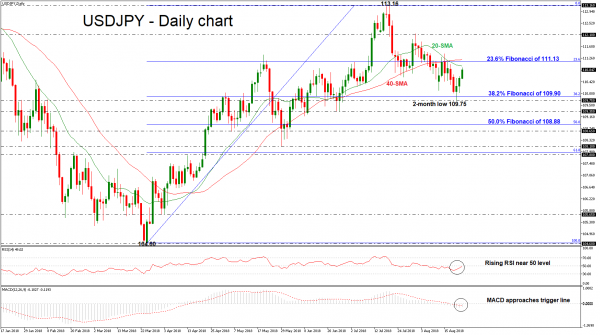

USDJPY reversed higher after touching an almost two-month low of 109.75 on August 21 but remained below the 20- and 40-day simple moving averages (SMAs). Moreover, the technical indicators showed some improvement as well, endorsing the short-term bullish structure, with the RSI edging higher towards its neutral threshold of 50 and the MACD gaining positive momentum to climb above its red-trigger line in the negative zone.

In case of further advances in the price, immediate resistance may be found near the 23.6% Fibonacci retracement level of upleg from 104.60 to 113.16, around 111.13. An upside break of that zone would open the way for the August 1 high of 112.10. If buyers manage to push above that hurdle, that could drive the pair until the 113.16 top, taken from the peak on July 19.

On the other side, if bears retake control, price declines may pause initially near the 38.2% Fibonacci mark of 109.90, which stands slightly above the 109.75 support. A bearish run below this area could take the price further down to 109.35 before it challenges the 50.0% Fibonacci of 108.88.

As regards the long-term picture, USDJPY remains mostly bullish as it holds above the 50-SMA in the weekly chart acting as a sign that the market is more likely to maintain its positive structure.