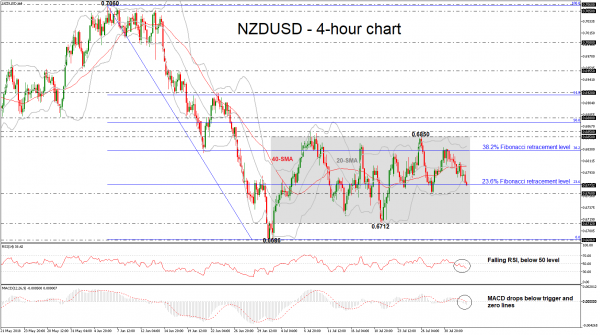

NZDUSD has come under renewed selling pressure over the last couple of days, falling back below the 23.6% Fibonacci retracement level of the downleg from 0.6686 to 0.7060, around 0.6775. Also, the pair is touching the lower Bollinger Band, however, it has not posted a fresh lower low, which makes one hesitant to trust further declines for now. It is worth mentioning that the price has been holding within a trading range since early July with upper boundary the 0.6850 resistance and lower boundary the 0.6712.

Looking at momentum oscillators in the 4-hour chart though, they suggest downside pressures may be on the cards in the short-term. The RSI is below its neutral 50 line, detecting negative momentum, and is also pointing downwards with strong momentum. The MACD oscillator is falling and is holding below its trigger line.

In case of downside movements, immediate support may be found at 0.6760, taken from the latest lows on July 27. A bearish break of that zone would open the way for the 0.6712 support level. If sellers manage to push below that hurdle too, that would drive the price until the 0.6686, identified by the bottom on July 3, suggesting further losses.

Alternatively, if the bulls retake control, price advances may stall initially near the latest high at the 38.2% Fibonacci mark of 0.6828. A potential upside violation of this area would send prices until the 0.6850 – 0.6858 resistance area.

Overall, NZDUSD is struggling in a sideways channel in the near term. A downside penetration of the channel would reinforce the negative medium-term outlook. However, an upside break would weaken the bearish picture.