US personal income rose 0.3% in July, spending rose 0.4%, both matched expectations. Headline PCE accelerated to 2.3% yoy, up from 2.2% yoy and beat expectation of 2.2%. PCE core also accelerated to 2.0% yoy, up from 1.9% yoy and matched expectation of 2.0% yoy. Core inflation now formally meet Fed’s target.

Initial jobless claims rose 3k to 213k in the week ended August 25, below expectation of 214k. Four-week moving average dropped -1.5k to 212.25k. That’s the lowest level since December 13, 1969. Continuing claims dropped -20k to 1.708m in the week ended August 18. Four-week moving average of continuing claims dropped -4.5k to 1.73125m.

Canada data was slightly less impressive. GDP rose 0.0% mom in June versus expectation of 0.2% mom. For Q2, GDP grew 2.9% annualized, slightly below expectation of 3.0%. Exports was the main driver to Q2’s growth, up 2.9%. Consumer spending growth also rose 0.6%. However, there was deceleration in business investments, contraction in inventories and imports. The set of data doesn’t add any additional reason for BoC to hike in September instead of October.

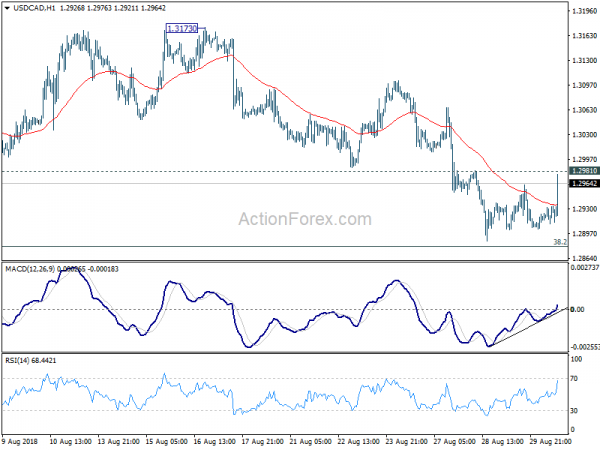

USD/CAD recovers strongly after the release with focus now back on 1.2981 minor resistance Break will bring stronger rebound.