Dollar turns mixed in early US session after weaker than expected economic data. Personal income rose 0.2% in March versus consensus of 0.3%. Personal spending rose 0.0% versus consensus of 0.2%. Headline CPI slowed to 1.8% yoy, down from 2.1% yoy. Core PCE slowed to 1.6% yoy down from 1.8% yoy. Dollar traders will look into the string of key events this week for guidance. Fed is widely expected to keep policies unchanged on Wednesday. But at this point, Fed fund futures are pricing in over 60% of a June hike. Markets would be eager to get some hints for that in this week’s FOMC statement. Meanwhile, ISM indices and non-farm payroll would shed some lights on how the US economy would rebound after a weak Q1.

Quick update: ISM manufacturing index dropped to 54.8 in April, below expectation of 56.7. Employment component also dropped sharply to 52.0, down from 58.9.

Macron talks tough on EU

Ahead of the French Election on May 9, front-runner pro-EU centrist Emmanuel Macron warned that EU must reform or face the risk of Frexit. Macron said that "I’m a pro-European, I defended constantly during this election the European idea and European policies because I believe it’s extremely important for French people and for the place of our country in globalization." Be he also emphasized that "we have to face the situation, to listen to our people, and to listen to the fact that they are extremely angry today, impatient and the dysfunction of the EU is no more sustainable." And he considers his mandate to "reform in depth the European Union and our European project" after winning the election.

Le Pen softens her stance

On the other hand, far-right euro-sceptic Marine Le Pen softened her stance on Euro. She still insisted of leaving Euro and repeated that the Euro is "dead", isn’t "viable" and "everyone has been saying it for years. But, she now noted that "the transition from the single currency to the European common currency is not a pre-requisite of all economic policy, the timetable will adapt to the immediate priorities and challenges facing the French government". And, "everything will be done to ensure an orderly transition … and the coordinated construction of the right for each country to control its own currency and its central bank."

Blair to be back in politics

In UK, former Prime Minister Tony Blair announced his return to politics as "this Brexit thing has given me a direct motivation to get more involved". He criticized that the Conservatives are keen to deliver "Brexit no matter what the cost". But he used a football metaphor and said that "the single market put us in the Champions League of trading agreements". A free trade agreement is like "League One" and "we are relegating ourselves". But after all, polls suggest that Blair’s Labour Party will be beaten heavily in the upcoming election in June.

May sells strong leadership

Current Prime Minister Theresa May responded to the approval of EU’s guidelines on Brexit negotiation. She emphasized that "what matters sitting around that table is a strong Prime Minister of the United Kingdom, with a strong mandate from the people of the United Kingdom which will strengthen our negotiating hand to ensure we get that possible deal."

EU leaders showed unity during the weekend and approved the Brexit negotiation guidelines unanimously. EU will insist on the approach that the exit deal should be completed before trade negotiations. It’s reported that UK will be required to "respect the obligation resulting from the whole period" of the membership and pay the agreed seven-year budget that concludes in 2020. The sum is estimated to be between EUR 40b and EUR 60b.

The European Commission will come up with a more detailed proposal for governments to approve on May 22. Formal negotiation will start after election in UK on June 8.

RBA watched in upcoming Asian session

RBA rate decision will be another focus this week. The central bank is widely expected to keep the cash rate unchanged at 1.50%. Rate has been staying at this record low since last August. Also, RBA would likely continue to adopt a neutral stance even though inflation has returned to target band of 2-3% in Q1. Meanwhile, one of the keys to shape the policy path this year would be the government budget to be unveiled on May 9.

China PMIs point to slowing growth

Released yesterday, the official China PMI manufacturing dropped to 51.2 in April, down from 51.8, and below expectation of 51.7. PMI non-manufacturing dropped to 54.0, down from 55.1. The data suggests that growth in China would slow after the unexpected pickup in first quarter. In particular, the employment component dipped into contraction region at 49.2 while output also dropped 0.4 pt to 53.8. There are also expectations that the government’s policy would turn into a more cautious approach ahead. Nonetheless, the economy in China will likely remain robust.

GBP/USD Mid-Day Outlook

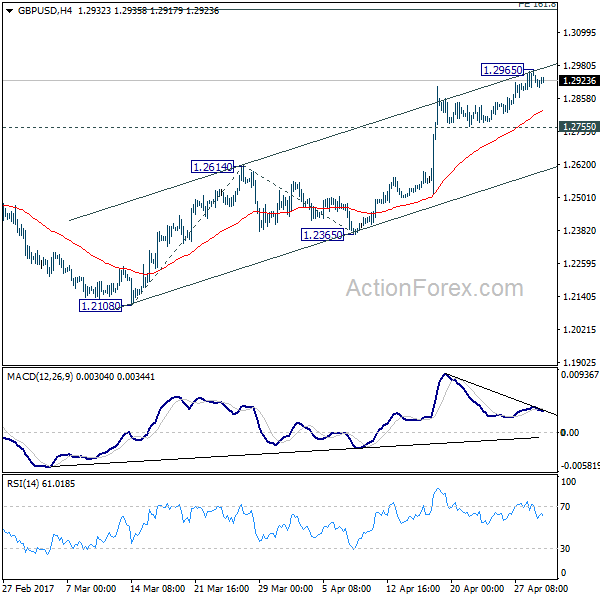

Daily Pivots: (S1) 1.2899; (P) 1.2932; (R1) 1.2975; More…

Intraday bias in GBP/USD remains neutral for consolidation below 1.2965 temporary top. Further rally is expected as long as 1.2755 minor support holds. Break of 1.2965 will target 161.8% projection of 1.2108 to 1.2614 from 1.2365 at 1.3184. At this point, price actions from 1.1946 are still interpreted as a correction pattern. Therefore, we’d expect strong resistance below 1.3444 to bring larger down trend resumption. On the downside, break of 1.2755 minor support will turn bias to the downside. Further break of 1.2614 resistance turned support will now indicate near term reversal.

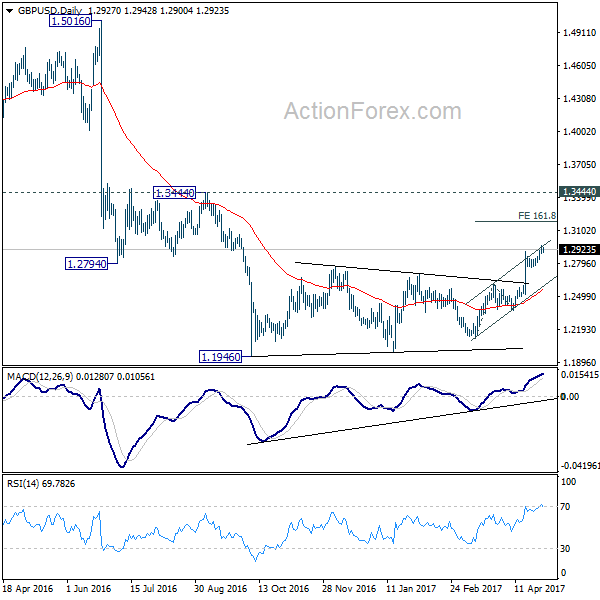

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term reversal yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | JPY | Manufacturing PMI Apr F | 52.7 | 52.8 | 52.8 | |

| 01:00 | AUD | TD Securities Inflation M/M Apr | 0.50% | 0.10% | ||

| 07:15 | CHF | Retail Sales (Real) Y/Y Mar | 2.10% | 0.50% | 0.60% | 0.70% |

| 12:30 | USD | Personal Income Mar | 0.20% | 0.30% | 0.40% | 0.30% |

| 12:30 | USD | Personal Spending Mar | 0.00% | 0.20% | 0.10% | 0.00% |

| 12:30 | USD | PCE Deflator M/M Mar | -0.20% | 0.10% | ||

| 12:30 | USD | PCE Deflator Y/Y Mar | 1.80% | 2.10% | ||

| 12:30 | USD | PCE Core M/M Mar | -0.10% | -0.10% | 0.20% | |

| 12:30 | USD | PCE Core Y/Y Mar | 1.60% | 1.80% | ||

| 14:00 | USD | ISM Manufacturing Apr | 54.8 | 56.7 | 57.2 | |

| 14:00 | USD | ISM Prices Paid Apr | 68.5 | 66.5 | 70.5 | |

| 14:00 | USD | Construction Spending M/M Mar | 0.40% | 0.80% | ||

| 23:50 | JPY | BOJ Minutes of March 15-16 Meeting | ||||

| 23:50 | JPY | Monetary Base Y/Y Apr | 21.20% | 20.30% |