‘Risk of closing the 109.40-60 gap should not be ignored, but price action suggests an early surge into the 112.15 to 114.65 retracement zone during May.’ – Westpac (based on FXStreet)

Pair’s Outlook

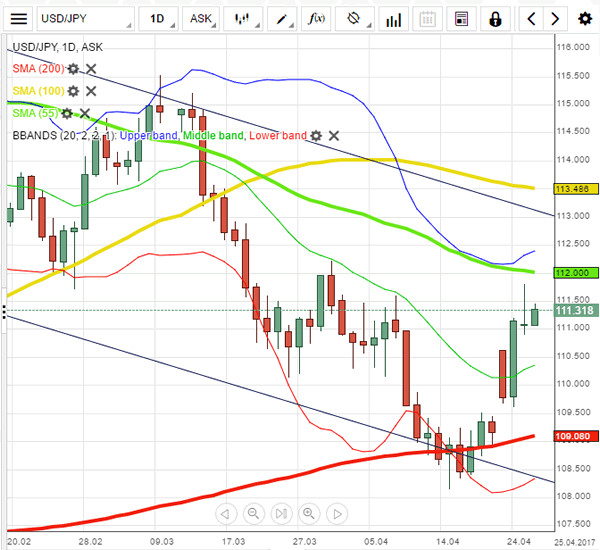

The USD/JPY currency pair remained relatively unchanged yesterday, with the 111.00 major level limiting downside volatility. The weekly R3 that was on the pair’s path appears to be unable to provide support or resistance, thus, more focus should be on the cluster around 110.20 and the one around 112.15. From a broad technical perspective the Greenback should continue moving up until the descending channel’s resistance line is reached; however, the mentioned supply area circa 112.15 could apply sufficient pressure on the Buck, resulting in another drop even back under 110.00. At the moment the US Dollar’s main goal is to manage to retain its positions above 111.00.

Traders’ Sentiment

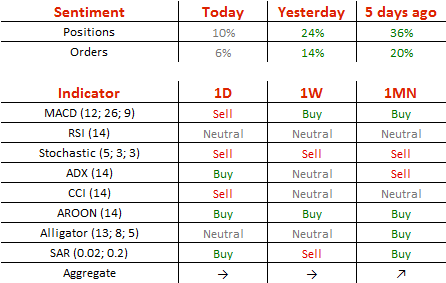

There are 55% of traders holding long positions today, compared to 62% yesterday. The share of buy orders inched down from 57 to 53%.