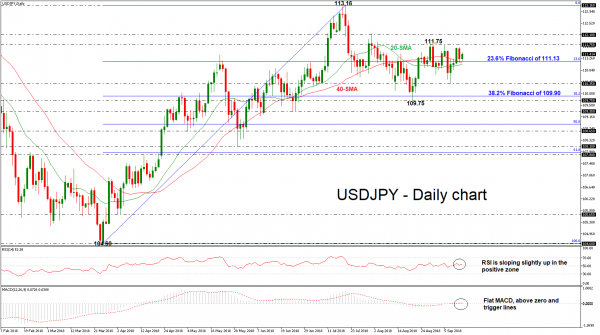

USDJPY has been developing around the 23.6% Fibonacci retracement level of the upleg from 104.60 to 113.16, around the 111.13 barrier over the last three weeks. Moreover, the price holds above the 20- and 40-simple moving averages (SMAs) in the daily timeframe, as well as the technical indicators stand near their neutral levels.

The RSI indicator is sloping slightly to the upside above the threshold of 50, while the MACD oscillator is flattening above the trigger and zero lines. Both are moving with weak momentum in the near term.

A clear attempt below the 23.6% Fibonacci (111.13) and the moving averages could drive the pair until the 110.35 support, taken from the low on September 7. Should traders continue to sell the pair below this level, immediate support could come from the 38.2% Fibonacci of 109.90 before touching the trough of 109.75 achieved on August 21.

On the flip side, a strong bullish movement above the 111.75 key resistance level, could push the pair until the next immediate barrier of 112.10. If the latter fails to halt bullish movements, the next target could be the 113.16 obstacle, where it topped on July 19.

Briefly, the outlook is neutral over the past two months and only a significant close above the 113.16 hurdle could resume the bullish picture. On the other side, a decline below May’s trough of 108.10 could shift the outlook to bearish.