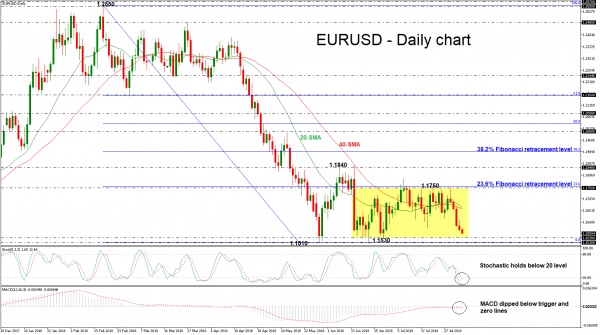

EURUSD has been underperforming in the past four days, breaking back below the 20- and 40-simple moving averages in the daily timeframe. The world’s most traded currency is ready to create a consolidation area if it touches again the 1.1510 – 1.1530 zone and reverses back up. The upper boundary of the channel is the 1.1750 resistance level, which stands near the 23.6% Fibonacci retracement level of the downleg from 1.2550 to 1.1510.

Momentum indicators are pointing to a negative bias in the short term with the stochastic oscillator holding in the oversold zone and continuing the bearish movement. Moreover, the MACD oscillator is slipping below the trigger and zero lines with strong momentum.

Further losses should see the aforementioned key area (1.1510 – 1.1530) acting as a major support. A drop below this level would reinforce the bearish structure and open the way towards the 1.1300 psychological barrier.

In the event of an upside reversal and a climb above the upper boundary of the in-progress trading range would challenge the 1.1840 resistance hurdle, taken from the high on June 7. Further gains would lead the way towards the 38.2% Fibonacci of 1.1910.

Turning to the bigger picture, the market seems to be in a bearish mode given that the price is trading below significant resistance obstacles such as the moving averages and the 23.6% Fibonacci mark.