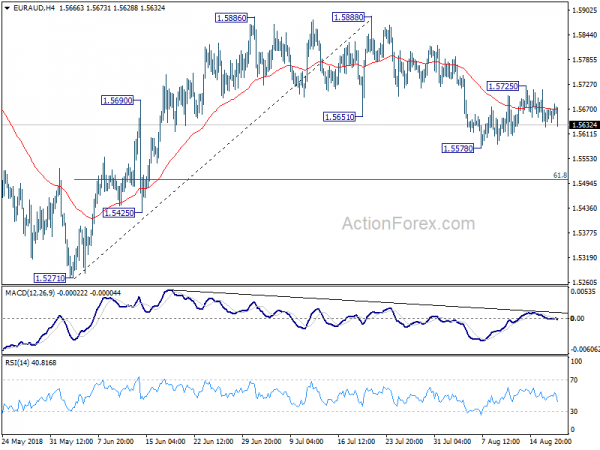

EUR/AUD edged higher to 1.5725 last week but retreated since then. Initial bias stays neutral this week first. On the downside, though, below 1.5578 will resume the fall from 1.5888 to 61.8% retracement of 1.5271 to 1.5888 at 1.5507. Firm break there will pave the way to retest 1.5271 low. On the upside, above 1.5725 will extend the rebound form 1.5578 to retest 1.5888 high.

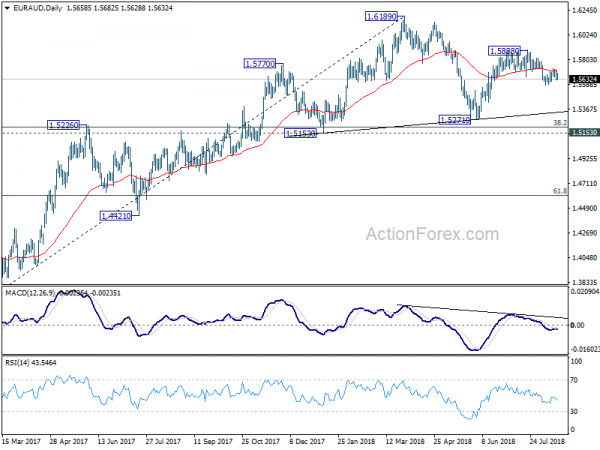

In the bigger picture, the rebound from 1.5271 was somewhat weaker than expected. EUR/AUD also failed to sustain above 55 day EMA and hints on some underlying bearishness. Though, for now, as long as 1.5271 support holds, medium term rise from 1.3624 (2017 low) is still mildly in favor to extend through 1.6189 high, to 1.6587 key resistance (2015 high). Nevertheless, firm break of 1.5271 will complete a head and shoulder top pattern (ls: 1.5770, h: 1.6189, rs: 1.5888). That would indicate medium term reversal and turn outlook bearish.

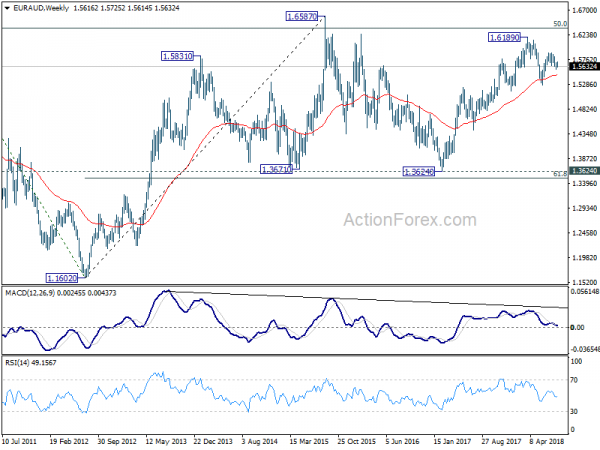

In the longer term picture, the rise from 1.1602 long term bottom (2012 low) isn’t over yet. We’ll keep monitoring the development but there is prospect of extending the rise to 61.8% retracement of 2.1127 to 1.1602 at 1.7488 and above. However, sustained trading below 1.3624 key support should indicate long term reversal and target 1.1602 long term bottom again.