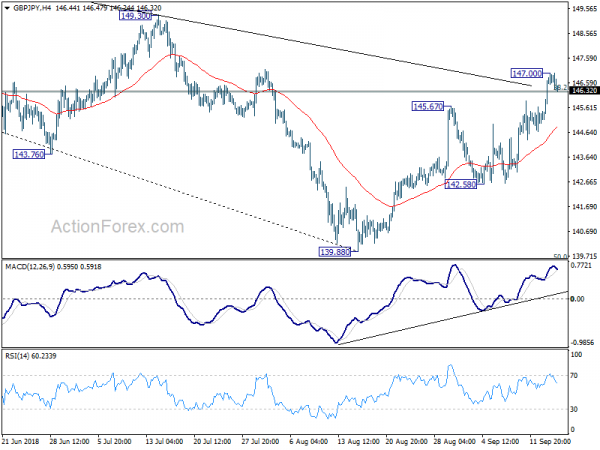

GBP?JPY rose further to as high as 147.00 last week before forming a temporary top there and retreated. Initial bias is neutral this week for some consolidations first. The break of 38.2% retracement of 156.59 to 139.88 at 146.26 and medium term falling trend line argues that whole decline from 156.59 has completed at 139.88, just ahead of 139.29/47 key support zone. Downside of retreat should be contained above 142.58 support to bring another rally. Above 147.00 will target 149.30 key resistance for confirming our bullish view.

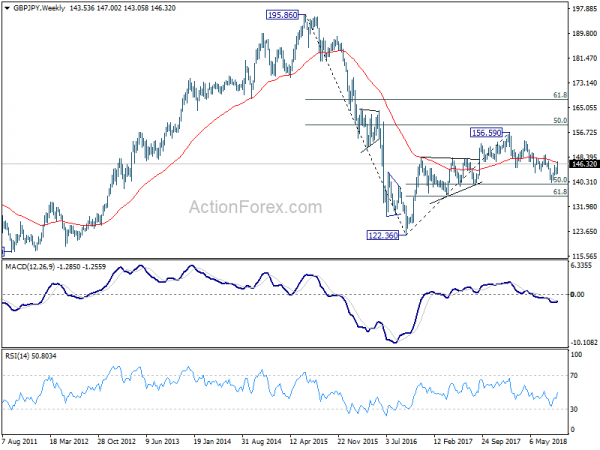

In the bigger picture, as long as 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) holds, the decline from 156.69 is seen as corrective move. That is, rise from 122.36 (2016 low), is still expected to extend higher through 156.69. However, sustained break of 139.29/47 should confirm medium term reversal and turn outlook bearish.

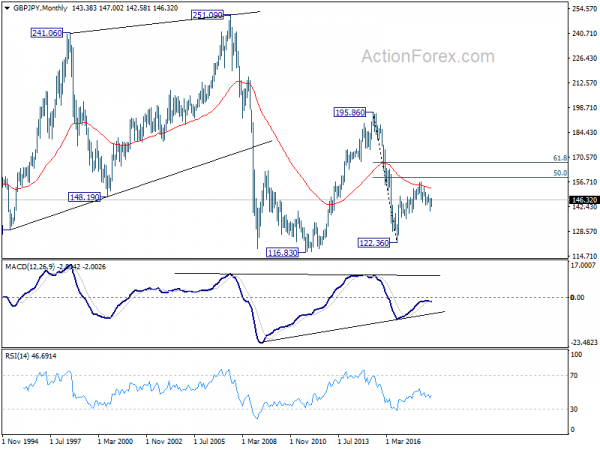

In the longer term picture, the failure to sustain above 55 month EMA (now at 152.74) is mixing up the outlook. Nonetheless, as long as 139.29 holds, rise from 122.36 is in favor to extend to 50% retracement of 195.86 (2015 high) to 122.36 (2016 low) at 159.11, and possibly further to 61.8% retracement at 167.78 before completion. However, firm break of 139.29 will turn focus back to 116.83/122.36 support zone instead.