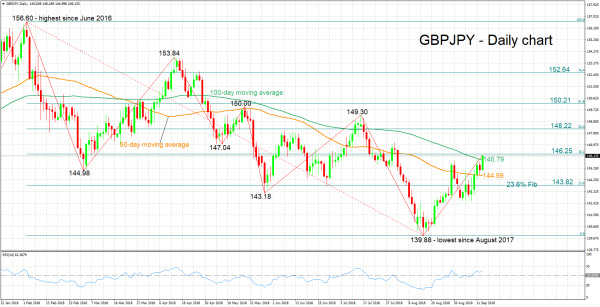

GBPJPY staged a spectacular comeback after falling to its lowest since August 2017 of 139.88 in mid-August. The pair is currently trading more than 600 pips above the aforementioned nadir, having risen to a six-week high of 146.19 earlier on Thursday.

The RSI continues heading higher, serving as a testament of the bullish momentum in the short term.

A more conclusive break above the current level of the 100-day moving average line at 145.79 could meet immediate resistance around the 38.2% Fibonacci retracement level of the downleg from 156.60 to 139.88 at 146.25. Steeper advances would turn the attention to the 50% Fibonacci mark at 148.22.

A move back down may meet support around the 50-day MA at 144.59, with more bearish activity potentially eyeing the zone around the 23.6% Fibonacci level at 143.82 for additional support.

The medium-term outlook remains mostly negative: the pair has been recording lower highs and lower lows from April onwards. However, the considerable gains over the last four weeks are increasingly challenging the bearish market structure in the medium-term. Should the bullish movement continue, and especially if the previous peak of 149.30 is violated to the upside, then that would clearly mark a shift in the pair’s outlook to a positive direction.

Overall, the short-term bias is bullish, while the negative medium-term outlook is becoming increasingly fragile.