day.” “We are disappointed to see that warnings from importers and exporters representing every sector of the U.S. economy have not been heeded with no time for mitigation.”

Jay Timmons, National Association of Manufacturers (NAM) President and CEO, said in a statement “more U.S. tariffs and Chinese retaliation risk undoing that progress and moving our economy in the wrong direction.” “Now is the time for talks—not just tariffs”.

China CSRC Fang: Trump’s tactic won’t work with China

Fang Xinghai, vice chairman of the China Securities Regulatory Commission (CSRC) criticized that the Trump’s new round of tariffs on China has “poisoned” the atmosphere for negotiations. Fang also warned that “President Trump is a hard-hitting businessman, and he tries to put pressure on China so he can get concessions from our negotiations. I think that kind of tactic is not going to work with China.” Also, according to Fang, “if he puts tariffs on all Chinese exports to the United States – which he says he will – even in that scenario, the negative impact on China’s economy is about 0.7 percent.”

Separately, the South China Morning Post in Hong Kong reported, citing unnamed source, that China will not send delegation to the US for more trade talks after the new round of tariffs.

All in all, what’s next will depend on the outcome of Vice Premier Liu He’s meeting in Beijing on the issue.

Canada Trudeau on NAFTA: Might be days or weeks away … it might not be

Canadian Foreign Minister Chrystia Freeland said yesterday that she will go to Washington again for more NAFTA talks this week. But the data is not fixed yet. She told reporters “we agreed we would continue to talk in Washington later this week … there are some conversations it’s better to have face-to-face and I think it’s absolutely the right thing for us to meet this week.” But no details were given.

Prime Minister Justin Trudeau indicated again that he’s prepared if NAFTA talks breaks down. He said “We’re not there yet … we might be days or weeks away now, it might not be.” And he insisted in protecting “supply management” which is one of the deadlock in the negotiations. The so-called supply management system of import tariffs and production limits that ensure high prices for dairy, egg and poultry product in Canada.

RBA minutes reiterated no strong case for near term rate move

The minutes of September 4 RBA meeting provided practically no surprise at all. most importantly, RBA reiterated that “the next move in the cash rate would more likely be an increase than a decrease.” However, “there was no strong case for a near-term adjustment in monetary policy.”

RBA also noted that a few global central banks including the Fed were expected to continuing rate hikes. This had been reflected in the markets, “most notably a broad-based appreciation of the US dollar” that “raised risks” for some, especially for “fragile emerging” markets. However, “the modest depreciation of the Australian dollar was helpful for domestic economic growth.”

The central bank also noted that there were “still significant tensions around global trade policy” that represented a “material risk” to the global outlook.

Also from Australia, house price index dropped -0.7% qoq in Q2, matched expectations.

Looking ahead

The economic calendar is not too busy today. Canada manufacturing sales and US NAHB housing index will be featured.

AUD/USD Daily Outlook

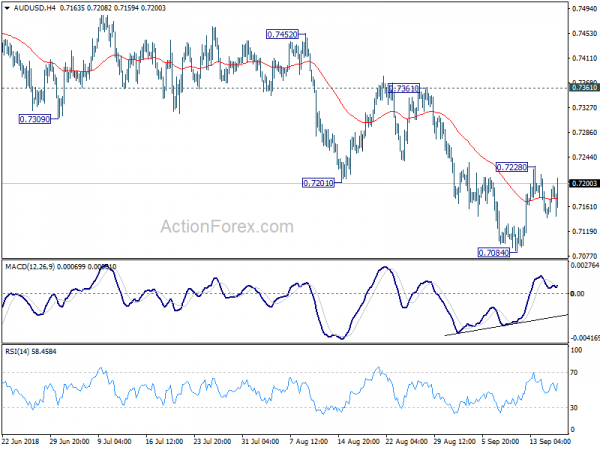

Daily Pivots: (S1) 0.7148; (P) 0.7172; (R1) 0.7203; More…

AUD/USD is staying in range of 0.7084/7228 and intraday bias remains neutral. Outlook is unchanged that rebound from 0.7084 short term bottom could extend through 0.7228. But it’s seen as a correction and upside should be limited well below 0.7361 resistance to bring down trend resumption. On the downside, break of 0.7084 will resume the fall from 0.8135 for key support level at 0.6826. However, sustained break of 0.7361 will carry larger bullish implication.

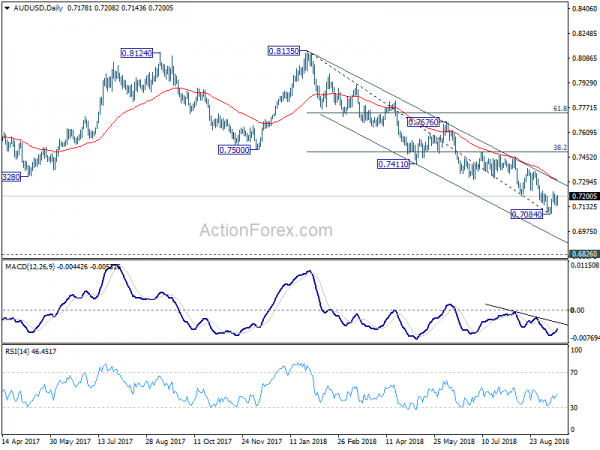

In the bigger picture, rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Fall from there would extend to have a test on 0.6826. There is prospect of resuming long term down trend from 1.1079 (2011 high). Current downside momentum as seen in daily and weekly MACD support this bearish case. Firm break of 0.6826 will target 0.6008 key support next (2008 low). On the upside, break of 0.7361 resistance, however, argues that a medium term bottom is possibly in place, and stronger rebound could follow. We’ll assess the medium term outlook later if this happens.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | House Price Index Q/Q Q2 | -0.70% | -0.70% | -0.70% | |

| 01:30 | AUD | House Price Index Y/Y Q2 | -0.60% | 2.00% | ||

| 01:30 | AUD | RBA Minutes Sep | ||||

| 12:30 | CAD | Manufacturing Sales M/M Jul | 1.00% | 1.10% | ||

| 14:00 | USD | NAHB Housing Market Index Sep | 66 | 67 | ||

| 20:00 | USD | Net Long-term TIC Flows (USD) Jul | 65.1B | -36.5B |