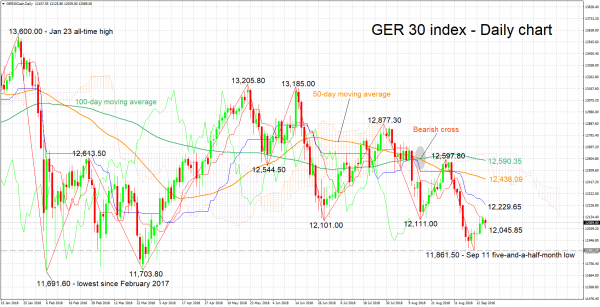

The Germany 30 index lost considerable ground after touching 12,597.80 in late August, this being its highest since August 10. Specifically, it is currently trading roughly 500 points below that peak.

The Tenkan- and Kijun-sen lines are negatively aligned, projecting a bearish short-term picture for the index.

Immediate support to losses may come around the current level of the Tenkan-sen at 12,045.85. The zone around this includes the 12,000 handle that may be of psychological importance. Further below, the region around the five-and-a-half-month low of 11,861.50 hit last week could provide additional support. Lower still, 11,691.60, a nadir last posted in early 2018, and prior to that visited in February 2017, would increasingly come in focus.

On the upside, resistance could occur around the Kijun-sen at 12,229.65, with the attention next turning to the 50-day (simple) moving average at 12,438.09 in case of steeper advances.

In terms of the medium-term outlook, it is looking negative, with trading activity taking place below the 50- and 100-day (simple) MA lines, as well as below the Ichimoku cloud.

Overall, both the short- and medium-term outlooks are looking bearish at the moment.