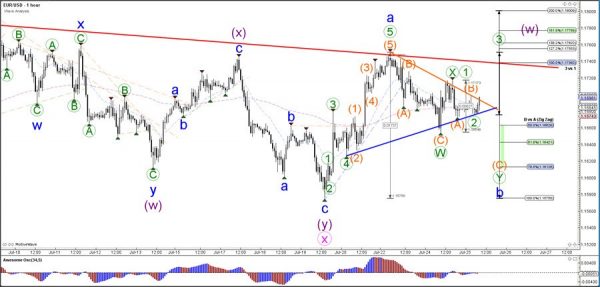

The EUR/USD made a bearish bounce at the resistance trend line as expected in yesterday’s wave analysis. Price is now showing bearish price action but could be running into support as price challenges the support Fibonacci levels of wave B (blue).

The EUR/USD could invalidate the ABC (blue) pattern if price manages to break below the bottom of wave B (blue) vs A, which is the 100% Fib level. A bullish reversal however could confirm a potential ABC (blue) zigzag pattern that could take price all the way up to the previous top which is indicated by the red box. Price is now still in the triangle pattern (indicated by the S&R trend lines) and the breakout above or below it will indicate the next trend.

The EUR/USD has completed 5 bullish waves (orange) within a 5th wave (green) of wave A (blue) as mentioned in yesterday’s wave analysis. Price is now building bearish momentum which could indicate a retracement to the Fibonacci levels and potential support of wave B (blue). A break above the resistance trend line (orange) could be a first indication that price is making a bullish reversal, completing wave B (blue) and starting wave C. But once again, a break below the bottom of wave B (100% level) invalidates the bullish ABC potential.