The San Francisco Fed released an interesting economic letter titled “Information in the Yield Curve about Future Recessions” yesterday.

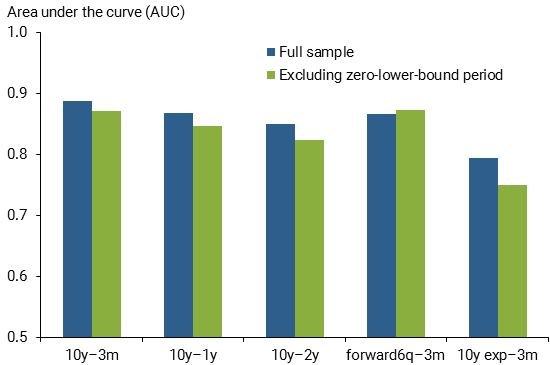

There it’s noted that yield curve inversion has been a “reliable predictor of recessions”. However, the difference between ten-year and three-month Treasury rates is the most useful term spread for forecasting recessions. That is, not the ten-year and two-year yield spread that’s most referred to.

Also, the letter noted that currently, the ten-year and three-month spread is still at a “comfortable distance from a yield curve inversion.” If the paper reflects the norm of FOMC member’s thoughts, the yield curve flattening shouldn’t be much of a curve for keeping rate hikes continue.