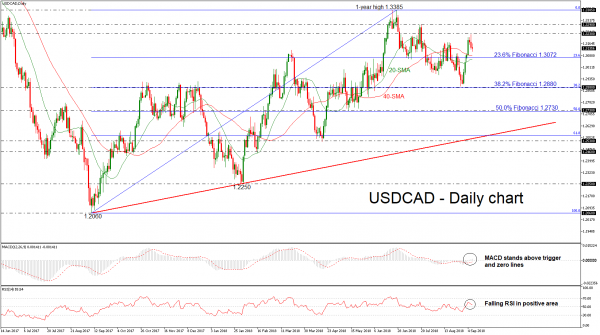

USDCAD has lost its positive momentum over the last couple of days after the bounce on the 1.3230 resistance level. In the short-term, the market could retain its neutral to bearish mode, confirmed by the 20- and 40-simple moving averages which are heading sideways. The RSI indicator is pointing south in the positive territory, while the MACD oscillator holds above its zero and trigger lines but with weak momentum.

An extension to the downside and below the 23.6% Fibonacci retracement level of the upleg from 1.2060 to 1.3385, around 1.3072 could open the door for the 38.2% Fibonacci mark which overlaps with the 1.2880 support. Even lower, the 50.0% Fibonacci near 1.2730 could attract a greater attention as any leg lower could endorse the short-term bearish bias.

On the other side, if the pair manages to jump higher, the immediate resistance level of 1.3230 could be the first stop for the bulls. Above this level the pair could hit the 1.3290 barrier, taken from the high on July 20 before being able to challenge again the one-year high of 1.3385.

In the bigger picture, USDCAD has been developing within an ascending movement over the last year following the rebound on the 1.2060 support hurdle.