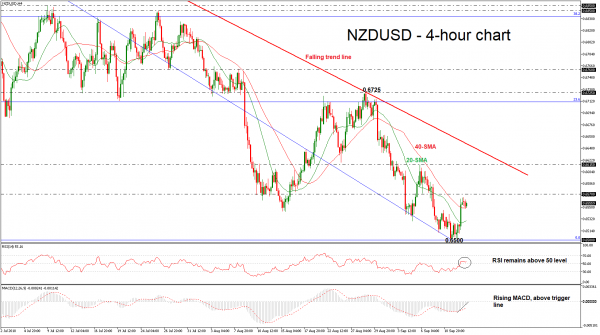

NZDUSD has finally reversed slightly to the upside in the short term following the rebound on the more than two-and-a-half-year low of 0.6500 on Monday. Momentum indicators in the 4-hour chart though are currently supporting that positive momentum is likely to strengthen. Specifically, the MACD is picking up speed near zero line and the RSI continues to hold above the threshold of 50.

Should the price decisively close above the 0.6570 resistance level, bulls could extend the current bullish sentiment towards the 0.6615, reached on September 6. Further advances above this level, could then target the area around the medium-term descending trend line, around 0.6640.

A clear dip below the 20- and 40-simple moving averages (SMAs) would bring the pair lower until the multi-month low of the 0.6500 handle. Such a dip may carry more downside extensions and may open the path towards the next support of 0.6345, marked by the low of January 2016.

In the medium-term, NZDUSD has been trading bearish in the past four months after the pullback on the 0.7390 hurdle.