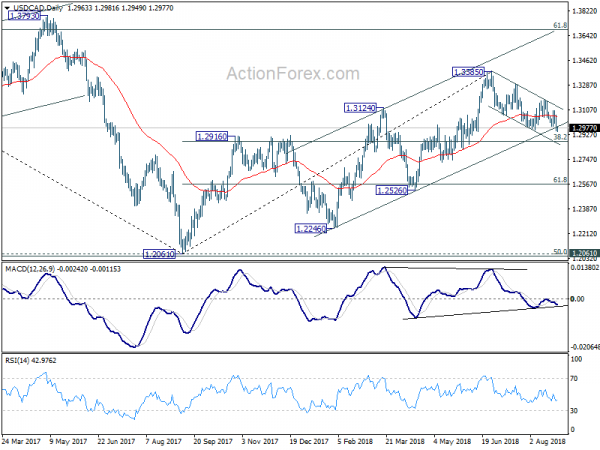

Daily Pivots: (S1) 1.2924; (P) 1.2996; (R1) 1.3039; More…

USD/CAD’s fall from 1.3385 resumed by taking out 1.2961 support. More importantly, the break of medium term channel support how carries some bearish implication. Intraday bias is back on the downside for 1.2879 fibonacci level first. Sustained break there will add to the case of medium term reversal and target next fibonacci level at 1.2567. On the upside, break of 1.3102 resistance is needed to indicate short term bottoming. Otherwise, outlook will now stay bearish in case of recovery.

In the bigger picture, the break of channel support (now at 1.2988), argues that rise from 1.2246, as well as that from 1.2061, has completed at 1.3385. Focus is back on 38.2% retracement of 1.2061 to 1.3385 at 1.2879. Decisive break there will affirm the case of medium term reversal and target 61.8% retracement at 1.2567 and below. That will also put key long term support at 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048 into focus. On the upside, break of 1.3385 will revive the bullish case and target 61.8% retracement of 1.4689 to 1.2061 at 1.3685 and above.