GBP/USD – 1.2892

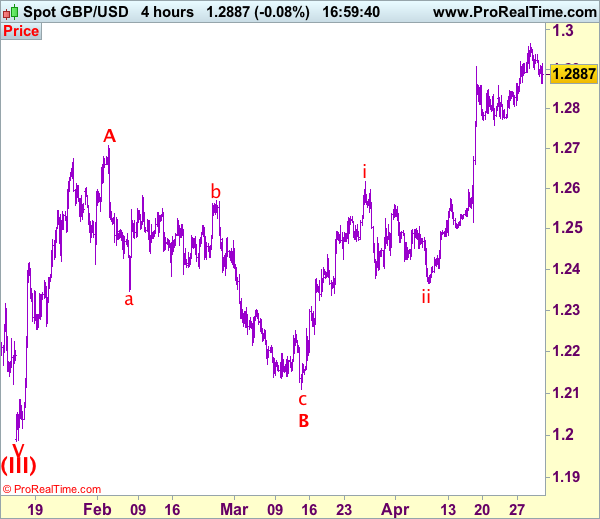

Recent wave: Wave V of larger degree wave (III) has ended at 1.1986 and major correction has commenced from there for gain to 1.3000 and 1.3140-50

Trend: Near term up

Original strategy :

Buy at 1.2850, Target: 1.3000, Stop: 1.2790

Position: –

Target: –

Stop: –

New strategy :

Buy at 1.2770, Target: 1.2960, Stop: 1.2710

Position: –

Target: –

Stop:-

As cable has retreated after rising to 1.2965 late last week, suggesting a minor top is formed there and consolidation below this level would be seen with initial downside bias for correction to 1.2805-10, however, reckon support at 1.2757 would contain downside and bring another rise later, above said resistance at 1.2965 would confirm recent upmove has resumed and extend gain to psychological resistance at 1.3000 but overbought condition should limit upside and 1.3050 and price should falter below 1.3100. We are keeping our view that the wave c as well as larger degree wave B has ended at 1.2109, hence impulsive wave C has commenced from there with wave i of C ended at 1.2616, follow by a correction to 1.2365 (end of wave ii) and wave iii rally is unfolding, hence further gain to indicated upside targets would be seen.

Our preferred count on the daily chart is that cable’s rebound from 1.3500 (wave (A) trough) is unfolding as a wave (B) with A ended at 1.7043, followed by triangle wave B and wave C as well as wave (B) has ended at 1.7192, the subsequent selloff is the larger degree wave (C) which is still unfolding with minor wave (III) of larger degree wave 3 ended at 1.1986, hence wave (IV) correction is in progress which could either be a triangle wave (IV) of a complex formation but upside should be limited to 1.3500 and price should falter well below 1.4000, bring another decline in wave (V) of 3 for weakness to 1.1500, then 1.1200.

On the downside, whilst initial pullback to 1.2845-55 and possibly support at 1.2805 cannot be ruled out, price should stay above support at 1.2757 and bring another rise later. A drop below this level would defer and signal a temporary top is formed instead, risk correction of recent upmove to 1.2700-10 later.