For now, Dollar and Swiss Franc remain the strongest one for today while Australian Dollar stays the weakest. But steep selling is seen in Sterling and Yen, which threaten to overtake Aussie’s place as the worst performing one. It’s unsure what’re the triggers for the selloff up to this moment. It could be a delayed reaction to UK’s no-deal Brexit notice, but we’re not too convinced by that. At the time same, there is no apparent surge in risk appetite or treasury yields. It’ll take us some more time to dig out the causes.

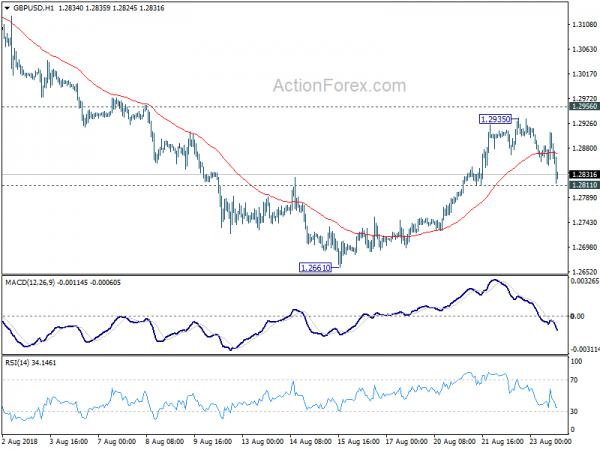

For GBP/USD, focus is now on 1.2811 minor support. Break there will mark the completion of the corrective rebound form 1.2661 at 1.2935. Deeper fall should then be seen back to retest 1.2661 low.

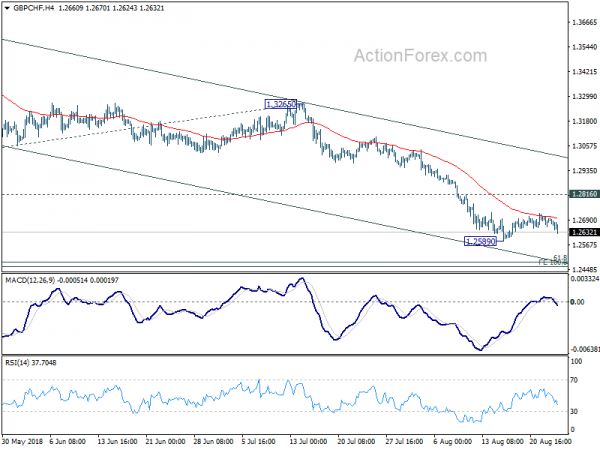

GBP/CHF is rejected by 4 hour 55 EMA and is heading back to 1.2589 temporary low. Break will resume larger fall from 1.3854 to cluster level of 100% projection of 1.3854 to 1.3049 from 1.3265 at 1.2460 and 61.8% retracement of 1.1638 to 1.3854 at 1.2485. We had a GBP/CHF short position as mentioned here. On break of 1.2589, we’ll lower the stop from 1.2820 to 1.2725. Of course, if 1.2589 is not taken out, we’ll keep everything unchanged first and wait.

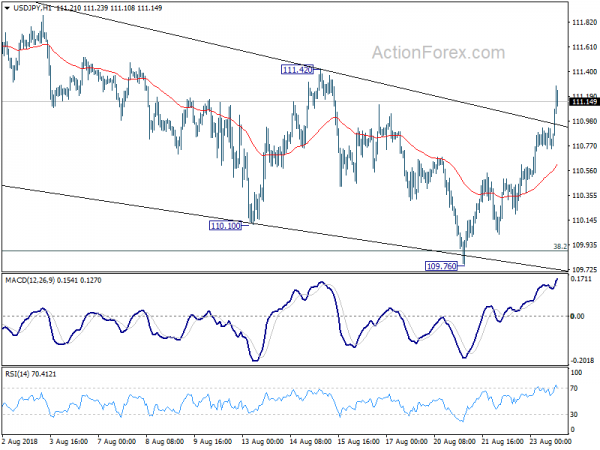

USD/JPY’s break of near term trendline is a sign of bullish reversal. Immediate focus is now on 111.42 resistance. Break will indicate completion of the correction from 113.17 at 109.76. And retest of 113.17 high would then be seen in near term.

So, 1.2811 in GBP/USD, 1.2589 in GBP/CHF and 111.42 in USD/JPY are the levels to watch.

In other markets, European stocks ended a rather dull day nearly flat. FTSE closed down -0.13%, DAX down -0.13% and CAC up 0.00%. Gold continues to press 1187.4 support and struggles to regain 1190. WTI crude oil is firm above 67 after yesterday’s rebound.