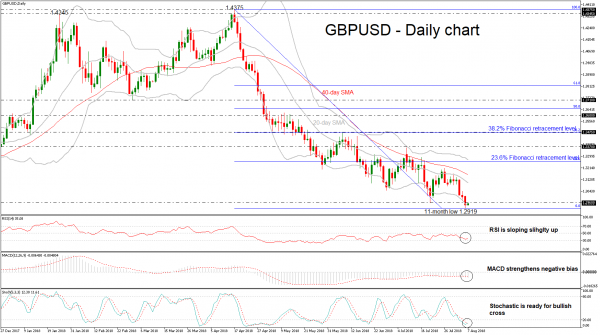

GBPUSD had been in a falling mode over the previous three days as it posted a fresh 11-month low of 1.2919. The rally brought the pair below the 20- and 40-simple moving averages (SMAs) and near the lower Bollinger Band in the daily timeframe. However, the technical indicators are suggesting for a possible upside correction.

The RSI indicator is moving slightly higher in the bearish zone, while the stochastic oscillator is ready to post a bullish crossover within the %K and %D lines in the oversold zone, indicating an upside movement is more likely than a downside one. However, the MACD oscillator is strengthening its negative momentum below the trigger and zero lines.

If the bulls manage to take charge from near the lower Bollinger Band or the 1.2960 barrier, then we would expect the price to touch the 20 and then the 40 SMAs at 1.3100 and 1.3165 respectively. Such a break would confirm an upside move until the 23.6% Fibonacci retracement level of the downleg from 1.4375 to 1.2919, around 1.3263, which stands near the upper Bollinger Band.

A clear dip below the 1.2919 low would bring the price until the 1.2770 support level, taken from the low on August 2017. Further losses would drive the pair towards the 1.2580 hurdle, identified by June 2017.

Overall, GBPUSD continues the strong negative outlook in the medium-term and was denied posting a strong bullish correction in the previous sessions.