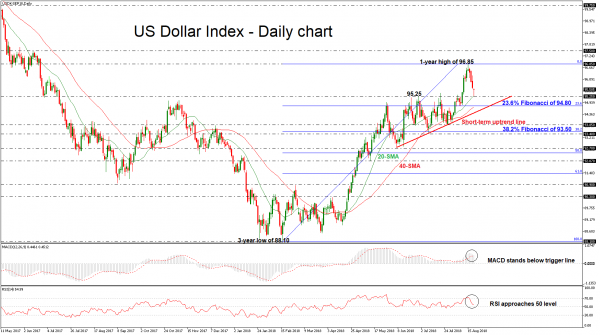

The US Dollar Index has declined considerably over the last three days following the bounce off the more than one-year high of 96.85, reached on August 15. The sharp sell-off, especially in the past sessions, has shifted the near-term bias from positive to negative. However, the price moved up after challenging the 20-day simple moving average (SMA) today, recovering on a significant part of its intraday losses.

The momentum indicators are supportive of the bearish picture, with the RSI falling to approach the 50 level, while the MACD oscillator slipped below the red-trigger line.

On the downside, the area between 95.25 and 94.80, outlined by the 23.6% Fibonacci retracement of the February 16 to August 15 upleg and the 20-day SMA, could provide immediate support. A penetration of this area would bring the short-term ascending trend line at 93.85, which has acted as a strong obstacle in July, in focus. Moreover, notice that the 38.2% Fibonacci of 93.50 lies not far below.

Should the price head north again, it would be interesting to see whether the one-year high (96.85) can stop the bullish movement. If this is not the case, the market could jump until the next high of 97.50, where it topped on June 2017.

Regarding the medium-term picture, the index has been remaining in an upward move since February after it hit a more than three-year low and currently, the price is holding above the 20- and 40-day SMAs, indicating a positive outlook.