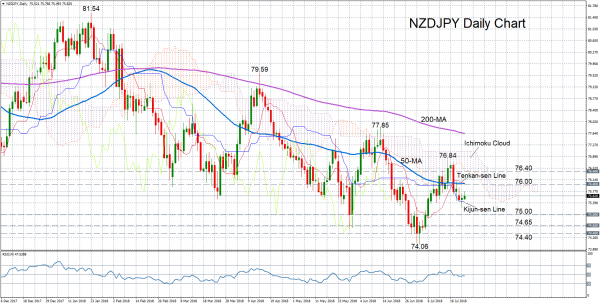

NZDJPY has retreated from the one-month top of 76.84 it touched last week, falling back below the Ichimoku cloud and the 50-day moving average. However, the negative momentum has eased in the past few days and the near-term bias is now looking more neutral as the RSI has flatlined just below the 50 neutral level.

If the RSI fails to rise above 50 in the next day or two and the immediate support of the Kijun-sen line around 75.45 fails, the 75.00 handle would be the next key level to watch. Below that, the previous congestion areas of 74.65 and 74.40 could act as downside hurdles before prices were to reach July’s 1½-year low of 74.06. A breach of that trough would signal a resumption of the year-long downtrend and underscore the bearish outlook.

However, if prices were to find positive momentum again, the 76 handle would be the first target on the upside. This is likely to prove a strong resistance barrier though, as besides being a psychological level, it also coincides with the 50-day moving average and the Tenkan-sen line. A break above this level would open the way towards the Ichimoku cloud, with the cloud bottom just above 76.40 being the next resistance point.

If the pair successfully moves back into the cloud, this would shift the short-term bias to bullish and turn the focus to the upside.