European majors stay generally firm today, continuing to ride on the boost from French election result. Meanwhile, Dollar closely follow as strong risk appetite lifts Fed rate hike expectations. Meanwhile, markets are eagerly waiting for US President Donald Trump to announce his tax reforms. Commodity currencies are generally under pressure and decoupled from stock markets. In particular, Canadian Dollar is pressured by weakness in oil prices, as well as US’s announcement of tariffs for lumber products.

Trump imposes countervailing duties on Canadian Lumber products

Commodity currencies are generally lower following the Japanese Yen. Canadian Dollar is pressured by news that US President Donald Trump’s administration imposed countervailing duties on Canadian Lumber products, ranging from 3% to 24.1%. Trump said yesterday that there will be 20% tax of softwood lumber coming from Canada. The move is seen as an escalation of trade battle between the US and its neighboring countries. US Commerce Secretary Wilbur Ross said that "it became apparent that Canada intends to effectively cut off the last dairy products being exported from the United States." And, because of unfair Canadian subsidies to the lumber industry, there is a need to impose "countervailing duties of roughly one billion dollars."

Canada fired back as a joint statement from Foreign Minister Chrystia Freeland and Natural Resources Minister Jim Carr noted that the tariff is an "unfair and punitive duty" imposed on baseless and unfounded" allegations. And, Canada "will vigorously defend the interests of the Canadian softwood lumber industry, including through litigation." Meanwhile, both ministries noted that "a negotiated settlement is not only possible but in the best interests of both countries."

Trump to cut corporate tax rate to 15%

The outlook of Fed rate, yields and Dollar will largely depend on what US President Donald Trump will deliver this Wednesday regarding his tax reforms. It’s reported that Trump would seek to lower corporate income tax rate to 15%, down from 35%. Meanwhile, individual tax rate could be capped at 33%. However, there are talks that such a plan would set up clashes with Republicans as some of them would oppose to raising the country’s debt. The outline of the plan itself would be the first test for Dollar. And the execution of the plan, including parliamentary approval, will be another test.

UK PM May to Meet EC Juncker

UK Prime Minister Theresa May will have a face-to-face meeting with President of the European Commission Jean-Claude Juncker and EU chief Brexit negotiator Michel Barnier tomorrow. That comes ahead of the EU summit on April 29, where leaders will approve the EU’s Brexit negotiation plan and guidelines. It’s reported that in the latest draft of EU negotiation plan, financial services was split off from wordings on the trade deal. And, "any future framework should safeguard financial stability in the Union and respect its regulatory and supervisory standards regime and application." That was believed to be in response to France’s request to separate financial services with trade. Meanwhile, EU would push for reciprocal guarantees to give EU citizens in UK, and UK citizens in EU, to acquire permanent residence after a continuous period of five years. EU will approve the negotiation guidelines and plans on April 29 but will wait until UK elections in June to start formal negotiations.

BoJ Deputy Iwata: BoJ in exit simulation

BoJ Deputy Governor Kikuo Iwata said that "the BOJ is carrying out a simulation based on several assumptions of an exit strategy." However, he acknowledged that Japan is still far from meeting the inflation target of 2%. BoJ will start its two-day policy meeting tomorrow and announce policy decisions on Thursday. It’s widely expected that the central bank will keep all monetary policies unchanged. Governor Haruhiko Kuroda said last week that it’s "premature to discuss in an exact way about exit strategy." Meanwhile, Kuroda also talked down the question of scarcity of assets to purchase. Kuroda noted that "I don’t think our monetary policy is constrained by the fact that we have acquired 40 percent of JGBs already, or our balance sheet is about 80 percent of GDP, which is certainly large compared with other central banks."

USD/CAD Mid-Day Outlook

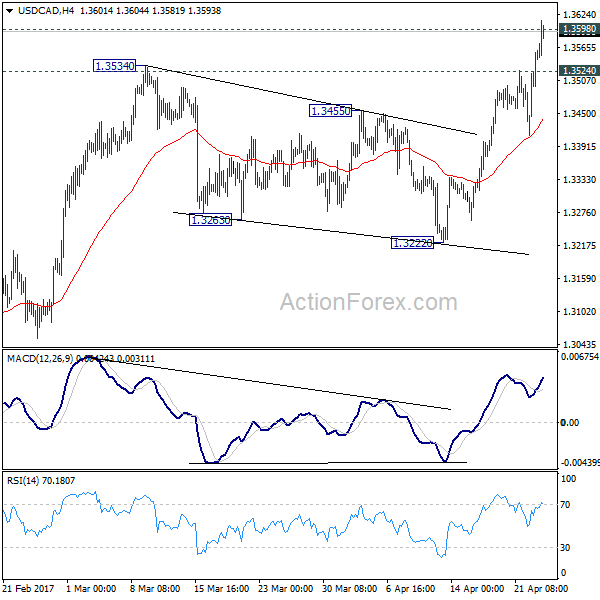

Daily Pivots: (S1) 1.3432; (P) 1.3476; (R1) 1.3543; More….

USD/CAD’s rise continues today. The break of 1.3598 key resistance indicates resumption of medium term rise from 1.2460. Intraday bias remains on the upside and USD/CAD should target next medium term fibonacci level at 1.3838. On the downside, below 1.3524 minor support will turn bias neutral and bring retreat. But downside should be contained well above 1.3222 support and bring another rise.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg from 1.2460 is likely still in progress and could target 61.8% retracement of 1.4689 to 1.2460 at 1.3838. We’d look for reversal signal there to start the third leg. However, break of 1.2968 will argue that the third leg has already started and should at least bring a retest of 1.2460 low. Meanwhile, sustained trading above 1.3838 would pave the way to retest 1.4689 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Y/Y Mar | 0.80% | 0.80% | 0.80% | |

| 08:30 | GBP | Public Sector Net Borrowing (GBP) Mar | 4.4B | 2.6B | 1.1B | -0.7B |

| 13:00 | USD | House Price Index M/M Feb | 0.80% | 0.30% | 0.00% | 0.20% |

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Feb | 5.90% | 5.80% | 5.73% | |

| 14:00 | USD | New Home Sales Mar | 584K | 592K | ||

| 14:00 | USD | Consumer Confidence Apr | 122.5 | 125.6 |