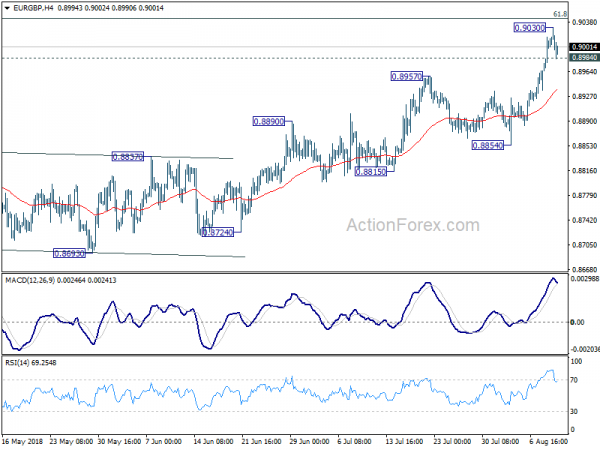

Daily Pivots: (S1) 0.8972; (P) 0.8995; (R1) 0.9034; More…

Touching of 0.8984 minor support suggests temporary topping at 0.9030. That’s inch below 61.8% retracement of 0.9305 to 0.8620 at 0.9043. Intraday bias is turned neutral for some consolidations. But downside of pull back should be contained well above 0.8854 support. Rise from 0.8620 is expected to extend. And, sustained trading above 0.9043 will pave the way to retest 0.9305 high.

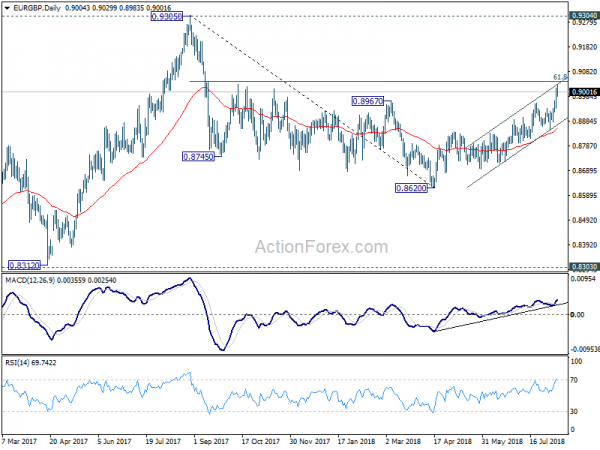

In the bigger picture, EUR/GBP is staying in long term range pattern from 0.9304 (2016 high). The corrective structure of the fall from 0.9305 to 0.8620 is raising the chance that rise from 0.8312 to 0.9305 is an impulsive move. But we’re not too confident on it yet. In any case, we’d stay cautious on strong resistance from 0.9304/5 to limit upside in case of further rally. Meanwhile, if there is another medium term decline, strong support will likely be seen from 0.8303 to contain downside.