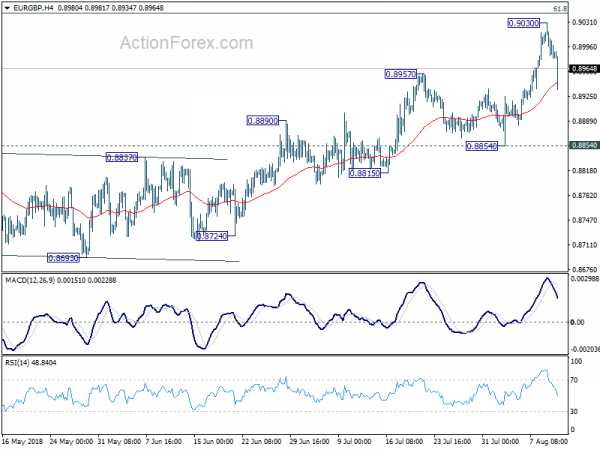

Daily Pivots: (S1) 0.8972; (P) 0.8995; (R1) 0.9034; More…

Despite rather deep pull back, price actions from 0.9030 are still seen as a correction only. And, near term outlook will stay bullish as long as 0.8854 support holds. On the upside, sustained break of 61.8% retracement of 0.9305 to 0.8620 at 0.9043 will extend the whole rise from 0.8620 to retest 0.9305 high.

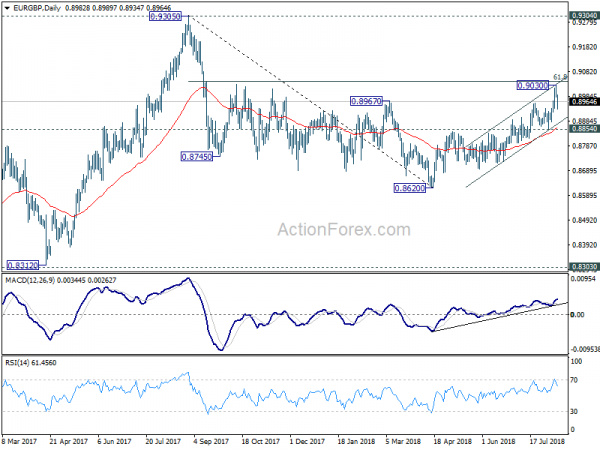

In the bigger picture, EUR/GBP is staying in long term range pattern from 0.9304 (2016 high). The corrective structure of the fall from 0.9305 to 0.8620 is raising the chance that rise from 0.8312 to 0.9305 is an impulsive move. But we’re not too confident on it yet. In any case, we’d stay cautious on strong resistance from 0.9304/5 to limit upside in case of further rally. Meanwhile, if there is another medium term decline, strong support will likely be seen from 0.8303 to contain downside.