Dollar edged up mildly after a rather uneventful FOMC rate decision. The lift on the greenback was from the fact that Fed tried to talk down Q1’s weakness. And there is no change in the expected rate path for Fed as markets are pricing in over 70% chance of a hike in June. But there was nothing for Dollar bulls to cheer neither. Traders will look into non-farm payroll report from US to be released tomorrow. For the moment, focuses remain on the weakness in Japanese Yen and Australian Dollar. In particular, the latter was dragged down to the lowest level since January by the slump in iron ore prices. Iron ore price started tumbling after Chinese Premier Li Keqiang indicated the plan to cut steel capacity. And based on that, Australia’s export values would probably continue to fall further ahead and there is more downside potential in the Aussie.

Fed said Q1 weakness "transitory"

As widely anticipated, the FOMC left the target range for the Fed funds rate unchanged at between 0.75- 1.00%. Although the accompanying statement was largely unchanged from the previous month, the implications were important in light of the slowdown in the first quarter. While acknowledging the recent weakness in growth and inflation, policymakers attributed it to ‘transitory effects’. The downplaying of 1Q17’s disappointments underpinned the Fed’s determination to carry on its normalization plan. The FOMC maintained its economic outlook and the gradual rate-hike approach. We continue to expect two more rate hikes this year with one coming in June. More in FOMC Sent Important Rate Hike Hint In An Apparently-Uneventful Meeting.

63% debate viewers said Macron the most convincing

In France, pro-EU centrist Emmanuel Macron emerged as the most convincing one in the final pre-election TV debate with EU-sceptic far-right Marine Le Pen. According to a viewers poll by French broadcaster BFMTV, 63% of viewers voted Macron as the "most convincing" of the pair after the debate. Some analysts called the angry exchange in the debate as extraordinarily violent, bitter and harsh. And Le Pen tried to push Macron to make a mistake but he didn’t. According to latest running poll average, Macron is still having 18% lead over Le Pen but that has narrowed mildly. While Macron is widely tipped to be the next French President, some analysts pointed out that Le Pen still have a slim chance of winning if turnout rate happens to be ultra-low. Eyes will now turn to the election this Sunday.

UK PM May accused EU of election interference

In UK, Prime Minister Theresa May accused that "the events of the last few days have shown that – whatever our wishes, and however reasonable the positions of Europe’s other leaders – there are some in Brussels who do not want these talks to succeed." And she complained that "Britain’s negotiating position in Europe has been misrepresented in the continental press. The European Commission’s negotiating stance has hardened. Threats against Britain have been issued by European politicians and officials. All of these acts have been deliberately timed to affect the result of the general election that will take place on 8 June."

Meanwhile, its reported that the so called "divorce" bill for Brexit is raised to EUR 100b for UK. EU’s chief Brexit negotiator Michel Barnier declined to "give any figures today" as "I can’t because I don’t know what the figures are." But he noted that "I cannot accept that term: blank cheque. There was never any question of asking the UK to give us a blank cheque. That would not be serious. All we’re asking for is that the accounts to be cleared for the honoring commitments the U.K. has entered."

RBA Lowe: Surge in household debt lowered economy’s resilience

In Australia, RBA Governor Philip Lowe said that "recent increase in household debt relative to our incomes has made the economy less resilient to future shocks." And he warned that in response to an economic shock, "an otherwise manageable downturn could be turned into something more serious." Regarding interest rate, he said that "at some point, interest rates in Australia will increase." However, he also emphasized that "this is not a signal about the near-term outlook for interest rates in Australia but rather a reminder that over time we could expect interest rates to rise, not least because of global developments."

On the data front…

Australia trade surplus narrowed to AUD 3.11b in March. China Caixin PMI services dropped to 51.5 in April. Eurozone will release services PMI and retail sales. UK will also release services PMI, mortgage approvals and M4. US will release trade balance, non-farm productivity, jobless claims an factory orders. Canada will release trade balance too.

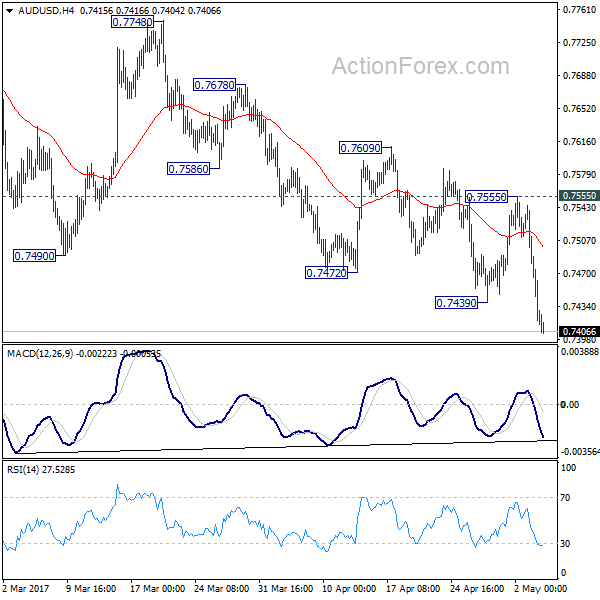

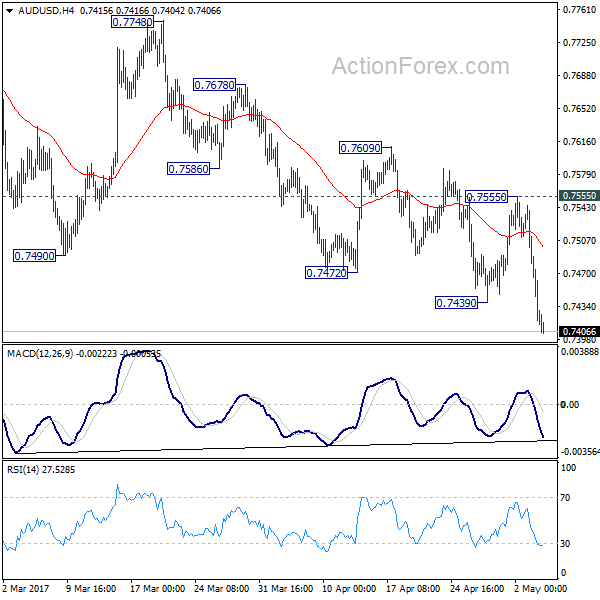

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7379; (P) 0.7462; (R1) 0.7506; More…

AUD/USD’s fall from 0.7158 resumed by taking out 0.7439 and reaches as low as 0.7404 so far. Intraday bias is turned back to the downside for deeper decline. As noted before, rise from 0.7158 has completed at 0.7748 already. Further fall should be seen back to 0.7144/7158 support zone. At this point, there is no clear sign of larger down trend resumption yet. Hence, we’ll be cautious on strong support from 0.7144/58 to contain downside and bring rebound. But, break of 0.7555 resistance is now needed to indicate short term bottoming. Otherwise, outlook will remain mildly bearish in case of recovery.

In the bigger picture, we’re still treating price actions from 0.6826 low as a correction pattern. And, as long as 38.2% retracement of 0.9504 to 0.6826 at 0.7849 holds, long term down trend from 1.1079 is expected to resume sooner or later. Break of 0.6826 low will target 0.6008 key support level. However, firm break of 0.7849 will indicate that rise from 0.6826 is developing into a medium term rebound, rather than a sideway pattern. In such case, stronger rise should be seen to 55 month EMA (now at 0.8118) and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | AUD | Trade Balance (AUD) Mar | 3.11B | 3.33B | 3.57B | |

| 1:45 | CNY | Caixin China PMI Services Apr | 51.5 | 52.6 | 52.2 | |

| 5:45 | CHF | SECO Consumer Confidence Apr | 3 | -3 | ||

| 7:45 | EUR | Italy Services PMI Apr | 53.7 | 52.9 | ||

| 7:50 | EUR | France Services PMI Apr F | 57.7 | 57.7 | ||

| 7:55 | EUR | Germany Services PMI Apr F | 54.7 | 54.7 | ||

| 8:00 | EUR | Eurozone Services PMI Apr F | 56.2 | 56.2 | ||

| 8:30 | GBP | Services PMI Apr | 54.6 | 55 | ||

| 8:30 | GBP | Mortgage Approvals Mar | 67K | 68K | ||

| 8:30 | GBP | M4 Money Supply M/M Mar | 0.20% | -0.30% | ||

| 9:00 | EUR | Eurozone Retail Sales M/M Mar | 0.10% | 0.70% | ||

| 11:30 | USD | Challenger Job Cuts Y/Y Apr | -2.00% | |||

| 12:30 | CAD | International Merchandise Trade (CAD) Mar | 0.3B | -1.0B | ||

| 12:30 | USD | Non-Farm Productivity Q1 P | 0.00% | 1.30% | ||

| 12:30 | USD | Unit Labor Costs Q1 P | 2.60% | 1.70% | ||

| 12:30 | USD | Trade Balance Mar | -44.9B | -43.6B | ||

| 12:30 | USD | Initial Jobless Claims (29 APR) | 246K | 257K | ||

| 14:00 | USD | Factory Orders Mar | 0.60% | 1.00% | ||

| 14:30 | USD | Natural Gas Storage | 74B |