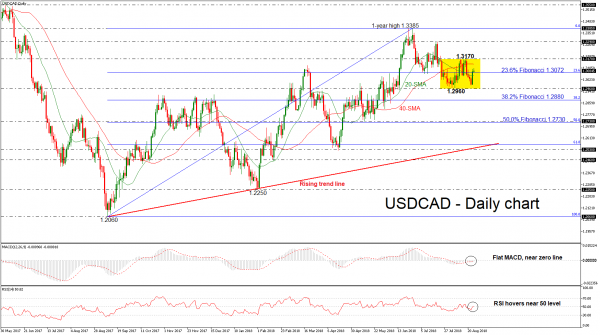

USDCAD is back above the 23.6% Fibonacci retracement level of the upleg from 1.2060 to 1.3385, around 1.3072 but the bias over the last month remains neutral. The pair has been developing within a narrow range with upper boundary the 1.3170 resistance level and lower boundary the 1.2960 support barrier.

In the short-term timeframe, the technical indicators are confirming the neutral bias as both are holding near their mid-levels. The MACD oscillator still stands above the trigger line but near the zero line with weak momentum, while the Relative Strength Index (RSI) is flattening around the threshold of 50. Moreover, the price holds within the 20- and 40-day simple moving averages (SMAs), failing to define a clear trend.

Should the price continue to move slightly higher, immediate resistance could be found around the 1.3170 resistance level, taken from the latest highs on August. An aggressive bullish rally above this area could open the way towards the 1.3290 hurdle and then until the one-year high of 1.3885.

In case of bearish extensions and a drop below the 23.6% Fibonacci (1.3072), the price could challenge the 1.2960 support level. Failure to hold above this level could open the door for the 38.2% Fibonacci region near 1.2880 before attention turns to the 50.0% Fibonacci of 1.2730.

Taking a look at the bigger picture, dollar/loonie has been trading within an ascending price structure since September 2017 and in the weekly timeframe, the price rebounded on the 20-SMA and is now moving higher.