Euro recovered broadly today as EU raised both growth and inflation forecast. Meanwhile, the Japanese Yen stays the weakest one on solid risk appetite. EU raised growth forecast for both EU and Eurozone in its Winter forecast released today. For EU growth is projected to be 1.8% in 2017 and 2018, up from November estimate of 1.6% and 1.8%. For Eurozone, growth is projected to be 1.6% in 2017 and 1.8% in 2018, up from November estimate of 1.5% and 1.7%. Inflation is also expected to pick up. For EU, inflation is projected to rise for 0.3% in 2016 to 1.8% in 2017 drop back to 1.7% in 2018. For Eurozone, inflation is expected to rise from 0.2% in 2016 to 1.7% in 2017 and drop back to 1.4% in 2018.

For UK, EU expected growth to "moderate in 2017 and weaken further in 2018. UK growth is expected to drop to 3.1% in 2017 to 1.2% in 2018. EU commissioner for economic and financial affairs, taxation and customs Pierre Moscovici said that "the European economy has proven resilient to the numerous shocks it has experienced over the past year." However, he emphasized that "with uncertainty at such high levels, it’s more important than ever that we use all policy tools to support growth."

French FM Sapin Hit Back at Navarro

French finance minister Michel Sapin hit back at US president Donal Trump’s advised Peter Navarro’s criticism on Germany. Navarro said Germany exploited the low exchange rate of Euro. Sapin plainly said that "these attacks clearly make no sense for a number of reasons". Firstly, Euro moved freely and ECB is independent to Eurozone’s member countries. And, "the ECB never tries to manipulate the exchange rate of the euro to achieve trade or competitive policy goals." Meanwhile, "the euro is the currency of the entire euro zone. On the international level what counts is the surplus of the entire Eurozone, not that of Germany."

European Yields Surged on Political Risks

Treasury yields rose solidly last week in France, Italy and Spain as political risks intensified in Europe. Rating agencies including S&P and Moody’s have warned of sovereign default should far right French presidential candidate Marine Le Pen’s plan to redenominate the country’s 1.7 trillion euro public debt into francs materialise. According to Moritz Kraemer, S&P’s head of sovereign ratings, "there is no ambiguity here [about the default]… If an issuer does not adhere to the contractual obligations to its creditors, including payment in the currency stipulated, [we] would declare a default". Moreover, Alastair Wilson, head of sovereign ratings at Moody’s, also suggested that any country leaving the euro would be in default if changing the currency of its debt caused investors to lose out financially relative to the original promise. He added that the consideration is whether "investors will be able to get back the value they put in, when they expected to get it back".

Fed Chair Yellen to Highlight the Week

On the data front, Japan Q4 GDP rose 0.2% qoq, below expectation of 0.3% qoq. GDP deflator dropped -0.1% yoy, above expectation of -0.2% yoy. German WPI rose 0.8% mom in January versus expectation of 0.3% mom.

Looking ahead, Fed chair Janet Yellen’s semiannual testimony to Congress is the main focus of the week. Yellen will testify before the Senate on Tuesday and the House on Wednesday. Markets would look for signals on any change on Fed’s forecasts of three rate hike this year. Some might also want to get hints on chance of March high. However, based on uncertainties over the fiscal policies Trump would adopt, it’s likely that Yellen would sound non-committal. As of Friday, fed fund futures are pricing in 13.3% chance of March hike, and 67.3% chance of hike by June.

Here are some highlights for the week ahead:

- Tuesday: Australia NAB business confidence; China CPI, PPI; German GDP, CPI final, ZEW; Italy GDP; Eurozone ZEW, industrial production; Swiss CPI, PPI; UK CPI, PPI; US PPI

- Wednesday: UK employment; Eurozone trade balance; US CPI, retail sales, Empire state manufacturing, industrial production, business inventories, NAHB housing index

- Thursday: Australia employment; ECB monetary policy accounts; US housing starts and building permits, jobless claims, Philly Fed survey

- Friday: New Zealand retail sales; Eurozone current account; UK retail sales; Canada foreign securities purchases; US leading indicator

EUR/USD Mid-Day Outlook

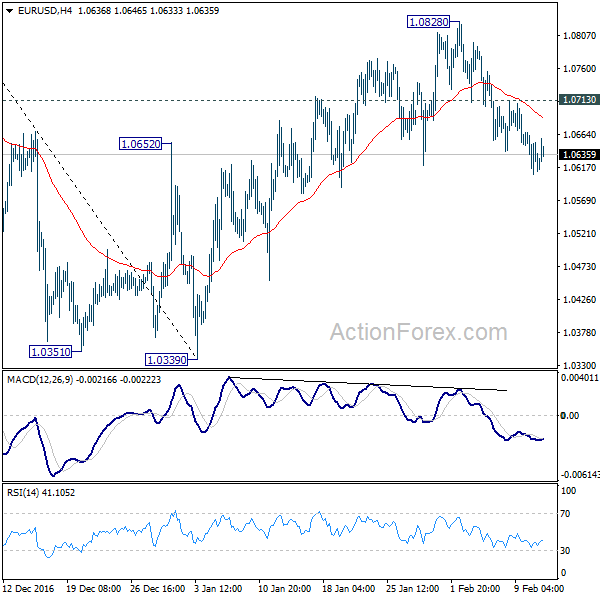

Daily Pivots: (S1) 1.0608; (P) 1.0638 (R1) 1.0668; More…..

EUR/USD recovers mildly after dipping to 1.0670. But intraday bias stays on the downside with 1.0713 minor resistance intact. Corrective rise from 1.0339 should have completed at 1.0838 already. Deeper decline should now be seen to retest 1.0339 low. Decisive break there will confirm resumption of medium term down trend. On the upside, however, above 1.0713 minor resistance will delay the bearish case and turn bias neutral first.

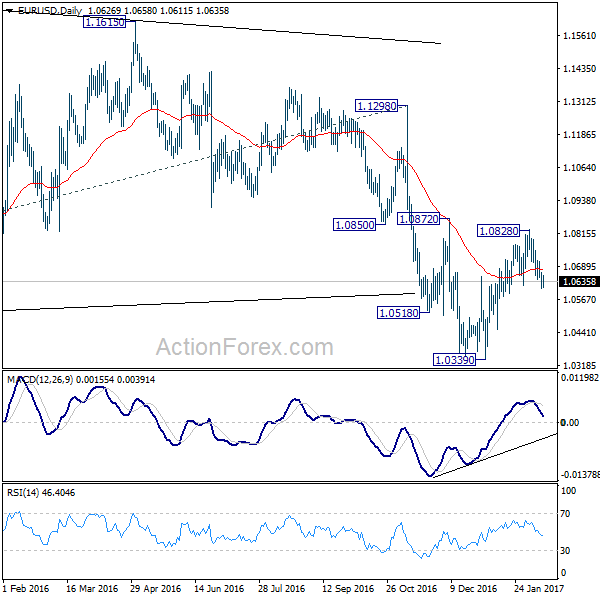

In the bigger picture, whole down trend from 1.6039 (2008 high) is in progress. Such down trend is expected to extend to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. On the upside, break of 1.1298 resistance is needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | GDP Q/Q Q4 P | 0.20% | 0.30% | 0.30% | |

| 23:50 | JPY | GDP Deflator Y/Y Q4 P | -0.10% | -0.20% | -0.20% | |

| 7:00 | EUR | German Wholesale Price Index M/M Jan | 0.80% | 0.30% | 1.20% | |

| 10:00 | EUR | European Commission Economic Forecasts |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box