Dollar is mild pressure against European majors in early US session after weaker than expected growth data. Q1 GDP in US grew 0.7% annualized, sharply lower than prior quarter’s 2.1% and missed expectation of 1.1%. While it’s common to have a soft first quarter in recent years, the miss could prompt some adjustment in market’s expectation on overall growth for the year. GDP price index, on the other hand, rose 2.3%, up from prior quarter’s 2.1% and beat expectation of 2.0%. Employment cost index rose 0.8% in Q1, above expectation of 0.6%. While the greenback stays weak against European majors, in particular Sterling, it’s showing some strength against Aussie and Yen and stays firm against Canadian Dollar.

Canadian Dollar stays soft too

Taking about Canada, GDP rose 0.0% mom in February, below expectation of 0.1% yoy and down from January’s 0.6% yoy. IPPI rose 0.8% mom in March, above expectation of 0.3%. But RMPI dropped -1.6% mom, below expectation of -0.4%. The loonie is sold off deeply this week and pressured on two fronts. Firstly, there was talk that US would pull out from NAFTA. US President Donald Trump then backtracked and said he won’t withdraw for the moment. This lifted some weight on the Canadian Dollar. Secondly, it’s dragged down by the fall in oil price. WTI hit as low as 48.20 yesterday, comparing to this month’s high at 53.76. While WTI is back above 49 for the moment, it’s struggling to find sustainable buying to pull it back above 50 handle.

EC Tusk: People, Money and Irealand first before talks on post-Brexit

European Council President Donald Tusk urged that UK must settle the issues of "people, money and Ireland" before negotiation on future relationship with EU. And, UK must honour it’s financial obligations to EU before starting talks on trade agreements. And future relations could only start once "we have achieved sufficient progress" on these key issues. And he emphasized that it’s "not only a matter of tactics, but – given the limited time-frame we have to conclude the talks – it is the only possible approach". German Chancellor Angel Merkel also insisted that "without progress on the many open questions of the exit, including the financial questions, it makes no sense to have parallel negotiations."

Released from UK, Q1 GDP grew 0.3% qoq, below expectation of 0.4% qoq, and down from prior quarter’s 0.7% qoq. Index of services rose 0.5% 3mo3m in February, in line with consensus. BBA mortgage approvals dropped to 41.1k in March. Sterling is so far immune from bad economic data.

Eurozone inflation surged

From Eurozone, CPI surged to 1.9% yoy in April, up from prior month’s 1.5% yoy and expectation of 1.8% yoy. Core CPI also jumped sharply to 1.2% yoy, up from 0.7% yoy and beat expectation of 1.0% yoy. Eurozone M3 money supply rose 5.3% yoy in March. Germany retail sales rose 0.1% mom in March, import price index dropped -0.5% mom. French GDP rose 0.3% qoq in Q1, below expectation of 0.4% qoq. Also from Europe, Swiss KOF leading indicator dropped to 106 in April.

Released from Japan, National CPI core was unchanged at 0.2% yoy in March. But Tokyo CPI core improved to -0.1% yoy in April. Retail sales rose 2.1 yoy in March. Household spending dropped -1.3%. Unemployment rate was unchanged at 2.8%. Industrial production dropped -2.1% mom. From Australia, PPI rose 0.5% qoq in Q1. New Zealand trade balance turned to NZD 332m surplus in March, building permits dropped -1.8% mom.

GBP/USD Mid-Day Outlook

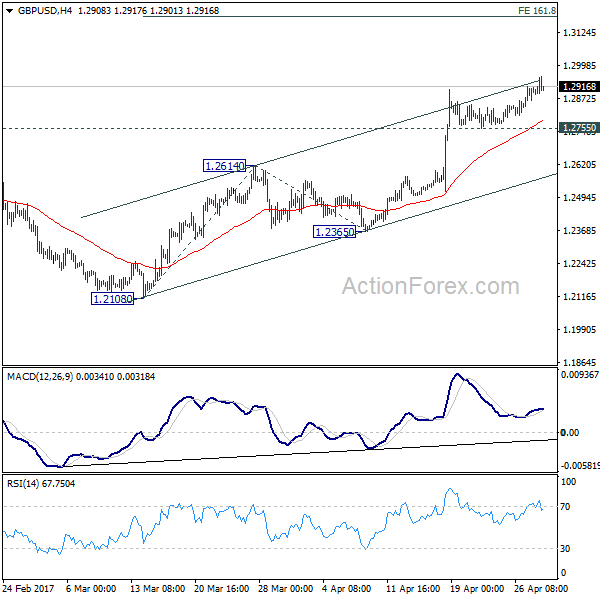

Daily Pivots: (S1) 1.2855; (P) 1.2885; (R1) 1.2933; More…

Intraday bias in GBP/USD remains on the upside and current rise from 1.2108 should target 161.8% projection of 1.2108 to 1.2614 from 1.2365 at 1.3184. At this point, price actions from 1.1946 are still interpreted as a correction pattern. Therefore, we’d expect strong resistance below 1.3444 to bring larger down trend resumption. On the downside, break of 1.2755 minor support will turn bias to the downside. Further break of 1.2614 resistance turned support will now indicate near term reversal.

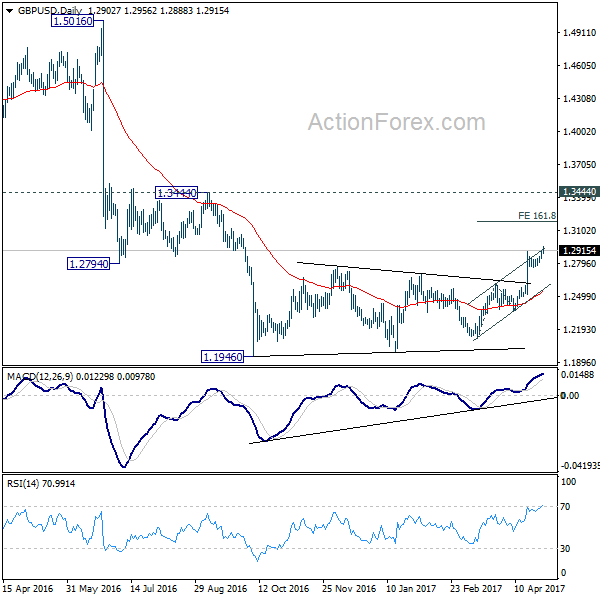

In the bigger picture, fall from 1.7190 is seen as part of the down trend from 2.1161. There is no sign of medium term reversal yet. Sustained trading below 61.8% projection of 2.1161 to 1.3503 from 1.7190 at 1.2457 will target 100% projection at 0.9532. Overall, break of 1.3444 resistance is needed to confirm medium term bottoming. Otherwise, outlook will remain bearish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Mar | -1.80% | 14.00% | 17.20% | |

| 22:45 | NZD | Trade Balance (NZD) Mar | 332M | 375M | -18M | -50M |

| 23:01 | GBP | GfK Consumer Confidence Apr | -7 | -7 | -6 | |

| 23:30 | JPY | Jobless Rate Mar | 2.80% | 2.90% | 2.80% | |

| 23:30 | JPY | Household Spending Y/Y Mar | -1.30% | -0.50% | -3.80% | |

| 23:30 | JPY | National CPI Core Y/Y Mar | 0.20% | 0.20% | 0.20% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Apr | -0.10% | -0.20% | -0.40% | |

| 23:50 | JPY | Retail Trade Y/Y Mar | 2.10% | 1.50% | 0.10% | 0.20% |

| 23:50 | JPY | Industrial Production M/M Mar P | -2.10% | -0.80% | 3.20% | |

| 01:30 | AUD | PPI Q/Q Q1 | 0.50% | 0.30% | 0.50% | |

| 05:00 | JPY | Housing Starts Y/Y Mar | 0.20% | -2.60% | -2.60% | |

| 05:30 | EUR | French GDP Q/Q Q1 A | 0.30% | 0.40% | 0.40% | |

| 06:00 | EUR | German Retail Sales M/M Mar | 0.10% | 0.00% | 1.80% | 1.10% |

| 06:00 | EUR | German Import Price Index M/M Mar | -0.50% | -0.10% | 0.70% | |

| 07:00 | CHF | KOF Leading Indicator Apr | 106 | 107.5 | 107.6 | 107.2 |

| 08:00 | EUR | Eurozone M3 Y/Y Mar | 5.30% | 4.70% | 4.70% | |

| 08:30 | GBP | BBA Mortgage Approvals Mar | 41.1K | 42.1K | 42.6K | 42.2K |

| 08:30 | GBP | GDP Q/Q Q1 A | 0.30% | 0.40% | 0.70% | |

| 08:30 | GBP | Index of Services 3M/3M Feb | 0.50% | 0.50% | 0.60% | |

| 09:00 | EUR | Eurozone CPI Estimate Y/Y Apr | 1.90% | 1.80% | 1.50% | |

| 09:00 | EUR | Eurozone CPI – Core Y/Y Apr A | 1.20% | 1.00% | 0.70% | |

| 12:30 | CAD | GDP M/M Feb | 0.00% | 0.10% | 0.60% | |

| 12:30 | CAD | Industrial Product Price M/M Mar | 0.80% | 0.30% | 0.10% | 0.30% |

| 12:30 | CAD | Raw Materials Price Index M/M Mar | -1.60% | -0.40% | 1.20% | 1.30% |

| 12:30 | USD | GDP (Annualized) Q1 A | 0.70% | 1.10% | 2.10% | |

| 12:30 | USD | GDP Price Index Q1 A | 2.30% | 2.00% | 2.10% | |

| 12:30 | USD | Employment Cost Index Q1 | 0.80% | 0.60% | 0.50% | |

| 13:45 | USD | Chicago PMI Apr | 56.7 | 57.7 | ||

| 14:00 | USD | U. of Michigan Confidence Apr F | 98 | 98 |