Weekly

• Last Candlesticks pattern: Shooting star

• Time of formation: 03 May 2016

• Trend bias: Down

Daily

• Last Candlesticks pattern: Shooting star

• Time of formation: 3 May 2016

• Trend bias: Sideways

EUR/USD – 1.0908

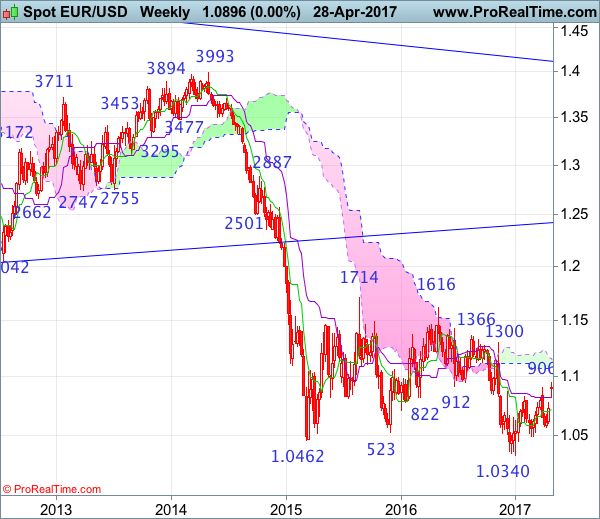

After last week’s gap-up opening and breaking of previous resistance at 1.0906, the single currency has maintained a firm undertone, adding credence to our view that the erratic rise from 1.0340 low is still in progress and may extend further gain, above 1.0951 resistance would bring subsequent rise to 1.1000 and then towards 1.1050-60 but upside should be limited to 1.1100 and price should falter well below previous chart resistance at 1.1300, bring selloff later.

On the downside, whilst initial pullback to 1.0820-25 cannot be ruled out, reckon downside would be limited to previous resistance at 1.0778 and bring another rise later. A daily close below the Kijun-Sen (now at 1.0761) would defer and suggest top is possibly formed, risk test of support at 1.0682 but break there is needed to add credence to this view, bring further fall to the lower Kumo (now at 1.0642). Looking ahead, only break of 1.0600-05 would provide confirmation and suggest the aforesaid rise from 1.0340 has possibly ended, risk test of key support at 1.0570 first.

Recommendation: Buy at 1.0800 for 1.1000 with stop below 1.0700.

On the weekly chart, although the single currency opened higher last week, lack of follow through buying formed a doji candlestick pattern, suggesting the direction is still unclear at the moment, if this week ends with a long white candlestick, this would add credence to our bullish view that low has been formed at 1.0340 earlier and extend this rebound for at least a retracement of recent decline to 1.1000, then test of the lower Kumo (now at 1.1070) but reckon the upper Kumo (now at 1.1161) would limit upside and resistance at 1.1300 should hold, price should falter below strong resistance at 1.1366.

On the downside, although initial pullback to the Kijun-Sen (now at 1.0820) is likely, reckon previous resistance at 1.0778 would limit downside and bring another rise later. A drop below the Tenkan-Sen (now at 1.0723 would risk weakness to 1.0682 support but break of 1.0570 support is needed to abort and signal the aforesaid corrective rise from 1.0340 low has ended instead, then further decline towards key level at 1.0493 would follow.