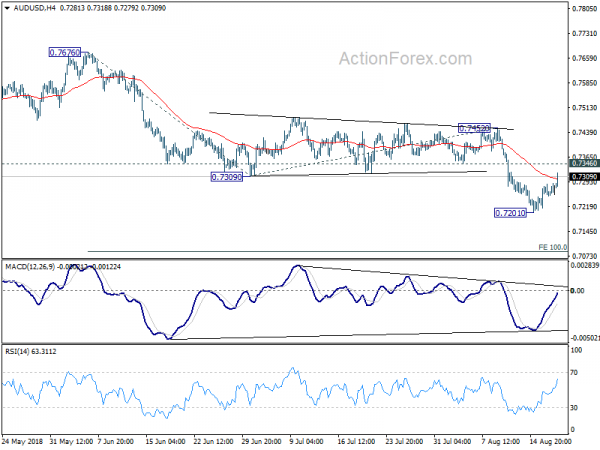

AUD/USD dropped further to 0.7201 last week but formed a short term bottom there and recovered. Initial bias stays mildly on the upside for further rebound. but upside should be limited by 0.7346 support turned resistance to bring fall resumption. On the downside, break of 0.7201 will extend the larger decline from 0.8135, to 100% projection of 0.7676 to 0.7309 from 0.7452 at 0.7085.

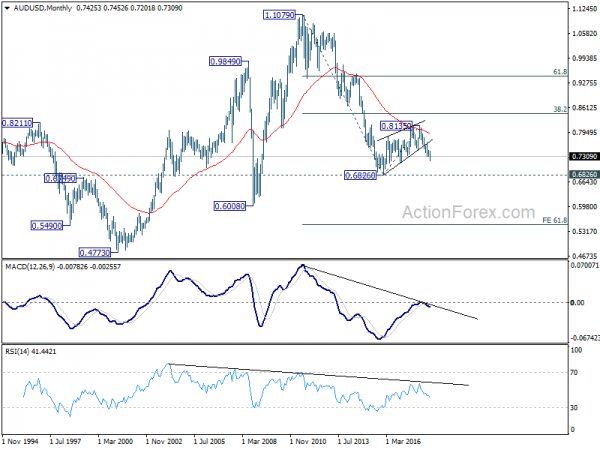

In the bigger picture, medium term rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Fall from there should now have a test on 0.6826. There is prospect of resuming long term down trend from 1.1079 (2011 high). But we’ll look at downside momentum to assess at a later stage. On the upside, break of 0.7452 resistance is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

In the longer term picture, rebound from 0.682 (2016 low) should have completed at 0.8135 already. Failure to reach 38.2% retracement of 1.1079 (2011 high) to 0.6826 at 0.8451 carries bearish implications. This is also supported by the corrective structure from 0.6826 to 0.8135, as well as the rejection by 55 month EMA. The down trend from 1.1079 is in favor to extend. On break of 0.6826, next target will be 61.8% projection of 1.1079 to 0.6826 from 0.8135 at 0.5507.